Shaw 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2011

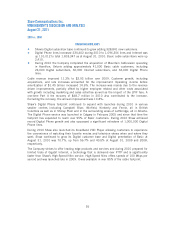

Financing activities

The changes in financing activities during the years were as follows:

(In millions Cdn) 2011 2010 2009

Issuance of Cdn $500 million 5.50% senior notes 498.2 ––

Issuance of Cdn $800 million 6.75% senior notes 778.9 ––

Issuance of Preferred Shares 300.0 ––

Issuance of Cdn $1.25 billion 5.65% senior notes –1,246.0 –

Issuance of Cdn $650 million 6.75% senior notes –645.6 –

Issuance of Cdn $600 million 6.50% senior notes –– 598.2

Senior notes and Preferred Shares issuance costs (17.3) (10.1) (4.6)

Repayment of CW Media US $389.6 million term loan (394.9) ––

Redemption of CW Media US $338.3 13.5% senior notes (333.9) ––

Redemption of US $440 million 8.25% senior notes –(465.5) –

Redemption of US $225 million 7.25% senior notes –(238.1) –

Redemption of US $300 million 7.20% senior notes –(312.6) –

Payments on cross-currency agreements –(291.9) –

Repayment of Videon CableSystems Inc. 8.15% senior

debentures –– (130.0)

Bank loans and bank indebtedness – net repayments –– (99.2)

Purchase of Class B Non-Voting Shares for cancellation –(118.1) (33.6)

Dividends paid to common shareholders (352.0) (372.1) (351.9)

Distributions paid to non-controlling interests (21.9) ––

Debt retirement costs –(79.5) (9.2)

Senior notes prepayment premium (19.5) ––

Proceeds on bond forward contracts –– 10.8

Issuance of Class B Non-Voting Shares 45.9 47.1 57.0

Repayment of Partnership debt (0.6) (0.5) (0.5)

Cash flow provided by financing activities 482.9 50.3 37.0

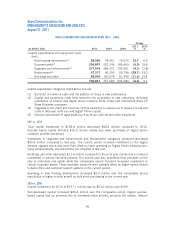

VI. LIQUIDITY AND CAPITAL RESOURCES

In the current year, the Company generated $603.0 million of free cash flow. Shaw used its

free cash flow along with net proceeds of $1.27 billion from its three senior notes issuances,

net proceeds of $290.9 million from its Preferred Share issuance, proceeds on issuance of

Class B Non-Voting Shares of $45.9 million and other net items of $23.2 million to pay

$981.2 million to complete the broadcasting business acquisition including repayment of the

CW Media term loan and breakage of related currency swaps, fund the net change in working

capital requirements of approximately $218.2 million, pay common share dividends of $352.0

million, fund cash requirements of the wireless discontinued operations of $148.0 million, pay

$353.4 million to redeem the Media senior unsecured notes including the prepayment

premium, purchase cable systems for $35.7 million and increase cash and cash equivalents by

$143.6 million.

65