Shaw 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2011, 2010 and 2009

[all amounts in thousands of Canadian dollars except share and per share amounts]

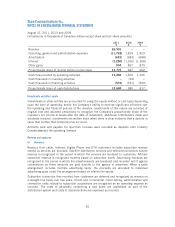

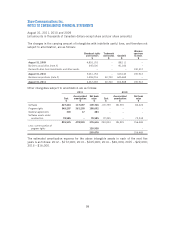

A summary of net assets acquired and allocation is as follows:

$

Net assets acquired at assigned fair values

Cash and cash equivalents 83,134

Receivables 296,665

Other current assets(1) 235,627

Future income taxes(7) 51,118

Derivative instrument 15,765

Investments and other assets 15,958

Property, plant and equipment 140,617

Intangibles(2) 1,567,259

Goodwill, not deductible for tax(3) 641,365

3,047,508

Current liabilities(1) (283,022)

Current debt(4) (399,065)

Derivative instruments(4) (81,975)

Non-current liabilities (104,509)

Future income taxes (311,298)

Long-term debt(5) (411,633)

Non-controlling interests(6) (245,714)

1,210,292

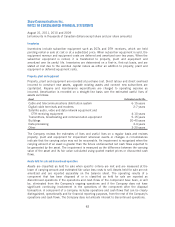

(1) The Company acquired a remaining tax indemnity amount of $25,906 as part of the

acquisition. The indemnity arose in 2007 as part of Canwest’s acquisition of Specialty

services where a wholly-owned subsidiary of CW Media entered into an agreement

pursuant to which certain of the parties agreed to indemnify the company in respect of

certain tax liabilities. A corresponding income tax liability was also assumed which

according to the terms of the agreement, will be recovered from other parties to the

agreement if and when the liabilities are settled.

(2) Intangibles include broadcast licenses, brands, program rights, a trademark and software

assets.

(3) Goodwill comprises the value of expected efficiencies from combining programming

content and distribution businesses into vertically integrated operations, growth

expectations and an assembled workforce.

(4) Current debt was comprised of a US $389,636 term loan. Shortly after closing the

acquisition, the Company repaid the term loan including breakage of the related currency

swaps.

(5) Long-term debt is comprised of US $338,306 13.5% senior unsecured notes due 2015.

The notes were subsequently redeemed (see note 10).

91