Shaw 2011 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2011, 2010 and 2009

[all amounts in thousands of Canadian dollars except share and per share amounts]

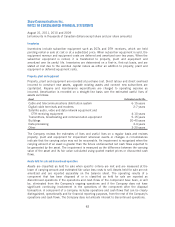

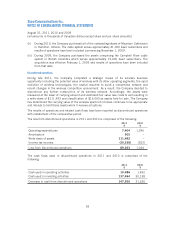

CRTC benefit obligations

The fair value of CRTC benefit obligations committed as part of business acquisitions are

initially recorded, on a discounted basis, at the present value of amounts to be paid net of any

expected incremental cash inflows. The obligation is subsequently adjusted for the incurrence

of related expenditures, the passage of time and for revisions to the timing of the cash flows.

Changes in the obligation due to the passage of time are recorded as accretion of long-term

liabilities in the income statement.

Asset retirement obligations

The Company recognizes the fair value of a liability for an asset retirement obligation in the

period in which it is incurred, on a discounted basis, with a corresponding increase to the

carrying amount of property and equipment, primarily in respect of transmitter sites. This cost

is amortized on the same basis as the related asset. The liability is subsequently increased for

the passage of time and the accretion is recorded in the income statement as accretion of long-

term liabilities. Revisions due to the estimated timing of cash flows or the amount required to

settle the obligation may result in an increase or decrease in the liability. Actual costs incurred

upon settlement of the obligation are charged against the liability to the extent recorded.

Deferred credits

Deferred credits primarily include: (i) prepayments received under IRU agreements amortized

on a straight-line basis into income over the term of the agreement; (ii) equipment revenue, as

described in the revenue and expenses accounting policy, deferred and amortized over two

years to five years; (iii) connection fee revenue and upfront installation revenue, as described in

the revenue and expenses accounting policy, deferred and amortized over two to ten years; and

(iv) a deposit on a future fibre sale.

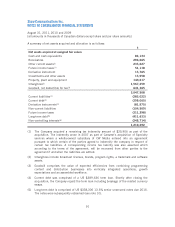

Income taxes

The Company accounts for income taxes using the liability method, whereby future income tax

assets and liabilities are determined based on differences between the financial reporting and

tax bases of assets and liabilities measured using substantively enacted tax rates and laws that

will be in effect when the differences are expected to reverse. Income tax expense for the period

is the tax payable for the period and any change during the period in future income tax assets

and liabilities.

Foreign currency translation

The financial statements of a foreign subsidiary, which is self-sustaining, are translated using

the current rate method, whereby assets and liabilities are translated at year-end exchange rates

and revenues and expenses are translated at average exchange rates for the year. Adjustments

arising from the translation of the financial statements are included in Other Comprehensive

Income (Loss).

Transactions originating in foreign currencies are translated into Canadian dollars at the

exchange rate at the date of the transaction. Monetary assets and liabilities are translated at the

year-end rate of exchange and non-monetary items are translated at historic exchange rates.

85