Shaw 2011 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2011, 2010 and 2009

[all amounts in thousands of Canadian dollars except share and per share amounts]

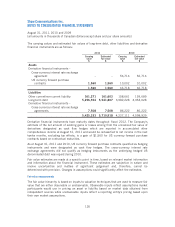

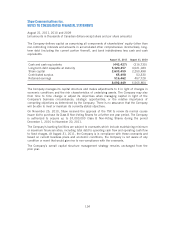

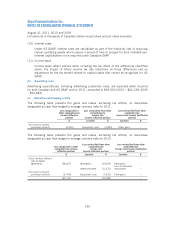

The Company defines capital as comprising all components of shareholders’ equity (other than

non-controlling interests and amounts in accumulated other comprehensive income/loss), long-

term debt (including the current portion thereof), and bank indebtedness less cash and cash

equivalents.

August 31, 2011 August 31, 2010

Cash and cash equivalents (443,427) (216,735)

Long-term debt repayable at maturity 5,320,457 4,021,033

Share capital 2,633,459 2,250,498

Contributed surplus 65,498 53,330

Retained earnings 516,462 457,728

8,092,449 6,565,854

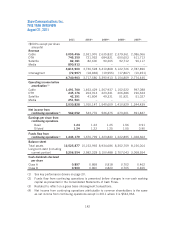

The Company manages its capital structure and makes adjustments to it in light of changes in

economic conditions and the risk characteristics of underlying assets. The Company may also

from time to time change or adjust its objectives when managing capital in light of the

Company’s business circumstances, strategic opportunities, or the relative importance of

competing objectives as determined by the Company. There is no assurance that the Company

will be able to meet or maintain its currently stated objectives.

On November 25, 2010, Shaw received the approval of the TSX to renew its normal course

issuer bid to purchase its Class B Non-Voting Shares for a further one year period. The Company

is authorized to acquire up to 37,000,000 Class B Non-Voting Shares during the period

December 1, 2010 to November 30, 2011.

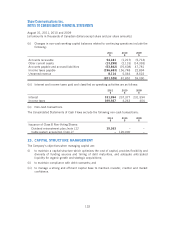

The Company’s banking facilities are subject to covenants which include maintaining minimum

or maximum financial ratios, including total debt to operating cash flow and operating cash flow

to fixed charges. At August 31, 2011, the Company is in compliance with these covenants and

based on current business plans and economic conditions, the Company is not aware of any

condition or event that would give rise to non-compliance with the covenants.

The Company’s overall capital structure management strategy remains unchanged from the

prior year.

134