Shaw 2011 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2011

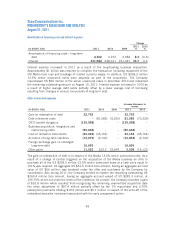

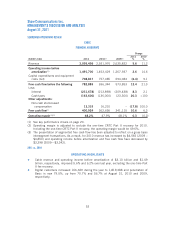

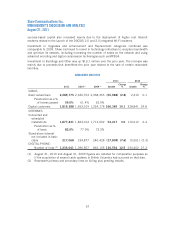

Amortization of financing costs and Interest expense

Change

(In $000’s Cdn) 2011 2010 2009

2011

%

2010

%

Amortization of financing costs – long-term

debt 4,302 3,972 3,984 8.3 (0.3)

Interest 331,584 248,011 237,047 33.7 4.6

Interest expense increased in 2011 as a result of the broadcasting business acquisition.

Approximately $1 billion was required to complete the transaction including repayment of the

CW Media term loan and breakage of related currency swaps. In addition, US $338.3 million

13.5% senior unsecured notes were assumed as part of the acquisition. The Company

repurchased US $56 million of the senior unsecured notes in December 2010 and redeemed

the remaining outstanding amount on August 15, 2011. Interest expense increased in 2010 as

a result of higher average debt levels partially offset by a lower average cost of borrowing

resulting from changes in various components of long-term debt.

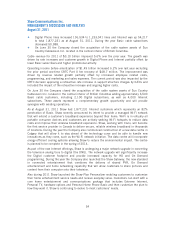

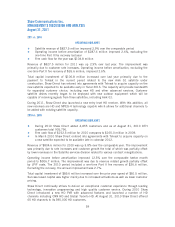

Other income and expenses

Increase (decrease) in

income

(In $000’s Cdn) 2011 2010 2009 2011 2010

Gain on redemption of debt 32,752 ––32,752 –

Debt retirement costs –(81,585) (8,255) 81,585 (73,330)

CRTC benefit obligation (139,098) ––(139,098) –

Business acquisition, integration and

restructuring costs (90,648) ––(90,648) –

Loss on derivative instruments (22,022) (45,164) – 23,142 (45,164)

Accretion of long-term liabilities (14,975) (2,142) – (12,833) (2,142)

Foreign exchange gain on unhedged

long-term debt 16,695 ––16,695 –

Other gains 11,022 5,513 19,644 5,509 (14,131)

The gain on redemption of debt is in respect of the Media 13.5% senior unsecured notes. As a

result of a change of control triggered on the acquisition of the Media business an offer to

purchase all of the US $338.3 million 13.5% senior unsecured notes at a cash price equal to

101% was required. An aggregate US $51.6 million face amount, having an aggregate accrued

value of US $56 million, was tendered under the offer and purchased by the Company for

cancellation. Also during 2011, the Company elected to redeem the remaining outstanding US

$260.4 million face amount, having an aggregate accrued valued of US $282.3 million, at

106.75% as set out under the terms of the indenture. As a result, the Company recorded a gain

of $32.8 million which resulted from recognizing the remaining unamortized acquisition date

fair value adjustment of $57.4 million partially offset by the 1% repurchase and 6.75%

redemption premiums totaling $19.5 million and $5.1 million in respect of the write-off of the

embedded derivative instrument associated with the early prepayment option.

49