Shaw 2011 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2011

In conjunction with the acquisition of the broadcasting business, the Company assumed a US

$389.6 million term loan and US $338.3 million senior unsecured notes. Shortly after closing

the acquisition, the Company repaid the term loan including breakage of the related cross

currency interest rate swaps. During the second quarter, the Company repurchased and

cancelled US $51.6 million face amount of the senior secured notes which had an aggregate

accrued value of US $56 million. During the fourth quarter, the Company elected to redeem the

remaining outstanding US $260.4 million face amount of the senior secured notes, having an

aggregate accrued valued of US $282.3 million. As a result of fluctuations of the Canadian

dollar relative to the US dollar, a foreign exchange gain was recorded.

Other gains increased in 2011 and decreased in 2010 due to a gain of $10.8 million on

cancellation of a bond forward contract in 2009 and amounts realized on disposal of property,

plant and equipment.

Equity income (loss) on investees

The Company recorded income of $13.4 million in respect of its 49.9% equity interest in CW

Media for the period September 1 to October 26, 2010. On October 27, 2010, the Company

acquired the remaining equity interest in CW Media as part of its purchase of all the broadcasting

assets of Canwest. Results of operations are consolidated effective October 27, 2010. The equity

income was comprised of approximately $19.6 million of operating income before amortization

partially offset by interest expense of $4.5 million and other net costs of $1.7 million. The

remaining equity income on investees is in respect of interests in several specialty channels. The

$11.3 million loss in the prior year was in respect of the 49.9% equity interest in CW Media for

the period May 3 to August 31, 2010. The loss was comprised of approximately $20.8 million of

operating income before amortization offset by interest expense of $9.9 million and other costs of

$22.2 million, the majority of which were fair value adjustments on derivative instruments and

foreign exchange losses on US denominated long-term debt.

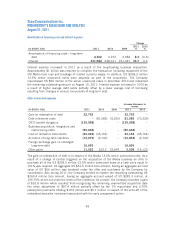

Income tax expense

The income tax expense was calculated using current statutory income tax rates of 27.9% for

2011, 29.3% for 2010, and 30.2% for 2009 and was adjusted for the reconciling items

identified in Note 15 to the Consolidated Financial Statements. Future income tax recoveries of

$17.6 million and $22.6 million related to reductions in corporate income tax rates were

recorded in 2010 and 2009, respectively. The significant growth in net income before taxes

over the past several years has reduced the Company’s tax loss carryforwards and the Company

became cash taxable in the latter part of 2009.

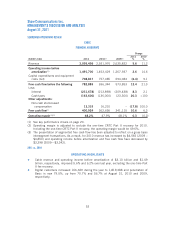

Loss from discontinued operations

Shaw completed its review of the wireless strategic initiative and concluded that the economics

as a new entrant would be extremely challenging, even with the Company’s established base

and considerable strengths and assets. As a result, the Company decided to discontinue further

construction of its wireless network and has classified all wireless activities as discontinued

operations, including restatement of the comparative period. The Company recorded after tax

losses of $89.3 million and $1.0 million for 2011 and 2010, respectively. The loss of $89.3

million was comprised of a write-down of assets of $111.5 million, operating expenditures and

amortization of $8.3 million and an income tax recovery of $30.5 million.

51