Shaw 2011 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2011, 2010 and 2009

[all amounts in thousands of Canadian dollars except share and per share amounts]

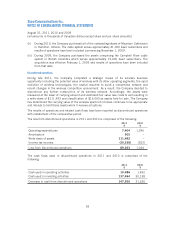

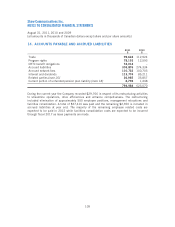

Long-term debt repayments

Mandatory principal repayments on all long-term debt in each of the next five years and

thereafter are as follows:

$

2012 613

2013 450,652

2014 950,694

2015 738

2016 300,786

Thereafter 3,616,974

5,320,457

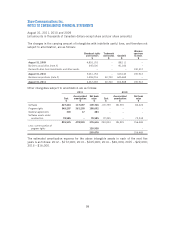

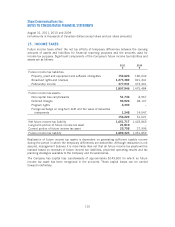

11. DEFERRED CREDITS

2011 2010

Accumulated Net book Accumulated Net book

Amount amortization value Amount amortization value

$$$ $$$

IRU prepayments 629,119 131,797 497,322 629,119 119,251 509,868

Equipment revenue 364,106 243,671 120,435 384,580 272,875 111,705

Connection fee and

installation revenue 21,501 11,875 9,626 19,591 12,317 7,274

Deposit on future fibre sale 2,000 – 2,000 2,000 – 2,000

Other 958 – 958 1,635 – 1,635

1,017,684 387,343 630,341 1,036,925 404,443 632,482

Amortization of deferred credits for 2011 amounted to $125,722 (2010 – $138,187; 2009 –

$153,168) and was recorded in the accounts as described below.

IRU agreements are in place for periods ranging from 21 to 60 years and are being amortized to

income over the agreement periods. Amortization in respect of the IRU agreements for 2011

amounted to $12,546 (2010 – $12,546; 2009 – $12,547). Amortization of equipment

revenue for 2011 amounted to $106,628 (2010 – $120,639; 2009 – $132,974).

Amortization of connection fee and installation revenue for 2011 amounted to $6,548 (2010 –

$5,002; 2009 – $7,647) and was recorded as revenue.

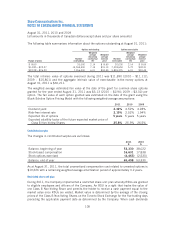

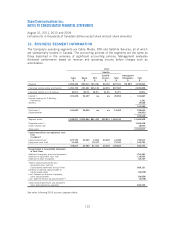

12. SHARE CAPITAL

Authorized

The Company is authorized to issue a limited number of Class A voting participating shares

(“Class A Shares”) of no par value, as described below, and an unlimited number of Class B

non-voting participating shares (“Class B Non-Voting Shares”) of no par value, Class 1 preferred

shares, Class 2 preferred shares, Class A preferred shares and Class B preferred shares.

102