Shaw 2011 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

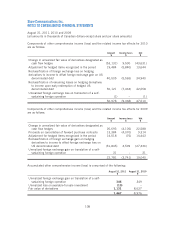

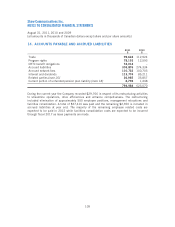

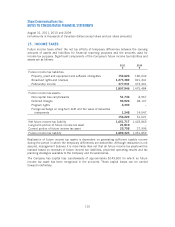

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2011, 2010 and 2009

[all amounts in thousands of Canadian dollars except share and per share amounts]

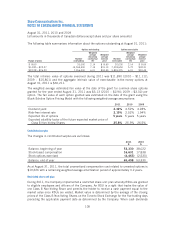

Within 30 days of closing the transaction, a subsidiary of CW Media was required to make a

change of control offer at a cash price equal to 101% of the obligations under the US

$338,306 senior unsecured notes in accordance with a related indenture. As a result, on

November 15, 2010, an offer was made to purchase all of the notes for an effective purchase

price of US $1,145.58 for each US $1,000 face amount. An aggregate of US $51,620 face

amount was tendered under the offer and purchased by the Company for cancellation for an

aggregate price of US $59,135, including accrued interest and repurchase premium. In

August, 2011 the Company redeemed the remaining outstanding US $260,380 face amount at

106.75% as set out under the terms of the indenture at an effective purchase price of US

$1,230.70 for each US $1,000 face amount for an aggregate purchase price of US $320,449,

including accrued interest and prepayment premium.

The Company recorded a gain of $32,752 in respect of the redemption which resulted from

recognizing the remaining unamortized acquisition date fair value adjustment of $57,358

partially offset by the 1% repurchase and 6.75% redemption premiums totaling $19,465, other

redemption costs of $17 and $5,124 in respect of the write-off of the embedded derivative

instrument associated with the early prepayment option.

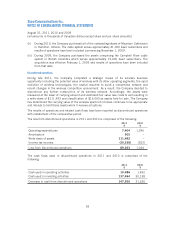

Debt retirement costs

In October 2009, the Company redeemed all of its outstanding US $440,000 8.25% senior

notes due April 11, 2010, US $225 million 7.25% senior notes due April 6, 2011 and US

$300 million 7.20% senior notes due December 15, 2011. The Company incurred costs of

$79,488 and wrote-off the remaining unamortized discount and finance costs of $2,097. In

connection with the early redemption of the US senior notes, the Company settled portions of

the principal component of the associated cross-currency interest rate swaps and entered into

offsetting or amended agreements with the counterparties for the remaining end of swap

notional principal exchanges (see note 21).

On April 15, 2009 the Company redeemed the Videon Cablesystems Inc. $130,000 Senior

Debentures. In connection with the early redemption, the Company incurred costs of $9,161

and wrote-off the remaining unamortized fair value adjustment of $906.

Debt covenants

The Company and its subsidiaries have undertaken to maintain certain covenants in respect of

the credit agreements and trust indentures described above. The Company and its subsidiaries

were in compliance with these covenants at August 31, 2011.

101