Shaw 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2011, 2010 and 2009

[all amounts in thousands of Canadian dollars except share and per share amounts]

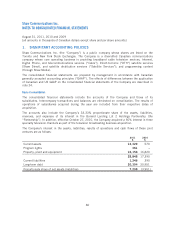

or equity instruments, and acquisition related restructuring costs must be expensed, (v) for

business combinations completed in stages, identifiable net assets are recognized at fair value

when control is obtained and a gain or loss is recognized for the difference in fair value and

carrying value of the previously held equity interests, (vi) the fair value of identifiable assets

and liabilities attributable to non-controlling interests must be recognized, and

(vii) non-controlling interests are recorded at either fair value or their proportionate share of the

fair value of identifiable net assets acquired.

Consolidated Financial Statements and Non-controlling Interests

Effective September 1, 2010, the Company early adopted CICA Handbook Section 1601

“Consolidated Financial Statements” and Section 1602 “Non-controlling Interests” which replace

Section 1600 “Consolidated Financial Statements”. The new standards provide guidance for the

preparation of financial statements and accounting for a non-controlling interest in a subsidiary in

consolidated financial statements subsequent to a business combination. For presentation and

disclosure purposes, non-controlling interests are classified as a separate component of

shareholders’ equity. In addition, net income and comprehensive income is attributed to the

Company’s shareholders and to non-controlling interests rather than reflecting the non-controlling

interests as a deduction to arrive at net income and comprehensive income.

Recent accounting pronouncements

International Financial Reporting Standards

In February 2008, the CICA Accounting Standards Board confirmed that Canadian publicly

accountable enterprises will be required to adopt International Financial Reporting Standards

(“IFRS”), as issued by the International Accounting Standards Board, for fiscal periods

beginning on or after January 1, 2011. These standards require the Company to begin reporting

under IFRS in fiscal 2012 with comparative data for the prior year.

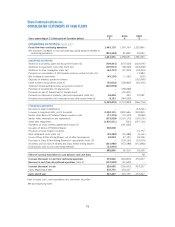

2. BUSINESS ACQUISITIONS AND DISCONTINUED OPERATIONS

Business acquisitions

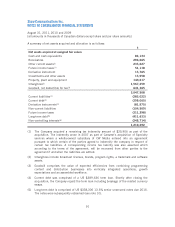

(i) Television broadcasting businesses

August 31, 2011

Cash(1)

Cumulative

equity

income Total

$$ $

Television broadcasting businesses 1,208,112 2,180 1,210,292

(1) The cash consideration includes $708,000 paid in 2010 for the Company’s initial equity

investment in CW Media and an option to acquire an additional equity interest. The

acquisition-date fair value of the Company’s initial equity investment approximated

$549,000 compared to its carrying value of $558,500 under the equity method of

accounting which resulted in an amount of approximately $9,500 related to transaction

costs which are included in business acquisition, integration and restructuring expenses

in the income statement.

89