Shaw 2011 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

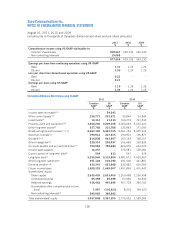

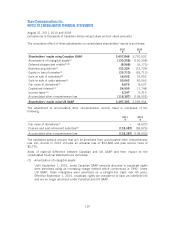

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2011, 2010 and 2009

[all amounts in thousands of Canadian dollars except share and per share amounts]

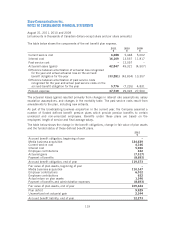

Cross-currency interest rate exchange agreements

During 2010, the Company redeemed all of its outstanding US $440,000 8.25% senior notes

due April 11, 2010, US $225,000 7.25% senior notes due April 6, 2011 and US $300,000

7.20% senior notes due December 15, 2011. In conjunction with the redemption of the US

$440,000 and US $225,000 senior notes, the Company paid $146,065 to unwind and settle a

portion of the principal component of two of the associated cross-currency interest rate swaps

and simultaneously entered into offsetting currency swap transactions for the remaining

outstanding notional principal amounts (i.e. the end of swap notional exchanges) and paid

$145,855 in respect of these offsetting swap transactions. These cross-currency agreements

were settled in 2011. In addition, upon redemption of the US $300,000 senior notes, the

Company entered into amended agreements with the counterparties of the cross-currency

agreements to fix the settlement of the principal liability on December 15, 2011 at $162,150.

At August 31, 2011, the carrying amount of the liability was $161,271 (2010- $158,661).

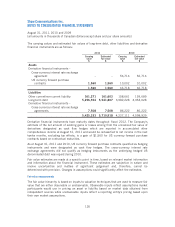

Upon redemption of the underlying hedged US denominated debt in 2010, the associated

cross-currency interest rate exchange agreements no longer qualified as cash flow hedges and

the remaining loss in accumulated other comprehensive loss of $50,121 was reclassified to the

income statement.

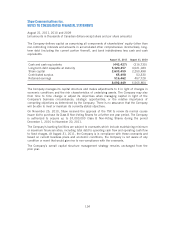

Risk management

The Company is exposed to various market risks including currency risk and interest rate risk,

as well as credit risk and liquidity risk associated with financial assets and liabilities. The

Company has designed and implemented various risk management strategies, discussed further

below, to ensure the exposure to these risks is consistent with its risk tolerance and business

objectives.

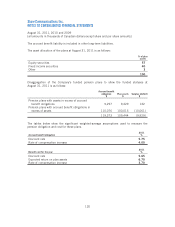

Currency risk

Certain of the Company’s capital expenditures and equipment costs are incurred in US dollars,

while its revenue is primarily denominated in Canadian dollars. Decreases in the value of the

Canadian dollar relative to the US dollar could have an adverse effect on the Company’s cash

flows. To mitigate some of the uncertainty in respect to capital expenditures and equipment

costs, the Company regularly enters into forward contracts in respect of US dollar

commitments. With respect to 2011, the Company entered into forward contracts to purchase

US $144,000 over a period of 11 months commencing in October 2010 at an average

exchange rate of 1.0249 Cdn. In addition, the Company entered into forward contracts to

purchase US $440,000 in respect of the closing of the Canwest acquisition on October 26,

2010 at an average rate of $1.0168. At August 31, 2011 the Company had forward contracts

to purchase US $48,000 over a period of 12 months commencing in September 2011 at an

average exchange rate of 0.9499 Cdn in respect of capital expenditures and equipment costs.

As part of the broadcasting business acquisition, the Company assumed US dollar denominated

debt. To mitigate some of the foreign exchange risk with respect to interest payments and

amounts due on redemption of the senior unsecured notes, the Company entered into forward

contracts to purchase US $340,000 at an average exchange rate of 0.9931. During prior years,

the Company had utilized cross-currency swaps, where appropriate, to hedge its exposures on

US dollar denominated debenture indebtedness, all of which was redeemed during 2010.

128