Shaw 2011 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

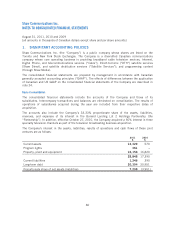

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2011, 2010 and 2009

[all amounts in thousands of Canadian dollars except share and per share amounts]

recognized on a straight-line basis over the two year vesting period. RSUs will be settled in cash

and the obligation for RSUs is revalued each period based on the market value of the Class B

Non-Voting Shares and the number of outstanding RSUs.

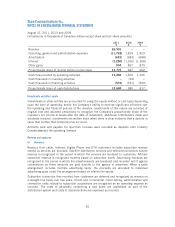

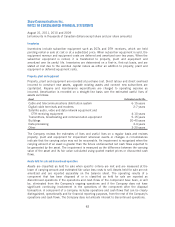

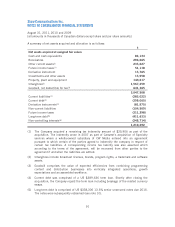

Earnings per share

Basic earnings per share is based on net income attributable to common shareholders adjusted

for dividends on preferred shares and is calculated using the weighted average number of

Class A Shares and Class B Non-Voting Shares outstanding during the year. The Company uses

the treasury stock method of calculating diluted earnings per share. This method assumes that

any proceeds from the exercise of stock options and other dilutive instruments would be used to

purchase Class B Non-Voting Shares at the average market price during the period.

Guarantees

The Company discloses information about certain types of guarantees that it has provided,

including certain types of indemnities, without regard to whether it will have to make any

payments under the guarantees (see note 17).

Use of estimates and measurement uncertainty

The preparation of consolidated financial statements in conformity with Canadian GAAP

requires management to make estimates and assumptions that affect the reported amounts of

assets and liabilities and disclosure of contingent assets and liabilities at the date of the

consolidated financial statements and the reported amounts of revenues and expenses during

the year. Actual results could differ from those estimates.

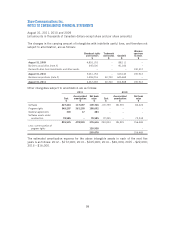

Key areas of estimation, where management has made difficult, complex or subjective judgments,

often as a result of matters that are inherently uncertain, are the allowance for doubtful accounts,

the ability to use income tax loss carryforwards and other future income tax assets, capitalization

of labour and overhead, useful lives of depreciable assets, contingent liabilities, certain

assumptions used in determining defined benefit plan pension expense, the fair value of assets

acquired and liabilities assumed in business acquisitions, and the recoverability of equipment

costs, indefinite life identifiable intangibles and goodwill using estimated future cash flows.

Significant changes in assumptions could result in impairment of intangible assets.

Adoption of recent accounting pronouncements

Business Combinations

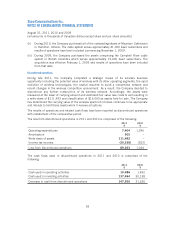

Effective September 1, 2010, the Company early adopted CICA Handbook Section 1582

“Business Combinations”, which replaces Section 1581 “Business Combinations”. The

differences which arise from the new accounting standard relate to details in applying the

acquisition method. The significant changes that result include (i) a change in the

measurement date for equity instruments issued by the acquirer from a few days before and

after the announcement date to the acquisition date, (ii) contingent consideration is recognized

at fair value and subsequently remeasured at each reporting date until settled, (iii) future

adjustments to income tax estimates are recorded in income whereas previously, certain

changes were recorded in goodwill, (iv) acquisition related costs, other than costs to issue debt

88