Shaw 2011 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2011, 2010 and 2009

[all amounts in thousands of Canadian dollars except share and per share amounts]

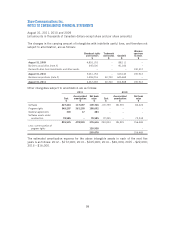

(6) Non-controlling interests in certain of the subsidiary specialty channels were assumed as

part of the acquisition and are recorded at their proportionate share of the fair value of

identifiable net assets acquired.

(7) Future income tax asset includes both current and non-current portions of $26,882 and

$24,236, respectively.

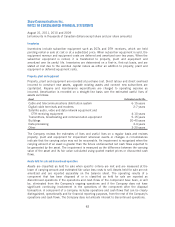

(ii) Cable systems

2011 2010(1) 2009

$$ $

Cash 35,652 163,875 46,300

Issuance of Class B Non-Voting Shares –120,000 –

Total purchase price 35,652 283,875 46,300

(1) The cash consideration paid, net of cash acquired of $5,070, was $158,805.

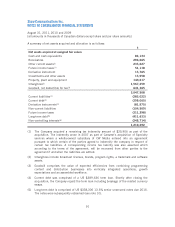

A summary of net assets acquired and allocation is as follows:

2011 2010 2009

$$ $

Net assets acquired at assigned fair values

Investments –206 –

Property, plant and equipment 9,295 57,796 6,825

Broadcast rights [note 9] 23,916 245,000 40,075

Other intangibles 305 ––

Goodwill, not deductible for tax [note 9] 4,300 81,032 –

37,816 384,034 46,900

Working capital deficiency 364 27,397 600

Other liability 1,800 ––

Future income taxes –72,762 –

2,164 100,159 600

Purchase price 35,652 283,875 46,300

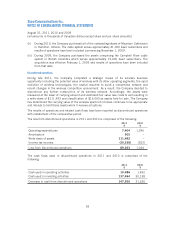

(i) During 2011, the Company purchased the assets of several cable systems serving

approximately 7,300 basic subscribers in the interior of British Columbia. These assets

were purchased as they compliment the Company’s existing surrounding cable systems.

Goodwill comprises the value of expected synergies and future growth opportunities. The

transaction has been accounted for using the acquisition method and results of operations

have been included from their respective acquisition dates. These assets have contributed

approximately $1,700 of revenue and $685 of operating income before amortization in

2011. The purchase price may be impacted by settlement of final closing adjustments for

working capital.

92