Shaw 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149

|

|

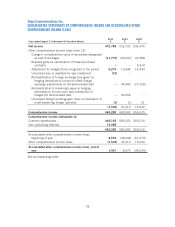

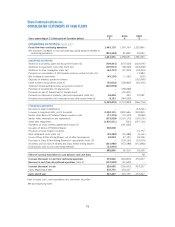

Shaw Communications Inc.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME AND ACCUMULATED OTHER

COMPREHENSIVE INCOME (LOSS)

Years ended August 31 [thousands of Canadian dollars]

2011

$

2010

$

2009

$

Net income 472,789 532,732 536,475

Other comprehensive income (loss) [note 13]

Change in unrealized fair value of derivatives designated

as cash flow hedges (11,770) (43,631) 22,588

Realized gains on cancellation of forward purchase

contracts –– 9,314

Adjustment for hedged items recognized in the period 4,274 13,644 14,443

Unrealized loss on available-for-sale investment (10) ––

Reclassification of foreign exchange loss (gain) on

hedging derivatives to income to offset foreign

exchange adjustments on US denominated debt –34,940 (27,336)

Reclassification of remaining losses on hedging

derivatives to income upon early redemption of

hedged US denominated debt –42,658 –

Unrealized foreign exchange gain (loss) on translation of

a self-sustaining foreign operation (3) (1) 31

(7,509) 47,610 19,040

Comprehensive income 465,280 580,342 555,515

Comprehensive income attributable to:

Common shareholders 446,192 580,342 555,515

Non-controlling interests 19,088 ––

465,280 580,342 555,515

Accumulated other comprehensive income (loss),

beginning of year 8,976 (38,634) (57,674)

Other comprehensive income (loss) (7,509) 47,610 19,040

Accumulated other comprehensive income (loss), end of

year 1,467 8,976 (38,634)

See accompanying notes

78