Shaw 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2011, 2010 and 2009

[all amounts in thousands of Canadian dollars except share and per share amounts]

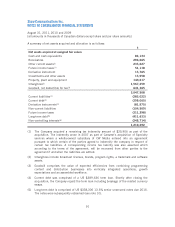

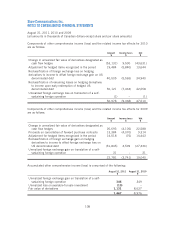

10. LONG-TERM DEBT

2011 2010

Effective

interest rates

Long-term

debt at

amortized

cost (1)

Adjustment

for

finance

costs (1)

Long-term

debt

repayable

at maturity

Long-term

debt at

amortized

cost (1)

Adjustment

for

finance

costs (1)

Long-term

debt

repayable

at maturity

% $$$$$ $

Corporate

Cdn senior notes-

6.10% due November 16, 2012 6.11 448,746 1,254 450,000 447,749 2,251 450,000

7.50% due November 20, 2013 7.50 347,938 2,062 350,000 347,129 2,871 350,000

6.50% due June 2, 2014 6.56 596,170 3,830 600,000 594,941 5,059 600,000

6.15% due May 9, 2016 6.34 294,036 5,964 300,000 292,978 7,022 300,000

5.70% due March 2, 2017 5.72 396,630 3,370 400,000 396,124 3,876 400,000

5.65% due October 1, 2019 5.69 1,241,477 8,523 1,250,000 1,240,673 9,327 1,250,000

5.50% due December 7, 2020 5.55 495,341 4,659 500,000 –– –

6.75% due November 9, 2039 6.89 1,415,823 34,177 1,450,000 641,684 8,316 650,000

5,236,161 63,839 5,300,000 3,961,278 38,722 4,000,000

Other

Burrard Landing Lot 2 Holdings

Partnership 6.31 20,393 64 20,457 20,950 83 21,033

Total consolidated debt 5,256,554 63,903 5,320,457 3,982,228 38,805 4,021,033

Less current portion 594 19 613 557 19 576

5,255,960 63,884 5,319,844 3,981,671 38,786 4,020,457

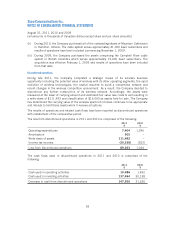

(1) Long-term debt is presented net of unamortized discounts, finance costs and bond

forward proceeds of $63,903 (August 31, 2010 – $38,805). Amortization for 2011

amounted to $6,022 (2010 – $5,312; 2009 – $4,466) of which $4,302 (2010 –

$3,972; 2009 – $3,984) was recorded as amortization of financing costs and $1,720

(2010 – $1,340; 2009 – $482) was recorded as interest expense. Interest expense in

2011 is also net of $7,782 in respect of amortization of an acquisition date fair value

adjustment to the CW Media US $338,306 senior unsecured notes. The notes were

subsequently redeemed in August 2011 (see Gain on redemption below).

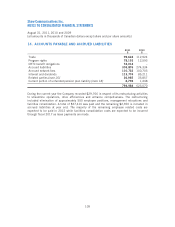

Interest on long-term debt included in interest expense amounted to $341,114 (2010 –

$250,679; 2009 – $237,546). Interest expense is net of $3,468 (2010 – $4,008; 2009 –

$981) of interest income, the majority of which is with respect to holding excess proceeds from

the senior notes issuances in cash and cash equivalents and short term securities or invested

pending use by the Company to finance operations, fund business acquisitions and repay

maturing debt.

99