Shaw 2011 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2011

Embedded derivative instruments

Derivatives embedded in other financial instruments or contracts are separated from their host

contracts and separately accounted for as derivatives when their economic characteristics and

risks are not closely related to the host contract, they meet the definition of a derivative and the

combined instrument or contract is not measured at fair value. The Company records embedded

derivatives at fair value with changes recognized in the income statement as loss/gain on

derivative instruments.

The following policies will be adopted in future years:

International Financial Reporting Standards

In February 2008, the CICA Accounting Standards Board (“AcSB”) confirmed that Canadian

publicly accountable enterprises will be required to adopt International Financial Reporting

Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”), for

fiscal periods beginning on or after January 1, 2011. These standards require the Company to

begin reporting under IFRS in the first quarter of fiscal 2012 with comparative data for the

prior year. The table below outlines the phases involved in the changeover to IFRS.

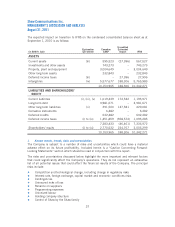

Phase Description and status

Impact assessment and

planning

This phase includes establishment of a project team and high-level

review to determine potential significant differences under IFRS as

compared to Canadian GAAP. This phase was completed and as a

result, the Company developed a transition plan and a preliminary

timeline to comply with the changeover date while recognizing that

project activities and timelines could change as a result of

unexpected developments.

Design and development – key

elements

This phase includes (i) an in-depth review to identify and assess

accounting and reporting differences, (ii) evaluation and selection

of accounting policies, (iii) assessment of impact on information

systems, internal controls, and business activities, and (iv) training

and communication with key stakeholders.

During 2009, the Company completed its preliminary identification

and assessment of accounting and reporting differences. In

addition, training was provided to certain key employees involved in

or directly impacted by the conversion process.

During 2010, the assessment of the impact on information systems

and design phase of system changes were completed and the

implementation phase commenced. The Company completed

further in-depth evaluations of those areas initially identified as

being potential accounting and reporting differences, as well as the

evaluation of IFRS 1 elections/exemptions which are discussed

below.

During 2011, the Company finalized its assessment of key

differences and is in the process of finalizing the quantitative

impact on the opening balance sheet and the quarterly periods.

Implementation This phase includes integration of solutions into processes and

financial systems that are required for the conversion to IFRS and

parallel reporting during the year prior to transition including

proforma financial statements and note disclosures. Process

solutions have been developed and implemented to incorporate

required revisions to internal controls during the changeover and on

an on-going basis.

33