Shaw 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2011

Other long-term liabilities were up $59.6 million mainly due to the non-current portion of CRTC

benefit obligations and benefit plans as a result of the Media acquisition as well as current year

defined benefit pension plan expense partially offset by the aforementioned reclassification of

the obligation in respect of the principal component of the US $300 million amended cross-

currency interest rate agreements.

Derivatives decreased $6.5 million as amounts have been reclassified to current liabilities

based on settlement dates.

Future income taxes increased $247.5 million primarily due to the Media acquisition partially

offset by current year tax recovery in respect of discontinued operations.

Share capital increased $383 million due to the issuance of 12,000,000 Preferred Shares for

net proceeds of $290.9 million as well as issuance of 4,594,347 Class B Non-Voting Shares

under the Company’s option plan and Dividend Reinvestment Plan (“DRIP”) for $89.8 million.

As of November 22, 2011, share capital is as reported at August 31, 2011 with the exception

of the issuance of 1,208,779 Class B Non-Voting Shares under the DRIP and upon exercise of

options subsequent to year end. Contributed surplus increased due to stock-based

compensation expense recorded in the current year. Accumulated other comprehensive income

decreased due settlement of the forward purchase contracts in respect of the closing of the

acquisition of the broadcasting business. Non-controlling interests arose in the current year due

to a number of non-wholly owned specialty channels acquired as part of the Media acquisition.

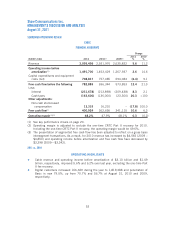

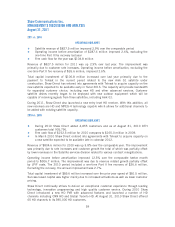

V. CONSOLIDATED CASH FLOW ANALYSIS

Operating activities

Change

(In $000’s Cdn) 2011 2010 2009

2011

%

2010

%

Funds flow from continuing

operations 1,443,179 1,376,799 1,323,840 4.8 4.0

Net decrease (increase) in non-cash

working capital balances related

to continuing operations (201,528) 81,852 59,090 >(100.0) 38.5

1,241,651 1,458,651 1,382,930 (14.9) 5.5

Funds flow from continuing operations increased in 2011 over 2010 due to the combined

impact of higher operating income before amortization adjusted for non-cash program rights

expenses partially offset by higher interest expense, funding of CRTC benefit obligations, the

realized loss on the mark-to-market payments to terminate the cross-currency interest rate

exchange agreements in conjunction with repayment of the CW Media term loan, higher current

income taxes and the acquisition, integration and restructuring costs in the current year. In

2010, funds flow from continuing operations increased due to growth in operating income

before amortization partially offset by higher current income tax expense.

The year-over-year net change in non-cash working capital balances is primarily due to the

seasonal advertising impact of the new Media division on accounts receivable in 2011, the

timing of payment of accounts payable and accrued liabilities and current taxes payable.

63