Shaw 2011 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2011, 2010 and 2009

[all amounts in thousands of Canadian dollars except share and per share amounts]

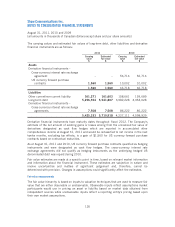

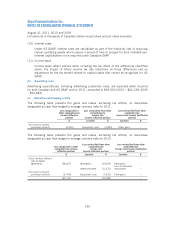

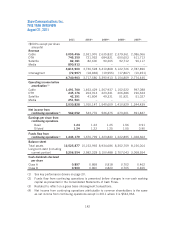

24. UNITED STATES GENERALLY ACCEPTED ACCOUNTING PRINCIPLES

The consolidated financial statements of the Company are prepared in Canadian dollars in

accordance with Canadian GAAP. The following adjustments and disclosures would be required

in order to present these consolidated financial statements in accordance with US GAAP.

Upon adoption of IFRS effective September 1, 2011, the Company will no longer be required to

reconcile its consolidated financial statements to US GAAP.

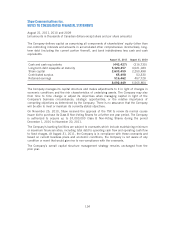

(a) Reconciliation to US GAAP

2011 2010 2009

$$$

Net income from continuing operations using Canadian

GAAP 562,052 533,776 536,475

Add (deduct) adjustments for:

Deferred charges and credits (2) (8) (2,337) 14,539 4,576

Business acquisition costs (3) 17,263 (12,739) –

Gain (loss) on derivative instruments (7) (3,327) 10,002 –

Capitalized interest (10) 22,358 8,195 1,337

Income taxes (11) (7,795) (13,839) (3,613)

Net income from continuing operations using US GAAP 588,214 539,934 538,775

Loss from discontinued operations using Canadian GAAP (89,263) (1,044) –

Adjustment for capitalized interest (3,903) ––

Loss from discontinued operations using US GAAP (93,166) (1,044) –

Net income from continuing operations using US GAAP 588,214 539,934 538,775

Loss from discontinued operations using US GAAP (93,166) (1,044) –

Net income using US GAAP 495,048 538,890 538,775

Net income using US GAAP attributable to:

Common shareholders 475,960 539,890 538,775

Non-controlling interests 19,088 ––

495,048 538,890 538,775

Other comprehensive income (loss) using Canadian GAAP (7,509) 47,610 19,040

Fair value of derivatives (7) 8,627 (8,627) –

Change in funded status of defined benefit pension and

post-retirement plans (9) (18,511) (38,167) 11,315

(17,393) 816 30,355

Comprehensive income using US GAAP 477,655 539,706 569,130

135