Shaw 2011 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2011, 2010 and 2009

[all amounts in thousands of Canadian dollars except share and per share amounts]

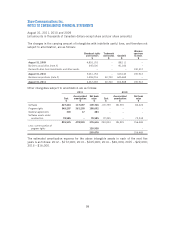

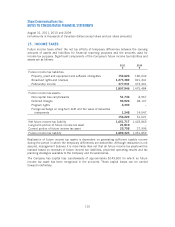

The following table summarizes information about the options outstanding at August 31, 2011:

Options outstanding Options exercisable

Range of prices

Number

outstanding

Weighted

average

remaining

contractual

life

Weighted

average

exercise

price

Number

exercisable

Weighted

average

remaining

contractual

life

Weighted

average

exercise

price

$ 8.69 20,000 2.14 $ 8.69 20,000 2.14 $ 8.69

$14.85 – $22.27 14,594,400 7.15 $19.13 7,303,650 5.72 $18.31

$22.28 – $26.20 7,356,000 6.01 $24.49 5,839,375 6.01 $24.45

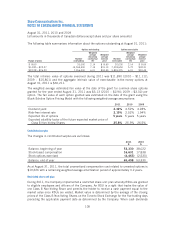

The total intrinsic value of options exercised during 2011 was $11,890 (2010 – $11,112;

2009 – $15,801) and the aggregate intrinsic value of exerciseable in-the-money options at

August 31, 2011 is $30,211.

The weighted average estimated fair value at the date of the grant for common share options

granted for the year ended August 31, 2011 was $3.13 (2010 – $2.94; 2009 – $3.02) per

option. The fair value of each option granted was estimated on the date of the grant using the

Black-Scholes Option Pricing Model with the following weighted-average assumptions:

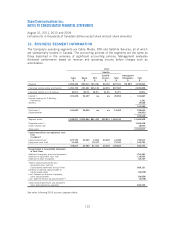

2011 2010 2009

Dividend yield 4.32% 4.52% 4.28%

Risk-free interest rate 2.19% 2.52% 1.94%

Expected life of options 5 years 5 years 5 years

Expected volatility factor of the future expected market price of

Class B Non-Voting Shares 25.8% 25.9% 26.5%

Contributed surplus

The changes in contributed surplus are as follows:

2011 2010

$$

Balance, beginning of year 53,330 38,022

Stock-based compensation 16,631 17,838

Stock options exercised (4,463) (2,530)

Balance, end of year 65,498 53,330

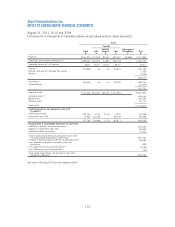

As at August 31, 2011, the total unamortized compensation cost related to unvested options is

$19,226 with a remaining weighted average amortization period of approximately 3.2 years.

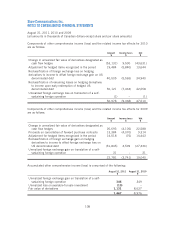

Restricted share unit plan

During 2011, the Company implemented a restricted share unit plan whereby RSUs are granted

to eligible employees and officers of the Company. An RSU is a right that tracks the value of

one Class B Non-Voting Share and permits the holder to receive a cash payment equal to the

market value once RSUs are vested. Market value is determined by the average of the closing

prices of the Class B Non-Voting Shares on the Toronto Stock Exchange for the five trading days

preceding the applicable payment date as determined by the Company. When cash dividends

105