Shaw 2011 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2011, 2010 and 2009

[all amounts in thousands of Canadian dollars except share and per share amounts]

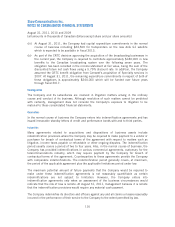

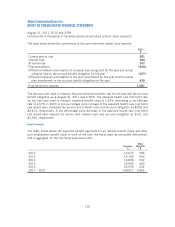

(iii) At August 31, 2011, the Company had capital expenditure commitments in the normal

course of business including $24,500 for transponders on the new Anik G1 satellite

which is expected to be available in fiscal 2013.

(iv) As part of the CRTC decision approving the acquisition of the broadcasting businesses in

the current year, the Company is required to contribute approximately $180,000 in new

benefits to the Canadian broadcasting system over the following seven years. The

obligation has been recorded in the income statement at fair value, being the sum of the

discounted future net cash flows using a 5.75% discount rate. In addition, the Company

assumed the CRTC benefit obligation from Canwest’s acquisition of Specialty services in

2007. At August 31, 2011, the remaining expenditure commitments in respect of both of

these obligations is approximately $244,000 which will be funded over future years

through fiscal 2017.

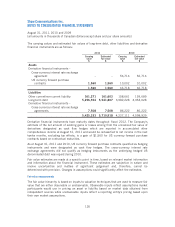

Contingencies

The Company and its subsidiaries are involved in litigation matters arising in the ordinary

course and conduct of its business. Although resolution of such matters cannot be predicted

with certainty, management does not consider the Company’s exposure to litigation to be

material to these consolidated financial statements.

Guarantees

In the normal course of business the Company enters into indemnification agreements and has

issued irrevocable standby letters of credit and performance bonds with and to third parties.

Indemnities

Many agreements related to acquisitions and dispositions of business assets include

indemnification provisions where the Company may be required to make payment to a vendor or

purchaser for breach of contractual terms of the agreement with respect to matters such as

litigation, income taxes payable or refundable or other ongoing disputes. The indemnification

period usually covers a period of two to four years. Also, in the normal course of business, the

Company has provided indemnifications in various commercial agreements, customary for the

telecommunications industry, which may require payment by the Company for breach of

contractual terms of the agreement. Counterparties to these agreements provide the Company

with comparable indemnifications. The indemnification period generally covers, at maximum,

the period of the applicable agreement plus the applicable limitations period under law.

The maximum potential amount of future payments that the Company would be required to

make under these indemnification agreements is not reasonably quantifiable as certain

indemnifications are not subject to limitation. However, the Company enters into

indemnification agreements only when an assessment of the business circumstances would

indicate that the risk of loss is remote. At August 31, 2011, management believes it is remote

that the indemnification provisions would require any material cash payment.

The Company indemnifies its directors and officers against any and all claims or losses reasonably

incurred in the performance of their service to the Company to the extent permitted by law.

116