Shaw 2011 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2011

The Media assets generate the majority of their revenue from advertising sales and subscription

based services. The acquisition of the assets was completed at an attractive point in time of the

economic cycle, Canwest was operating under creditor protection and had undergone a

restructuring process in advance of Shaw’s acquisition. Significant costs had been removed from

the business and assets had been rationalized, including closure of the E! channel. Considering

the improving economic conditions within Canada and the restructuring process that Canwest had

undertaken, Shaw was positioned to benefit from these assets as the economy and advertising

market improved.

As part of the CRTC decision approving the acquisition, Shaw is required to contribute

approximately $180.0 million in new benefits to the broadcasting system over the next seven

years. Most of this contribution will be used to create new programming on Shaw Media services,

construct digital transmission towers and provide a satellite solution for over-the-air viewers whose

local television stations do not convert to digital. Shaw will also continue to fund the remaining

CRTC benefit obligation of approximately $95.0 million, as at October 27, 2010, related to the

Canwest purchase of Specialty services from Alliance Atlantis in 2007.

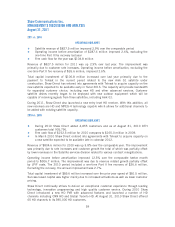

Revenue and operating income before amortization for the period from October 27, 2010 to

August 31, 2011 was $890.9 million and $251.6 million, respectively. For informational

purposes, on a comparative basis to last year, Media revenues for the current full twelve month

period were up approximately 7%, and operating income before amortization, excluding the

one-time Part II fee recovery last year, increased almost 25%. The annual improvement was due

to higher revenues mainly driven by the strengthening of the advertising market.

During 2011 Global performed well, with Big Brother returning for its thirteenth season and

consistently holding a top 10 position. In addition, Combat Hospital was the top ranked Canadian

drama this summer and Media’s specialty channels continued to have a strong presence in the

rankings.

During the year, in an innovative way for customers to access content whenever and wherever they

want, Shaw released its Global App for the iPad. It was the number one free download on the

Canadian App Store during the entire first week of launch. The Global App for iPad offers viewers

another exciting way to access the network’s blockbuster library of premium content, including

full episodes of House, The Good Wife, NCIS: LA, The Office, Rookie Blue and Survivor.

Media was successful in renegotiating 4 collective bargaining agreements covering over 1,000

unionized employees, the majority of which had been out of contract for 4 to 5 years. A fair and

equitable solution for both business and the unionized employees was reached and the new

agreements have been ratified.

Capital investment since acquisition included the conversion of transmitters from analog to digital

in the CRTC mandated markets, upgrades of aging production equipment and improvements to

network infrastructure and websites. After closing the acquisition the integration of various back-

office infrastructure commenced and was substantially complete at August 31, 2011.

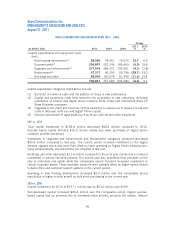

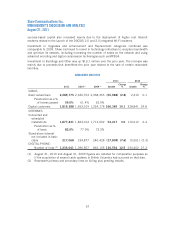

IV. FINANCIAL POSITION

Total assets at August 31, 2011 were $12.5 billion compared to $10.2 billion at August 31,

2010. Following is a discussion of significant changes in the consolidated balance sheet since

August 31, 2010.

61