Shaw 2011 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2011, 2010 and 2009

[all amounts in thousands of Canadian dollars except share and per share amounts]

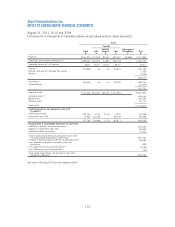

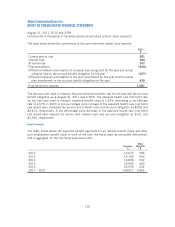

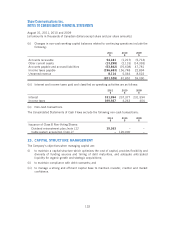

19. OTHER LONG-TERM LIABILITIES

2011

$

2010

$

Pension liabilities [note 18] 169,593 132,839

Amended cross-currency interest rate agreements [note 21] –158,661

CRTC benefit obligations 146,970 –

Post retirement liabilities [note 18] 15,693 –

Program rights liabilities 7,527 –

Asset retirement obligations 7,770 –

Other 3,569 –

351,122 291,500

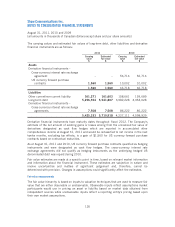

20. RELATED PARTY TRANSACTIONS

The following sets forth transactions in which the Company and its affiliates, directors or

executive officers are involved.

Normal course transactions

The Company has entered into certain transactions and agreements in the normal course of

business with certain of its related parties. These transactions are measured at the exchange

amount, which is the amount of consideration established and agreed to by the related parties.

Corus Entertainment Inc. (“Corus”)

The Company and Corus are subject to common voting control. During the year, network fees of

$136,487 (2010 – $135,334; 2009 – $121,659), advertising fees of $1,482 (2010 – $502;

2009 – $621) and programming fees of $876 (2010 – $1,070; 2009 – $1,066) were paid to

various Corus subsidiaries and entities subject to significant influence. In addition, the

Company provided administrative and other services for $1,274 (2010 – $1,909; 2009 –

$1,934), uplink of television signals for $4,861 (2010 – $4,930; 2009 – $5,112) and

Internet services and lease of circuits for $1,488 (2010 – $1,461; 2009 – $1,167). During

2010 and 2009, the Company provided cable system distribution access and affiliate

broadcasting services to Corus Custom Networks, the advertising division of Corus, for $1,518

and $1,514, respectively.

The Company provided Corus with television advertising spots in return for radio and television

advertising. No monetary consideration was exchanged for these transactions and no amounts

were recorded in the accounts.

123