Shaw 2011 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

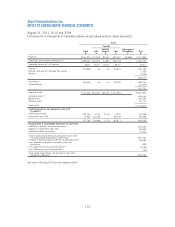

August 31, 2011, 2010 and 2009

[all amounts in thousands of Canadian dollars except share and per share amounts]

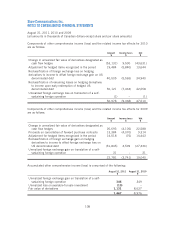

Irrevocable standby letters of credit and commercial surety bonds

The Company and certain of its subsidiaries have granted irrevocable standby letters of credit

and commercial surety bonds, issued by high rated financial institutions, to third parties to

indemnify them in the event the Company does not perform its contractual obligations. As of

August 31, 2011, the guarantee instruments amounted to $2,274 (2010 – $1,110). The

Company has not recorded any additional liability with respect to these guarantees, as the

Company does not expect to make any payments in excess of what is recorded on the

Company’s consolidated financial statements. The guarantee instruments mature at various

dates during fiscal 2012 and 2013.

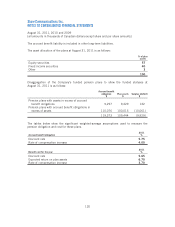

18. EMPLOYEE BENEFIT PLANS

Defined contribution pension plans

The Company has defined contribution pension plans for the majority of its non-union and

certain union employees and, for the majority of these employees, contributes 5% of eligible

earnings to the maximum amount deductible under the Income Tax Act. Total pension costs in

respect of these plans for the year were $29,161 (2010 – $23,550; 2009 – $21,148) of

which $18,080 (2010 – $13,755; 2009 – $12,281) was expensed and the remainder

capitalized. During 2011, in addition to the impact of salary escalation and growth of eligible

employees, pension expense was also impacted by the Media business acquisition.

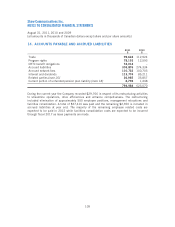

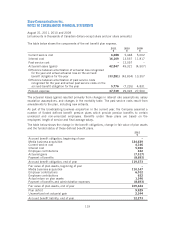

Defined benefit pension plans

The Company provides a non-contributory defined benefit pension plan for certain of its senior

executives. Benefits under this plan are based on the employees’ length of service and their

highest three-year average rate of pay during their years of service. Employees are not required

to contribute to this plan and the plan is unfunded. There are no minimum required

contributions and no discretionary contributions are currently planned.

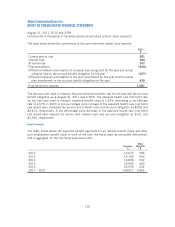

The table below shows the change in benefit obligation for this plan.

2011

$

2010

$

Accrued benefit obligation and plan deficit, beginning of year 274,594 195,659

Current service cost 6,288 5,448

Past service cost –12,057

Interest cost 16,109 13,557

Actuarial losses 42,847 49,321

Payment of benefits (5,910) (1,448)

Accrued benefit obligation and plan deficit, end of year 333,928 274,594

117