Shaw 2011 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2011, 2010 and 2009

[all amounts in thousands of Canadian dollars except share and per share amounts]

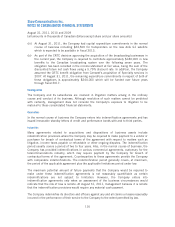

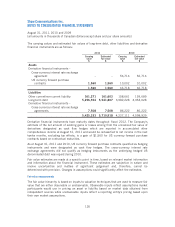

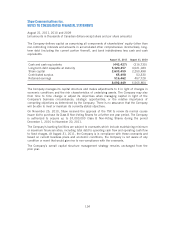

The carrying values and estimated fair values of long-term debt, other liabilities and derivative

financial instruments are as follows:

2011 2010

Carrying Estimated Carrying Estimated

value fair value value fair value

$$$$

Assets

Derivative financial instruments –

Cross-currency interest rate exchange

agreement – – 56,716 56,716

US currency forward purchase

contracts 1,560 1,560 10,002 10,002

1,560 1,560 66,718 66,718

Liabilities

Other current/non-current liability 161,271 161,603 158,661 159,689

Long-term debt 5,256,554 5,541,807 3,982,228 4,353,028

Derivative financial instruments –

Cross-currency interest rate exchange

agreements 7,508 7,508 86,222 86,222

5,425,333 5,710,918 4,227,111 4,598,939

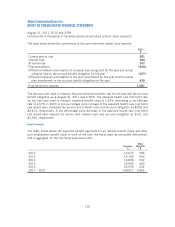

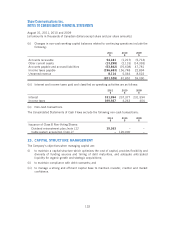

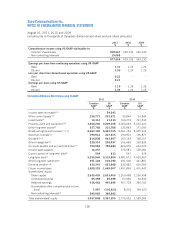

Derivative financial instruments have maturity dates throughout fiscal 2012. The Company’s

estimate of the net amount of existing gains or losses arising from the unrealized fair value of

derivatives designated as cash flow hedges which are reported in accumulated other

comprehensive income at August 31, 2011 and would be reclassified to net income in the next

twelve months, excluding tax effects, is a gain of $1,560 for US currency forward purchase

contracts based on contractual maturities.

As at August 31, 2011 and 2010, US currency forward purchase contracts qualified as hedging

instruments and were designated as cash flow hedges. The cross-currency interest rate

exchange agreements did not qualify as hedging instruments as the underlying hedged US

denominated debt was repaid during 2010.

Fair value estimates are made at a specific point in time, based on relevant market information

and information about the financial instrument. These estimates are subjective in nature and

involve uncertainties and matters of significant judgement and, therefore, cannot be

determined with precision. Changes in assumptions could significantly affect the estimates.

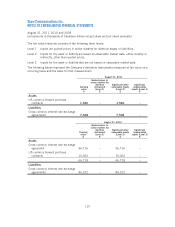

Fair value measurements

The fair value hierarchy is based on inputs to valuation techniques that are used to measure fair

value that are either observable or unobservable. Observable inputs reflect assumptions market

participants would use in pricing an asset or liability based on market data obtained from

independent sources while unobservable inputs reflect a reporting entity’s pricing based upon

their own market assumptions.

126