Shaw 2011 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2011, 2010 and 2009

[all amounts in thousands of Canadian dollars except share and per share amounts]

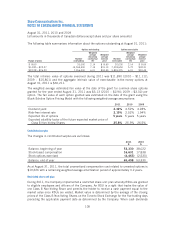

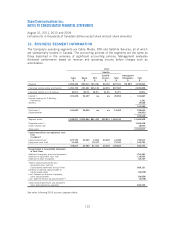

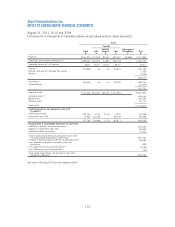

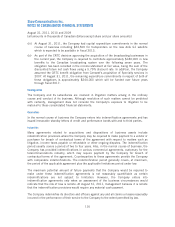

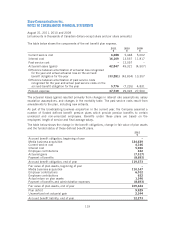

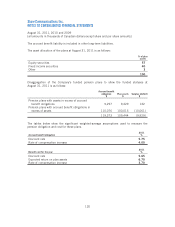

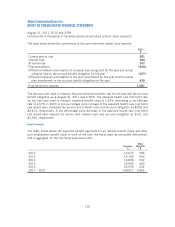

16. BUSINESS SEGMENT INFORMATION

The Company’s operating segments are Cable, Media, DTH and Satellite Services, all of which

are substantially located in Canada. The accounting policies of the segments are the same as

those described in the summary of significant accounting policies. Management evaluates

divisional performance based on revenue and operating income before charges such as

amortization.

2011

Satellite

Cable

$

Media

$

DTH

$

Satellite

Services

$

Total

$

Intersegment

Eliminations

$

Total

$

Revenue 3,095,456 890,913 745,350 82,181 827,531 (72,997) 4,740,903

Operating income before amortization 1,491,700 251,561 245,176 42,391 287,567 – 2,030,828

Operating income as % of revenue 48.2% 28.2% 32.9% 51.6% 34.7% – 42.8%

Interest(1) 231,678 53,237 n/a n/a 25,952 – 310,867

Burrard Landing Lot 2 Holdings

Partnership 1,291

Wireless 19,426

331,584

Cash taxes (2) 163,600 24,600 n/a n/a 51,400 – 239,600

Corporate/other (29,951)

209,649

Segment assets 7,249,671 2,830,944 861,424 502,810 1,364,234 – 11,444,849

Corporate assets (1) 1,065,028

Assets held for sale 16,000

Total assets 12,525,877

Capital expenditures and equipment costs

(net)

by segment

Capital expenditures 677,375 27,060 5,962 25,520 31,482 – 735,917

Equipment costs (net) 31,442 – 75,341 – 75,341 – 106,783

708,817 27,060 81,303 25,520 106,823 – 842,700

Reconciliation to Consolidated Statements

of Cash Flows

Additions to property, plant and equipment 704,461

Additions to equipment costs (net) 119,933

Additions to other intangibles 64,727

Total of capital expenditures and

equipment costs (net) per

Consolidated Statements of Cash Flows 889,121

Decrease in working capital related to

capital expenditures (16,679)

Less: Proceeds on disposal of property,

plant and equipment (26,826)

Less: Satellite services equipment profit (4) (2,916)

Total capital expenditures and equipment

costs (net) reported by segments 842,700

See notes following 2009 business segment table.

112