Shaw 2011 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2011, 2010 and 2009

[all amounts in thousands of Canadian dollars except share and per share amounts]

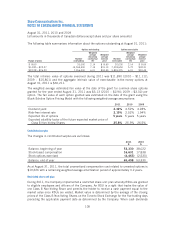

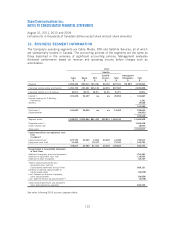

(4) The profit from the sale of satellite equipment is subtracted from the calculation of

segmented capital expenditures and equipment costs (net) as the Company views the

profit on sale as a recovery of expenditures on customer premise equipment.

(5) Consolidated capital expenditures include the Company’s proportionate share of the

Burrard Landing Lot 2 Holdings Partnership (the “Partnership”) capital expenditures

which the Company is required to proportionately consolidate. As the Partnership’s

operations are self funded, the Partnership’s capital expenditures are subtracted from the

calculation of segmented capital expenditures and equipment costs (net).

(6) 2010 includes the impact of a one-time CRTC Part II fee recovery of $48,662 for Cable

and $26,570 for combined satellite.

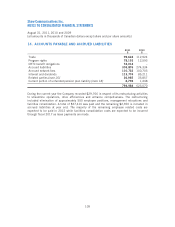

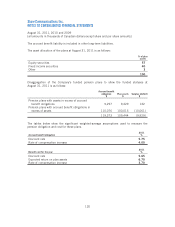

17. COMMITMENTS AND CONTINGENCIES

Commitments

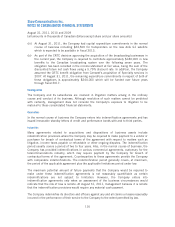

(i) During prior years, the Company, through its subsidiaries, purchased 28 Ku-band

transponders on the Anik F1 satellite and 18 Ku-band transponders on the Anik F2

satellite from Telesat Canada. During 2006, the Company’s traffic on the Anik F1 was

transferred to the Anik F1R under a capacity services arrangement which has all of the

same substantive benefits and obligations as on Anik F1. In addition, the Company leases

a number of C-band and Ku-band transponders. Under the Ku-band F1 and F2

transponder purchase agreements, the Company is committed to paying an annual

transponder maintenance fee for each transponder acquired from the time the satellite

becomes operational for a period of 15 years.

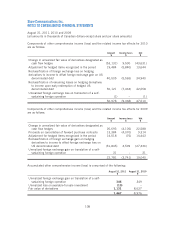

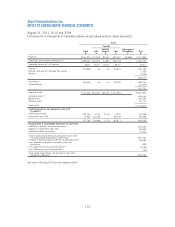

(ii) The Company has various long-term commitments of which the majority are for the

maintenance and lease of satellite transponders, program related agreements, lease of

transmission facilities, and lease of premises as follows:

$

2012 616,542

2013 286,249

2014 264,107

2015 257,086

2016 136,598

Thereafter 492,386

2,052,968

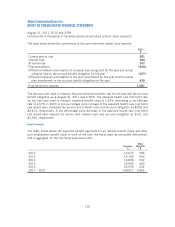

Program agreements generally commit the Company to acquire specific programs or films

or certain levels of future productions. The acquisition of these program rights is

contingent on actual production or airing of the programs or films. At August 31, 2011,

there is approximately $430,000 included above in respect of such program rights

commitments.

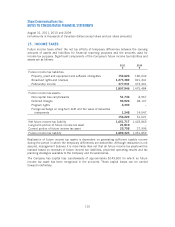

Included in operating, general and administrative expenses are transponder maintenance

expenses of $58,381 (2010 – $58,369; 2009 – $58,343) and rental expenses of

$90,181 (2010 – $66,987; 2009 – $67,663).

115