Shaw 2011 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2011, 2010 and 2009

[all amounts in thousands of Canadian dollars except share and per share amounts]

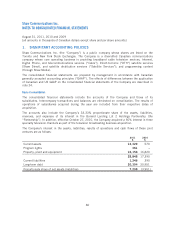

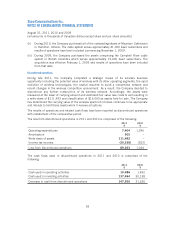

Other long-term assets

Other long-term assets primarily include (i) equipment costs, as described in the revenue and

expenses accounting policy, deferred and amortized on a straight-line basis over two to five

years; (ii) credit facility arrangement fees amortized on a straight-line basis over the term of the

facility; (iii) long-term receivables and (iv) the non-current portion of prepaid maintenance and

support contracts.

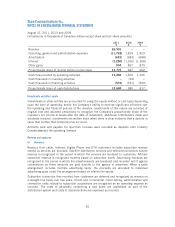

Intangibles

The excess of the cost of acquiring cable, satellite and media businesses over the fair value of

related net identifiable tangible and intangible assets acquired is allocated to goodwill. Net

identifiable intangible assets acquired consist of amounts allocated to broadcast rights and

licenses, trademarks, brands, program rights, material agreements and software assets.

Broadcast rights and licenses, trademarks and brands represent identifiable assets with

indefinite useful lives. Spectrum licenses were acquired in Industry Canada’s auction of

licenses for advanced wireless services and have an indefinite life.

Goodwill and intangible assets with an indefinite life are not amortized but are subject to an

annual review for impairment. Identifiable intangibles are tested for impairment by comparing

the estimated fair value of the intangible asset with its carrying amount. Goodwill impairment is

determined using a two-step process. The first step involves a comparison of the estimated fair

value of the reporting unit to its carrying amount, including goodwill. If the fair value of a

reporting unit exceeds its carrying amount, goodwill of the reporting unit is considered not

impaired, thus the second step of the impairment test is unnecessary. If the carrying amount of

the reporting unit exceeds its fair value, the second step of the impairment test is performed to

measure the amount of the impairment loss.

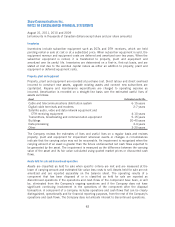

Program rights represent licensed rights acquired to broadcast television programs on the

Company’s conventional and specialty television channels and program advances are in respect

of payments for programming prior to the window license start date. For licensed rights, the

Company records a liability for program rights and corresponding asset when the license period

has commenced and all of the following conditions have been met: (i) the cost of the program is

known or reasonably determinable, (ii) the program material has been accepted by the Company

in accordance with the license agreement and (iii) the material is available to the Company for

telecast. Program rights are expensed on a systematic basis generally over the estimated

exhibition period as the programs are aired and are included in operating, general and

administrative expenses.

Software that is not an integral part of the related hardware is classified as an intangible asset.

Software assets are amortized on a straight-line basis over estimated useful lives ranging from

four to ten years. The Company reviews the estimates of lives and useful lives on a regular basis

and reviews software assets for impairment whenever events or changes in circumstances indicate

that the carrying value may not be recoverable. An impairment is recognized when the carrying

amount of an asset is greater than the future undiscounted net cash flows expected to be

generated by the asset. The impairment is measured as the difference between the carrying value

of the asset and its fair value calculated using quoted market prices or discounted cash flows.

84