Shaw 2011 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149

|

|

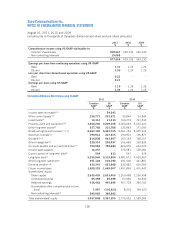

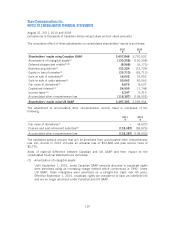

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2011, 2010 and 2009

[all amounts in thousands of Canadian dollars except share and per share amounts]

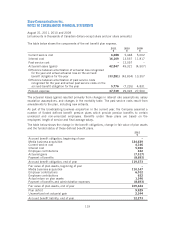

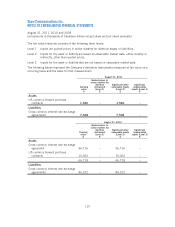

The fair value hierarchy consists of the following three levels:

Level 1 Inputs are quoted prices in active markets for identical assets or liabilities.

Level 2 Inputs for the asset or liability are based on observable market data, either directly or

indirectly, other than quoted prices.

Level 3 Inputs for the asset or liability that are not based on observable market data.

The following tables represent the Company’s derivative instruments measured at fair value on a

recurring basis and the basis for that measurement:

August 31, 2011

Carrying

value

Quoted prices in

active markets for

identical

instrument

(Level 1)

Significant other

observable inputs

(Level 2)

Significant

unobservable

inputs (Level 3)

$$ $ $

Assets

US currency forward purchase

contracts 1,560 –1,560 –

Liabilities

Cross-currency interest rate exchange

agreements 7,508 –7,508 –

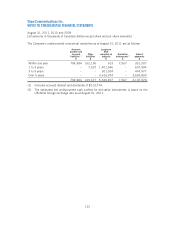

August 31, 2010

Carrying

value

Quoted prices in

active markets for

identical

instrument

(Level 1)

Significant other

observable inputs

(Level 2)

Significant

unobservable

inputs (Level 3)

$$ $ $

Assets

Cross-currency interest rate exchange

agreement 56,716 – 56,716 –

US currency forward purchase

contracts 10,002 – 10,002 –

66,718 – 66,718 –

Liabilities

Cross-currency interest rate exchange

agreements 86,222 – 86,222 –

127