Shaw 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

db

4

2011

Annual Report

Table of contents

-

Page 1

2011 Annual Report -

Page 2

...' Reports Consolidated Financial Statements Notes to Consolidated Financial Statements Five Years in Review Shareholders' Information Corporate Information The Annual General Meeting of Shareholders will be held on January 12, 2012 at 11:00am (Mountain Time) at the Shaw Barlow Trail Building... -

Page 3

AR 2011 It's an exciting time for Shaw. We're taking our business to the next level through innovation and leading edge technology. The power of the most advanced network gives us the opportunity to offer Canadians unparalleled products and services, compelling choice and everyday value. Over the ... -

Page 4

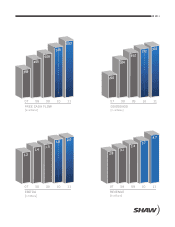

AR 2011 07 08 09 10 11 07 08 09 10 11 FREE CASH FLOW [in millions] DIVIDENDS [in millions] 07 08 09 10 11 07 08 09 10 11 EBITDA [in billions] REVENUE [in billions] -

Page 5

... of specialty channels and conventional programming. Shaw, including our executive team, was recognized in March 2011, receiving the 2010 Canadian Dealmaker of the Year Award for the Media and Telecommunications Industry. This strategic acquisition allows us to unite broadcasting services and... -

Page 6

... customers share their ideas on Internet usage allowances and billing. As a result of these consultations, we launched new Internet packages with higher speeds and expanded usage allowances, including an industry leading 250 Mbps service using DOCSIS 3.0 technology to meet the increasing data... -

Page 7

... ahead as we build on our past success. We are starting the new fiscal year with a number of strategic initiatives on the agenda including our digital network upgrade and Wi-Fi build. We are operating in a dynamic environment marked by rapid technology advances, intense competition and lingering... -

Page 8

... the business Government regulations and regulatory developments Key performance drivers Critical accounting policies and estimates Related party transactions New accounting standards Known events, trends, risks and uncertainties SUMMARY OF QUARTERLY RESULTS RESULTS OF OPERATIONS FINANCIAL POSITION... -

Page 9

... and pursued by Shaw; Shaw's ability to execute its strategic plans; changing conditions in the entertainment, information and communications industries; industry trends; changes in the competitive environment in the markets in which Shaw operates and from the development of new markets for emerging... -

Page 10

... Shaw Business), satellite direct-to-home services (through Shaw Direct) and engaging programming content (through Shaw Media). Shaw Media operates the second largest conventional television network in Canada, Global Television, and 18 specialty networks. It provides customers with high-quality... -

Page 11

... service offerings to include digital programming, On Demand programming, High Definition ("HD") television including three dimensional ("3D") HD, Internet, and Digital Phone. During 2011 Shaw commenced a major upgrade of its network to convert television analog tiers to digital (the Digital Network... -

Page 12

... of free On Demand programming including hit TV series, movies, events, music videos and more. Shaw offers On Demand programming in over 98% of its footprint. As at August 31, 2011 the Company had approximately 1,820,000 Digital subscribers, representing a penetration rate of over 79% of Basic cable... -

Page 13

...a 100 Mbps service. Shaw operates two Internet data centres in Calgary, Alberta and several smaller regional centres. The data centres allow the Company to manage its Internet services exclusively, providing e-mail service directly to its customers using "@shaw.ca" e-mail addresses, provisioning web... -

Page 14

... network is also used to carry Shaw Digital Phone capacity and video signals. In addition, Shaw Business provides services to small and medium size business, Internet Service Providers ("ISPs"), cable companies, broadcasters, governments and other organizations that require end-to-end Internet, data... -

Page 15

... by the satellite. Shaw Direct and Satellite Services businesses share the satellite infrastructure distributing digital video and audio signals to different markets (residential and business), thereby allowing the Company to derive distinct revenue streams from different customers using a common... -

Page 16

... companies in the transportation industry in Canada, with over 40,500 vehicles using its services. Shaw Tracking's services capture all related information pertaining to an asset (i.e. location, performance and productivity measures) and effectively integrate into a carrier's fleet management system... -

Page 17

... 2011 the Media results were equity accounted until October 27, 2010, at which time the balance sheet and results of operations were consolidated. The acquisition of Shaw's Media business included the Global Television Network ("Global"), and a leading portfolio of Specialty services. Technology is... -

Page 18

... may also be affected by competition and varying levels of promotional activity undertaken by the Company. Shaw's Cable and Satellite businesses generally are not dependent upon any single customer or upon a few customers. The Media business segment financial results are subject to fluctuations... -

Page 19

... States in 2002. Its revenues for the year ended August 31, 2011 were not material. (d) Employees As at August 31, 2011, the Company employed approximately 12,500 persons. D. Government regulations and regulatory developments Substantially all of the Corporation's business activities are subject to... -

Page 20

... potential for new or increased fees through regulation Effective September 1, 2009, each licensed BDU contributes 1.5% of its gross revenues derived from Broadcasting to the Local Programming Improvement Fund ("LPIF") to support local television stations operating in non-metropolitan markets. The... -

Page 21

... revenue from the uplink and transport of pay and specialty services, to support Canadian programming. If the CRTC proceeds to introduce the proposed exemption order, new regulatory fees or charges could be imposed upon this business. Access rights Shaw's cable systems require access to support... -

Page 22

Shaw Communications Inc. MANAGEMENT'S DISCUSSION AND ANALYSIS August 31, 2011 The CRTC recently reviewed the obligations of carriers to provide service and to subsidize the provision of services to customers living in high cost areas. As a result of the review, the CRTC reduced the number of high-... -

Page 23

... data. The Province of Alberta also recently passed the Missing Persons Act, which enhances LEAs' ability to access customer records to assist in locating missing persons. Digital transition In July 2009 the CRTC identified the major markets where it expects conventional television broadcasters... -

Page 24

... 10-percent market share or less, by revenue, or (3) remove telecommunications restrictions completely. Shaw participated in the consultation and has expressed support for an increase of direct foreign investment limits for broadcasting undertakings to 49% in order to ensure competitive parity among... -

Page 25

...customers in a cost-effective manner. iii) Free cash flow The Company uses free cash flow as a measure of the Company's ability to repay debt and return cash to shareholders. Consolidated free cash flow is calculated as follows: ($000's Cdn) 2011 2010(5) 2009(4)(5) Cable free cash flow(1) Satellite... -

Page 26

... and Digital Phone lines includes all phone lines on billing plus scheduled installations due to the growth nature of these products. All subscriber counts exclude complimentary accounts but include promotional accounts. Cable measures penetration for basic services as a percentage of homes passed... -

Page 27

... equipment revenue commences once the subscriber service is activated. There is no specified term for which the customer will receive the related subscription service, therefore the Company has considered various factors including customer churn, competition from new entrants, and technology changes... -

Page 28

...expenses recognized from ongoing service activities on its income statement. Equipment revenue and costs are deferred and recognized over the anticipated term of the related future revenue (i.e., the monthly service revenue) with the period of recognition spanning two to five years. As a result, the... -

Page 29

... related to new customer management, billing and operating support systems. Labour costs directly related to these and other projects are capitalized. Cable regional construction departments, which are principally involved in constructing, rebuilding and upgrading the cable/Internet/Digital Phone... -

Page 30

... plant and equipment and other intangibles over the estimated useful service lives of the items. These estimates of useful lives involve considerable judgment. In determining these estimates, the Company takes into account industry trends and company-specific factors, including changing technologies... -

Page 31

... unchanged for a period exceeding 5 years: Å Å Å Cable systems DTH and satellite services Media The Company also owns AWS licenses that are required to operate a wireless system in Canada. The AWS licenses have indefinite lives and are subject to an annual review for impairment by comparing the... -

Page 32

...March 1, 2011, the estimates that have been utilized in the impairment tests reflect any changes in market conditions and are as follows: Terminal Value Terminal Operating Income before Amortization Terminal Growth Rate Multiple Discount Rate Cable systems DTH and satellite services Media Wireless... -

Page 33

...funded plans) and expected average remaining years of service of employees. While the Company believes these assumptions are reasonable, differences in actual results or changes in assumptions could affect employee benefit obligations and the related income statement impact. The Company accounts for... -

Page 34

... in return for radio and television advertising. Burrard Landing Lot 2 Holdings Partnership The Company has a 33.33% interest in the Partnership. During the current year, the Company paid the Partnership for lease of office space in Shaw Tower. Shaw Tower, located in Vancouver, BC, is the Company... -

Page 35

... August 31, 2011 Specialty Channels The Company has interests in a number of specialty television channels which are either subject to joint control or significant influence, including Historia, Series+, Mystery, Dusk, and The Cave. During the current year the Company paid network fees and provided... -

Page 36

...income and comprehensive income. Adoption of accounting policies for Shaw Media The following accounting policies have been adopted for the Company's new television broadcasting operations (Shaw Media). Revenue Subscriber revenue is recognized monthly based on subscriber levels. Advertising revenues... -

Page 37

...review to identify and assess accounting and reporting differences, (ii) evaluation and selection of accounting policies, (iii) assessment of impact on information systems, internal controls, and business activities, and (iv) training and communication with key stakeholders. During 2009, the Company... -

Page 38

...27 Consolidated and Separate Financial Statements. (ii) Employee benefits IFRS 1 provides the option to recognize all cumulative actuarial gains and losses on defined benefit plans deferred under Canadian GAAP in opening retained earnings on the date of transition to IFRS. The Company has elected to... -

Page 39

Shaw Communications Inc. MANAGEMENT'S DISCUSSION AND ANALYSIS August 31, 2011 changes in accounting policies are expected to impact the Company's consolidated financial statements. The list and comments should not be regarded as a complete list of changes that will result from the transition to IFRS... -

Page 40

Shaw Communications Inc. MANAGEMENT'S DISCUSSION AND ANALYSIS August 31, 2011 Under IFRS, past service costs of defined benefit plans are expensed on a straight-line basis over the vesting period. Under Canadian GAAP, past service costs were amortized on a straight-line basis over the estimated ... -

Page 41

.... They do not represent an exhaustive list of all potential issues that could affect the financial results of the Company. The principal risks include Competition and technological change, including change in regulatory risks Interest rate, foreign exchange, capital market and economic conditions... -

Page 42

... signals, including other DTH satellite services, satellite master antenna systems, multipoint distribution systems ("MDS"), other competitive cable television undertakings and telephone companies offering video service. To a lesser extent, Shaw's cable television systems compete with the direct... -

Page 43

... of Shaw Digital Phone. MEDIA The OTA and Specialty television business and the advertising markets in which they operate are highly competitive. Numerous broadcast and specialty television networks compete for advertising revenues. The CRTC has also substantially increased the number of Specialty... -

Page 44

...the government. This regulation relates to, among other things, licensing, competition, programming carriage and the potential for new or increased fees. ii) Interest rate, foreign exchange, capital market and economic conditions risks As at August 31, 2011 Shaw has the following financial exposures... -

Page 45

... security, ongoing maintenance and placement of insurance on its network equipment and data centers. The Company self-insures the plant in the cable and Internet distribution system as the cost of insurance is generally prohibitive. The risk of loss is mitigated as most of the cable plant is located... -

Page 46

Shaw Communications Inc. MANAGEMENT'S DISCUSSION AND ANALYSIS August 31, 2011 limited to a localized geographic area and therefore resulting business interruption and financial damages would be limited. Further, the Company has back-up disaster recovery plans in the event of plant failure and ... -

Page 47

...systems or processes. Although the Company has taken steps to reduce this risk, there can be no assurance that losses may not occur. xi) Dividend payments The Company currently pays monthly dividends in amounts approved on a quarterly basis by the Board of Directors. At the current approved dividend... -

Page 48

... Media business with lower advertising revenues in the summer months. In the fourth quarter of 2010, revenue and operating income before amortization declined by $4.8 million and $11.5 million, respectively, due to customer growth offset by timing of On-Demand events, increased promotional activity... -

Page 49

... included debt retirement costs of $81.6 million in respect of the US senior note redemptions, a loss on derivative instruments of $44.4 million, the one-time Part II fee recovery of $75.3 million and an income tax recovery of $17.6 million related to reductions in corporate income tax rates. During... -

Page 50

Shaw Communications Inc. MANAGEMENT'S DISCUSSION AND ANALYSIS August 31, 2011 III. RESULTS OF OPERATIONS OVERVIEW OF FISCAL 2011 CONSOLIDATED RESULTS Change 2011 2010 % % (In $000's Cdn except per share amounts) 2011 2010 2009 Operations: Revenue Operating income before amortization(1) ... -

Page 51

... expenses 2011 vs. 2010 Consolidated revenue of $4.74 billion for the twelve month period improved 27.5% over the prior year. The improvement was primarily due to the acquisition of Shaw Media, as well as rate increases and growth in the Cable and Satellite divisions. Consolidated operating income... -

Page 52

... improvement was due to the revenue related growth, partially offset by higher employee related and other costs associated with the increased subscriber base including marketing and sales activities, as well as the impact of the new LPIF fees. The 2010 annual period also benefitted from a one-time... -

Page 53

... from changes in various components of long-term debt. Other income and expenses Increase (decrease) in income 2011 2010 (In $000's Cdn) 2011 2010 2009 Gain on redemption of debt Debt retirement costs CRTC benefit obligation Business acquisition, integration and restructuring costs Loss on... -

Page 54

... years. Most of this contribution will be used to create new programming on Shaw Media services, construct digital transmission towers and provide a satellite solution for OTA viewers whose local television stations do not convert to digital. The fair value of the obligation on the acquisition date... -

Page 55

... Financial Statements. Future income tax recoveries of $17.6 million and $22.6 million related to reductions in corporate income tax rates were recorded in 2010 and 2009, respectively. The significant growth in net income before taxes over the past several years has reduced the Company's tax loss... -

Page 56

.... The change in net other costs and revenue of $57.5 million also reduced the current year and was primarily due to amounts related to the CRTC benefit obligation and various acquisition, integration and restructuring costs partially offset by debt retirement costs and amounts related to derivative... -

Page 57

Shaw Communications Inc. MANAGEMENT'S DISCUSSION AND ANALYSIS August 31, 2011 SEGMENTED OPERATIONS REVIEW CABLE FINANCIAL HIGHLIGHTS Change 2011 2010 % % ($000's Cdn) 2011 2010(3) 2009(3) Revenue Operating income before amortization(1) Capital expenditures and equipment costs (net) Free cash ... -

Page 58

... Company closed the acquisition of the cable system assets of Sun Country Cablevision Inc. located in the central interior of British Columbia. Å Cable revenue for 2011 of $3.10 billion improved 5.6% over the prior year. The growth was driven by rate increases and customer growth in Digital Phone... -

Page 59

..., Ontario adding approximately 41,000 Basic cable customers, including 24,000 Digital subscribers, 30,000 Internet subscribers, and 32,000 Digital Phone lines. Å Cable revenue improved 11.3% to $2.93 billion over 2009. Customer growth, including acquisitions, and rate increases accounted for the... -

Page 60

... in new subdivisions. Capital and equipment costs (net) related to the acquisition of new customers, including installation of internet and digital phone modems, DCTs, filters and commercial drops for Shaw Business customers. Upgrades to the plant and build out of fibre backbone to reduce use of... -

Page 61

... in Buildings and Other was up $19.1 million over the prior year. The increase was mainly due to proceeds that benefitted the prior year related to the sale of certain redundant facilities. SUBSCRIBER STATISTICS 2011 Change Growth % 2010 Change Growth % 2011 2010(1) 2009(1) CABLE: Basic... -

Page 62

Shaw Communications Inc. MANAGEMENT'S DISCUSSION AND ANALYSIS August 31, 2011 SATELLITE (DTH and Satellite Services) FINANCIAL HIGHLIGHTS 2011 % Change 2010 % ($000's Cdn) 2011 2010(4) 2009(4) DTH (Shaw Direct) Satellite Services Revenue Operating income before amortization(1) DTH (Shaw Direct)... -

Page 63

... technology, innovative programming and high quality customer service. During 2010 Shaw Direct introduced a new HD PVR with advanced features and launched a number of HD channels including CNN HD and Global Toronto HD. At August 31, 2010 Shaw Direct offered 65 HD channels to its 395,000 HD customers... -

Page 64

... Collectively these assets, including the Global Television Network and over 20 Specialty services, form Shaw Media, a new division of Shaw. The aggregate purchase price for the Canwest broadcasting assets, including the amounts paid to acquire the shares of CW Media from affiliates of Goldman Sachs... -

Page 65

...digital in the CRTC mandated markets, upgrades of aging production equipment and improvements to network infrastructure and websites. After closing the acquisition the integration of various backoffice infrastructure commenced and was substantially complete at August 31, 2011. IV. FINANCIAL POSITION... -

Page 66

... of acquisition related costs partially offset by investments in several specialty channels purchased in the Media acquisition. Property, plant and equipment and other intangibles increased $195.6 million and $72.8 million, respectively as current year capital investment and amounts acquired on... -

Page 67

...the broadcasting business. Non-controlling interests arose in the current year due to a number of non-wholly owned specialty channels acquired as part of the Media acquisition. V. CONSOLIDATED CASH FLOW ANALYSIS Operating activities Change 2011 2010 % % (In $000's Cdn) 2011 2010 2009 Funds flow... -

Page 68

... for investing activities in 2011 decreased over the prior year due to the cash outlay of $744.1 million in 2010 in respect of the Company's initial investment in CW Media and the Mountain Cable acquisition partially offset by amounts paid to complete the acquisition of the media business and higher... -

Page 69

...23.2 million to pay $981.2 million to complete the broadcasting business acquisition including repayment of the CW Media term loan and breakage of related currency swaps, fund the net change in working capital requirements of approximately $218.2 million, pay common share dividends of $352.0 million... -

Page 70

... 30 every five years thereafter. Holders of the Series B Preferred Shares will be entitled to receive cumulative quarterly dividends, as and when declared by the Company's board of directors, at a rate set quarterly equal to the then current three-month Government of Canada Treasury Bill yield plus... -

Page 71

... Communications Inc. MANAGEMENT'S DISCUSSION AND ANALYSIS August 31, 2011 The Company's DRIP allows holders of Class A Shares and Class B Non-Voting Shares who are residents of Canada to automatically reinvest monthly cash dividends to acquire additional Class B Non-Voting Shares. During the year... -

Page 72

...respect of defined benefit plans and program rights. VII. ADDITIONAL INFORMATION Additional information relating to Shaw, including the Company's Annual Information Form dated November 29, 2011, can be found on SEDAR at www.sedar.com. VIII. COMPLIANCE WITH NYSE CORPORATE GOVERNANCE LISTING STANDARDS... -

Page 73

... 2011. Further information on the Media segment is included in Note 16 to the consolidated financial statements. The Media segment will be included in management's evaluation of internal controls over financial reporting for the fiscal year ended August 31, 2012. There were no changes in the Company... -

Page 74

... financial statements of Shaw Communications Inc. and all the information in this annual report are the responsibility of management and have been approved by the Board of Directors. The financial statements have been prepared by management in accordance with Canadian generally accepted accounting... -

Page 75

... information regarding this acquisition is included in Note 2 to the consolidated financial statements. The Media segment had assets and revenues representing approximately 23% and 19%, respectively, of the related consolidated financial statement amounts as of and for the year ended August 31, 2011... -

Page 76

... Other Comprehensive Income (Loss), and Cash Flows for each of the years in the three-year period ended August 31, 2011, and a summary of significant accounting policies and other explanatory information. Management's Responsibility for the Consolidated Financial Statements Management is responsible... -

Page 77

...accordance with the standards of the Public Company Accounting Oversight Board (United States), Shaw Communications Inc.'s internal control over financial reporting as of August 31, 2011, based on the criteria established in Internal Control-Integrated Framework issued by the Committee of Sponsoring... -

Page 78

... the Public Company Accounting Oversight Board (United States) To the Shareholders of Shaw Communications Inc. We have audited Shaw Communications Inc.'s internal control over financial reporting as at August 31, 2011, based on criteria established in Internal Control - Integrated Framework issued... -

Page 79

... Statements of Income, Comprehensive Income, Changes in Shareholders' Equity and Cash Flows for each of the years in the three-year period ended August 31, 2011, and our report dated November 29, 2011 expressed an unqualified opinion thereon. November 29, 2011 Calgary, Canada Chartered Accountants... -

Page 80

...] 2011 $ 2010 $ ASSETS Current Cash and cash equivalents Accounts receivable [note 3] Inventories [note 4] Other current assets [note 5] Derivative instruments [note 21] Assets held for sale [note 2] Future income taxes [note 15] Investments and other assets [note 6] Property, plant and equipment... -

Page 81

..., plant and equipment [note 7] Other intangibles [note 9] Operating income Amortization of financing costs - long-term debt [note 10] Interest [notes 10 and 16] Gain on redemption of debt [note 10] Debt retirement costs [note 10] CRTC benefit obligation [note 2] Business acquisition, integration and... -

Page 82

Shaw Communications Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME AND ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS) Years ended August 31 [thousands of Canadian dollars] 2011 $ 2010 $ 2009 $ Net income Other comprehensive income (loss) [note 13] Change in unrealized fair value of derivatives... -

Page 83

... increase to inventories Deposits on wireless spectrum licenses Cable business acquisitions [note 2] Television broadcasting business acquisitions [note 2] Purchase of Government of Canada bond Proceeds on sale of Government of Canada bond Proceeds on disposal of property, plant and equipment [note... -

Page 84

... the Toronto and New York Stock Exchanges. The Company is a diversified Canadian communications company whose core operating business is providing broadband cable television services, Internet, Digital Phone, and telecommunications services ("Cable"); Direct-to-home ("DTH") satellite services (Shaw... -

Page 85

... on relative fair values. Subscriber connection fees received from customers are deferred and recognized as revenue on a straight-line basis over two years. Direct and incremental initial selling, administrative and connection costs related to subscriber acquisitions are recognized as an operating... -

Page 86

... FINANCIAL STATEMENTS August 31, 2011, 2010 and 2009 [all amounts in thousands of Canadian dollars except share and per share amounts] Installation revenue received on contracts with commercial business customers is deferred and recognized as revenue on a straight-line basis over the related service... -

Page 87

... Digital cable terminals and modems Satellite audio, video and data network equipment and DTH receiving equipment Transmitters, broadcasting and communication equipment Buildings Data processing Other 6-15 years 2-7 years 4-10 5-15 20-40 3-4 3-20 years years years years years The Company reviews... -

Page 88

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2011, 2010 and 2009 [all amounts in thousands of Canadian dollars except share and per share amounts] Other long-term assets Other long-term assets primarily include (i) equipment costs, as described in the revenue and ... -

Page 89

... are translated at year-end exchange rates and revenues and expenses are translated at average exchange rates for the year. Adjustments arising from the translation of the financial statements are included in Other Comprehensive Income (Loss). Transactions originating in foreign currencies... -

Page 90

... business acquisitions are netted against the related debt instrument and amortized to income using the effective interest rate method. Accordingly, long-term debt accretes over time to the principal amount that will be owing at maturity. Derivative financial instruments The Company uses derivative... -

Page 91

... plans such as changes in discount rates, expected return on plan assets, expected retirement ages and projected salary increases. Actuarial gains (losses) are amortized on a straight-line basis over EARSL which for active employees covered by the unfunded defined benefit pension plan is 10.5 years... -

Page 92

... share Basic earnings per share is based on net income attributable to common shareholders adjusted for dividends on preferred shares and is calculated using the weighted average number of Class A Shares and Class B Non-Voting Shares outstanding during the year. The Company uses the treasury stock... -

Page 93

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2011, 2010 and 2009 [all amounts in thousands of Canadian dollars except share and per share amounts] or equity instruments, and acquisition related restructuring costs must be expensed, (v) for business combinations ... -

Page 94

...,000 in new benefits to the Canadian broadcasting system over the next seven years. Most of this contribution will be used to create new programming on Canwest services, construct digital transmission towers and provide a satellite solution for over-the-air viewers whose local television stations do... -

Page 95

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2011, 2010 and 2009 [all amounts in thousands of Canadian dollars except share and per share amounts] A summary of net assets acquired and allocation is as follows: $ Net assets acquired at assigned fair values Cash and ... -

Page 96

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2011, 2010 and 2009 [all amounts in thousands of Canadian dollars except share and per share amounts] (6) Non-controlling interests in certain of the subsidiary specialty channels were assumed as part of the acquisition ... -

Page 97

...FINANCIAL STATEMENTS August 31, 2011, 2010 and 2009 [all amounts in thousands of Canadian dollars except share and per share amounts] (ii) During 2010, the Company purchased all of the outstanding shares of Mountain Cablevision in Hamilton, Ontario. The cable system serves approximately 41,000 basic... -

Page 98

... Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2011, 2010 and 2009 [all amounts in thousands of Canadian dollars except share and per share amounts] 3. ACCOUNTS RECEIVABLE 2011 $ 2010 $ Subscriber and trade receivables Due from officers and employees Due from related... -

Page 99

... and 2009 [all amounts in thousands of Canadian dollars except share and per share amounts] 6. INVESTMENTS AND OTHER ASSETS 2011 $ 2010 $ Investment, at cost net of write-down: Investment in a private technology company Investments, at equity: CW Media [note 2] Specialty channel networks Other... -

Page 100

... 2,068,280 328,314 Cable and telecommunications distribution system Digital cable terminals and modems Satellite audio, video and data network equipment and DTH receiving equipment Transmitters, broadcasting, communications and production equipment Buildings Data processing Other assets Land Assets... -

Page 101

...2009 [all amounts in thousands of Canadian dollars except share and per share amounts] 9. INTANGIBLES Carrying amount 2011 $ 2010 $ Broadcast rights and licenses Cable systems DTH and satellite services Television broadcasting Program rights Goodwill Non-regulated satellite services Cable systems... -

Page 102

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2011, 2010 and 2009 [all amounts in thousands of Canadian dollars except share and per share amounts] The changes in the carrying amount of intangibles with indefinite useful lives, and therefore not subject to ... -

Page 103

... (2010 - $4,008; 2009 - $981) of interest income, the majority of which is with respect to holding excess proceeds from the senior notes issuances in cash and cash equivalents and short term securities or invested pending use by the Company to finance operations, fund business acquisitions and repay... -

Page 104

...with office/retail space and living/working space in Vancouver, BC. In the fall of 2004, the commercial construction of the building was completed and at that time, the Partnership issued 10 year secured mortgage bonds in respect of the commercial component of the Shaw Tower. The bonds bear interest... -

Page 105

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2011, 2010 and 2009 [all amounts in thousands of Canadian dollars except share and per share amounts] Within 30 days of closing the transaction, a subsidiary of CW Media was required to make a change of control offer at a... -

Page 106

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2011, 2010 and 2009 [all amounts in thousands of Canadian dollars except share and per share amounts] Long-term debt repayments Mandatory principal repayments on all long-term debt in each of the next five years and ... -

Page 107

... conversions Purchase of shares for cancellation Stock option exercises August 31, 2009 Purchase of shares for cancellation Stock option exercises Issued in respect of an acquisition [note 2] Share issue costs August 31, 2010 Stock option exercises Dividend reinvestment plan August 31, 2011 22,550... -

Page 108

... B Preferred Shares also represent a series of Class 2 preferred shares and holders will be entitled to receive cumulative quarterly dividends, as and when declared by the Company's board of directors, at a rate set quarterly equal to the then current three-month Government of Canada Treasury Bill... -

Page 109

... using the Black-Scholes Option Pricing Model with the following weighted-average assumptions: 2011 2010 2009 Dividend yield Risk-free interest rate Expected life of options Expected volatility factor of the future expected market price of Class B Non-Voting Shares Contributed surplus The changes... -

Page 110

... B Non-Voting Shares who are residents of Canada to automatically reinvest monthly cash dividends to acquire additional Class B Non-Voting Shares. During the current year, the Company announced that the Class B Non-Voting Shares distributed under its DRIP would be new shares issued from treasury... -

Page 111

... Shares were outstanding under the Company's stock option plan at August 31, 2011 (2010 - 23,993,150; 2009 - 23,714,667). 13. OTHER COMPREHENSIVE INCOME (LOSS) AND ACCUMULATED OTHER COMPREHENSIVE INCOME Components of other comprehensive income (loss) and the related income tax effects for 2011... -

Page 112

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2011, 2010 and 2009 [all amounts in thousands of Canadian dollars except share and per share amounts] Components of other comprehensive income (loss) and the related income tax effects for 2010 are as follows: Amount $ ... -

Page 113

...Canadian dollars except share and per share amounts] 14. ACCOUNTS PAYABLE AND ACCRUED LIABILITIES 2011 $ 2010 $ Trade Program rights CRTC benefit obligations Accrued liabilities Accrued network fees Interest and dividends Related parties [note 20] Current portion of unfunded pension plan liability... -

Page 114

... assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Significant components of the Company's future income tax liabilities and assets are as follows: 2011 $ 2010 $ Future income tax liabilities: Property, plant and equipment and software intangibles... -

Page 115

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2011, 2010 and 2009 [all amounts in thousands of Canadian dollars except share and per share amounts] The income tax expense differs from the amount computed by applying Canadian statutory rates to income before income ... -

Page 116

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2011, 2010 and 2009 [all amounts in thousands of Canadian dollars except share and per share amounts] 16. BUSINESS SEGMENT INFORMATION The Company's operating segments are Cable, Media, DTH and Satellite Services, all of... -

Page 117

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2011, 2010 and 2009 [all amounts in thousands of Canadian dollars except share and per share amounts] 2010 Satellite Cable $ Revenue Operating income before amortization Operating income as % of revenue Interest (1) ... -

Page 118

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2011, 2010 and 2009 [all amounts in thousands of Canadian dollars except share and per share amounts] 2009 Satellite Satellite Services $ 90,205 49,331 54.7% n/a Intersegment Eliminations $ (19,955) - - - Cable $ Revenue... -

Page 119

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2011, 2010 and 2009 [all amounts in thousands of Canadian dollars except share and per share amounts] (4) The profit from the sale of satellite equipment is subtracted from the calculation of segmented capital ... -

Page 120

... years. The obligation has been recorded in the income statement at fair value, being the sum of the discounted future net cash flows using a 5.75% discount rate. In addition, the Company assumed the CRTC benefit obligation from Canwest's acquisition of Specialty services in 2007. At August 31, 2011... -

Page 121

... by the Media business acquisition. Defined benefit pension plans The Company provides a non-contributory defined benefit pension plan for certain of its senior executives. Benefits under this plan are based on the employees' length of service and their highest three-year average rate of pay during... -

Page 122

...-average assumptions used to measure the pension obligation and cost for this plan. Accrued benefit obligation 2011 % 2010 % Discount rate Rate of compensation increase Benefit cost for the year 2011 % 5.50 5.75 5.00 5.00 2010 % 2009 % Discount rate Rate of compensation increase 5.75 6.75... -

Page 123

... below shows the change in the benefit obligations, change in fair value of plan assets and the funded status of these defined benefit plans. 2011 $ Accrued benefit obligation, beginning of year Media business acquisition Current service cost Interest cost Employee contributions Actuarial gains... -

Page 124

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2011, 2010 and 2009 [all amounts in thousands of Canadian dollars except share and per share amounts] The accrued benefit liability is included in other long-term liabilities. The asset allocation of the plans at August ... -

Page 125

... business acquisition in the current year, the Company assumed post employments benefits plans that provide post retirement health and life insurance coverage. 2011 $ Accrued benefit obligation, beginning of year Media business acquisition Current service cost Interest cost Actuarial loss Plan... -

Page 126

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2011, 2010 and 2009 [all amounts in thousands of Canadian dollars except share and per share amounts] The table below shows the components of the post-retirement benefit plan expense. 2011 $ Current service cost Interest... -

Page 127

... uplink of television signals for $4,861 (2010 - $4,930; 2009 - $5,112) and Internet services and lease of circuits for $1,488 (2010 - $1,461; 2009 - $1,167). During 2010 and 2009, the Company provided cable system distribution access and affiliate broadcasting services to Corus Custom Networks, the... -

Page 128

...- $9,571; 2009 - $9,886) to the Partnership for lease of office space in Shaw Tower. Shaw Tower, located in Vancouver, BC, is the Company's headquarters for its Lower Mainland operations. Specialty Channels As a result of the television broadcasting business acquisition in the current year (see note... -

Page 129

...time of a business acquisition. The fair value of publicly traded notes is based upon current trading values. Other notes and debentures are valued based upon current trading values for similar instruments. (vi) Derivative financial instruments The fair value of cross-currency interest rate exchange... -

Page 130

... financial instruments have maturity dates throughout fiscal 2012. The Company's estimate of the net amount of existing gains or losses arising from the unrealized fair value of derivatives designated as cash flow hedges which are reported in accumulated other comprehensive income at August 31, 2011... -

Page 131

... Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2011, 2010 and 2009 [all amounts in thousands of Canadian dollars except share and per share amounts] The fair value hierarchy consists of the following three levels: Level 1 Level 2 Level 3 Inputs are quoted prices in active... -

Page 132

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2011, 2010 and 2009 [all amounts in thousands of Canadian dollars except share and per share amounts] Cross-currency interest rate exchange agreements During 2010, the Company redeemed all of its outstanding US $440,000 ... -

Page 133

... interest rates. Credit risk Accounts receivable in respect of Cable and Satellite divisions are not subject to any significant concentrations of credit risk due to the Company's large and diverse customer base. For the Media division, a significant portion of sales are made to advertising agencies... -

Page 134

... factors such as the number of days the subscriber account is past due, whether or not the customer continues to receive service, the Company's past collection history and changes in business circumstances. As at August 31, 2011, $121,221 (2010 - $79,434) of accounts receivable is considered to be... -

Page 135

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2011, 2010 and 2009 [all amounts in thousands of Canadian dollars except share and per share amounts] The Company's undiscounted contractual maturities as at August 31, 2011 are as follows: Accounts payable and accrued ... -

Page 136

... income tax expense (recovery) Equity loss (income) on investee Debt retirement costs Gain on redemption of debt CRTC benefit obligation [note 2] CRTC benefit obligation payments Business acquisition, integration and restructuring expenses Stock-based compensation Defined benefit pension plans Loss... -

Page 137

...Canadian dollars except share and per share amounts] (ii) Changes in non-cash working capital balances related to continuing operations include the following: 2011 $ 2010 $ 2009 $ Accounts receivable Other current assets Accounts payable and accrued liabilities Income taxes payable Unearned revenue... -

Page 138

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2011, 2010 and 2009 [all amounts in thousands of Canadian dollars except share and per share amounts] The Company defines capital as comprising all components of shareholders' equity (other than non-controlling interests ... -

Page 139

... to reconcile its consolidated financial statements to US GAAP. (a) Reconciliation to US GAAP 2011 $ 2010 $ 2009 $ Net income from continuing operations using Canadian GAAP Add (deduct) adjustments for: Deferred charges and credits (2) (8) Business acquisition costs (3) Gain (loss) on derivative... -

Page 140

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2011, 2010 and 2009 [all amounts in thousands of Canadian dollars except share and per share amounts] 2011 $ 2010 $ 2009 $ Comprehensive income using US GAAP attributable to: Common shareholders Non-controlling interests... -

Page 141

... charges and credits(2) (8) Business acquisitions(3) Equity in loss of investee(4) Gain on sale of subsidiary(5) Gain on sale of cable systems(6) Fair value of derivatives(7) Capitalized interest(10) Income taxes(11) Accumulated other comprehensive loss Shareholders' equity using US GAAP 3,457,848... -

Page 142

Shaw Communications Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS August 31, 2011, 2010 and 2009 [all amounts in thousands of Canadian dollars except share and per share amounts] (2) Deferred charges and credits The excess of equipment costs over equipment revenues are deferred and amortized under... -

Page 143

... the shares in HomeStar Services Inc. This would have resulted in a gain on disposition of the consideration the Company exchanged for its investment in Star Choice and an increase in the acquisition cost for Star Choice. (6) Gain on sale of cable systems The gain on sale of cable systems determined... -

Page 144

... above, the impact of future income tax rate reductions on those differences and an adjustment for the tax benefit related to capital losses that cannot be recognized for US GAAP. (b) Advertising costs Advertising expenditures, including advertising production costs, are expensed when incurred for... -

Page 145

... derivatives designated as cash flow hedges to manage currency risks for 2009. Gain recognized in other comprehensive income (effective portion) $ Cross-currency interest rate exchange agreements 24,799 Gain (loss) reclassified from other comprehensive income into income (effective portion) Location... -

Page 146

Shaw Communications Inc. FIVE YEAR IN REVIEW August 31, 2011 2011 2010(3) 2009(3) 2008(3) 2007(3) ($000's except per share amounts) Revenue Cable DTH Satellite Media Intersegment Operating income before amortization(1) Cable DTH Satellite Media Net income from continuing operations(4) Earnings per ... -

Page 147

... Management Information Circular dated July 22, 1999, a Shareholder's Adjusted Cost Base (ACB) was reduced for tax purposes. For details on the calculation of the revised ACB, please refer to the Company's September 1, 1999 and September 13, 1999 press releases on Shaw's Investor Relations website... -

Page 148

...Shaw's website, www.shaw.ca Information concerning Shaw's compliance with the corporate governance listing standards of the New York Stock Exchange is available in the investors section on Shaw's website, www.shaw.ca INTERNET HOME PAGE Shaw's Annual Report, Annual Information Form, Quarterly Reports... -

Page 149

We, the leading entertainment and communications company, deliver exceptional customer experience through outstanding people sharing Shaw Values.