Shaw 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2011

MEDIA

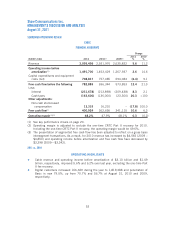

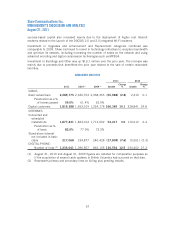

FINANCIAL HIGHLIGHTS

($000’s Cdn)

October 27, 2010 to

August 31, 2011 (3)

Revenue 890,913

Operating income before amortization (1) 251,561

Capital expenditures:

Broadcast and transmission 15,107

Buildings/other 11,953

27,060

Free cash flow before the following 224,501

Less:

Interest (2) (53,237)

Cash taxes (24,600)

Other adjustments:

Non-cash stock-based compensation 842

CRTC benefit obligation funding (30,357)

Non-controlling interests (19,808)

Free cash flow (1) 97,341

Operating margin (1) 28.2%

(1) See key performance drivers on page 20.

(2) Interest includes an allocation to the Media division based on the cost of debt incurred by

the Company to repay Media debt.

(3) On October 27, 2010, the Company completed the acquisition of 100% of the

broadcasting businesses of Canwest. The acquisition included all of the OTA channels and

the specialty television business, including Canwest’s equity interest in CW Media.

OPERATING HIGHLIGHTS

ŠOn October 27, 2010 Shaw completed the final steps in its purchase of all of the

broadcasting assets of Canwest. Collectively these assets, including the Global Television

Network and over 20 Specialty services, form Shaw Media, a new division of Shaw.

ŠThe aggregate purchase price for the Canwest broadcasting assets, including the amounts

paid to acquire the shares of CW Media from affiliates of Goldman Sachs Capital Partners

and the debt assumed at CW Media, was approximately $2.0 billion.

60