Rogers 2010 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

102 ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT

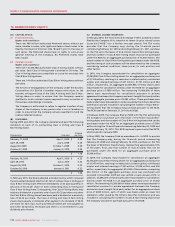

In August 2010, the Company redeemed the entire outstanding

principal amount of its U.S.$490 million ($516 million) 9.625% Senior

Notes due 2011 and $460 million 7.625% Senior Notes due 2011,

resulting in a write-down of the previously recorded fair value

increment of $8 million.

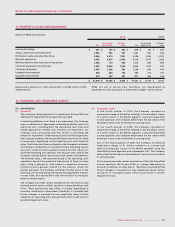

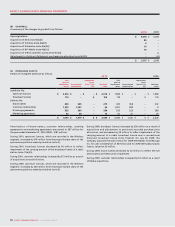

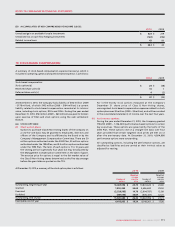

(G) WEIGHTED AVERAGE INTEREST RATE:

The Company’s effective weighted average interest rate on all long-

term debt, as at December 31, 2010, including the effect of the

Derivatives, was 6.68% per annum (2009 – 7.27% per annum).

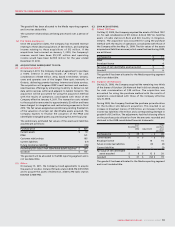

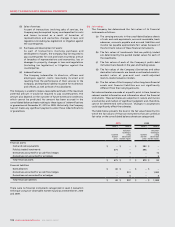

(H) PRINCIPAL REPAYMENTS:

As at December 31, 2010, principal repayments due within each of the

next five years and thereafter on all long-term debt are as follows:

2011 $ –

2012 816

2013 348

2014 1,094

2015 826

Thereafter 5,639

$ 8,723

Coincident with the maturity of the Company’s U.S. dollar denominated

long-term debt, certain of the Company’s Derivatives also mature

(note 15(d)(iii)).

(I) FOREIGN EXCHANGE:

Foreign exchange gains related to the translation of long-term debt

recorded in the consolidated statements of income totalled $20 million

(2009 – gain of $126 million).

(J) TERMS AND CONDITIONS:

The provisions of the Company’s $2.4 billion bank credit facility

described above impose certain restrictions on the operations and

activities of the Company, the most significant of which are debt

maintenance tests.

In addition, certain of the Company’s Senior Notes and Debentures

described above contain debt incurrence tests as well as restrictions

upon additional investments, sales of assets and payment of dividends,

all of which are suspended in the event the public debt securities are

assigned investment grade ratings by at least two of three specified

credit rating agencies. As at December 31, 2010, all of these public debt

securities were assigned an investment grade rating by each of the

three specified credit rating agencies and, accordingly, these restrictions

have been suspended for so long as such investment grade ratings are

maintained. The Company’s other Senior Notes do not contain any such

restrictions, regardless of the credit ratings for such securities.

In addition to the foregoing, the repayment dates of certain debt

agreements may be accelerated if there is a change in control of the

Company.

At December 31, 2010 and 2009, the Company was in

compliance with all of the terms and conditions of its long-term

debt agreements.

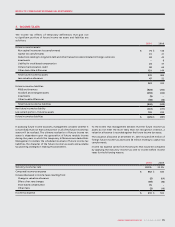

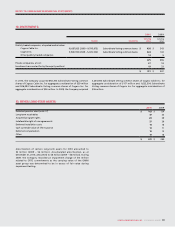

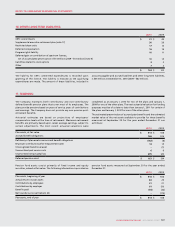

(A) OVERVIEW:

The Company is exposed to credit risk, liquidity risk and market risk. The

Company’s primary risk management objective is to protect its income

and cash flows and, ultimately, shareholder value. Risk management

strategies, as discussed below, are designed and implemented to ensure

the Company’s risks and the related exposures are consistent with its

business objectives and risk tolerance.

(B) CREDIT RISK:

Credit risk represents the financial loss that the Company would

experience if a counterparty to a financial instrument, in which the

Company has an amount owing from the counterparty, failed to meet

its obligations in accordance with the terms and conditions of its

contracts with the Company.

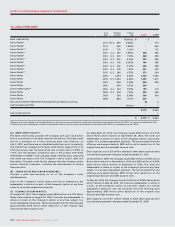

The Company’s credit risk is primarily attributable to its accounts

receivable. The amounts disclosed in the consolidated balance sheets

are net of allowances for doubtful accounts, estimated by the

Company’s management based on prior experience and their

assessment of the current economic environment. The Company

establishes an allowance for doubtful accounts that represents its

estimate of incurred losses in respect of accounts receivable. The main

components of this allowance are a specific loss component that relates

to individually significant exposures and an overall loss component

established based on historical trends. At December 31, 2010, the

Company had accounts receivable of $1,480 million (2009 – $1,310

million), net of an allowance for doubtful accounts of $138 million (2009

– $157 million). At December 31, 2010, $715 million (2009 – $563 million)

of accounts receivable is considered past due, which is defined as

amounts outstanding beyond normal credit terms and conditions for

the respective customers. The Company believes that its allowance for

doubtful accounts is sufficient to reflect the related credit risk.

The Company believes that the concentration of credit risk of accounts

receivable is limited due to its broad customer base, dispersed across

varying industries and geographic locations throughout Canada.

The Company has established various internal controls, such as credit

checks, deposits on account and billing in advance, designed to mitigate

credit risk and has also established procedures to suspend the

availability of services when customers have fully utilized approved

credit limits or have violated established payment terms. While the

Company’s credit controls and processes have been effective in

mitigating credit risk, these controls cannot eliminate credit risk and

there can be no assurance that these controls will continue to be

effective or that the Company’s current credit loss experience

will continue.

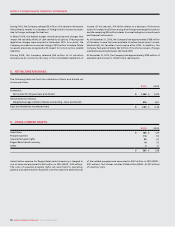

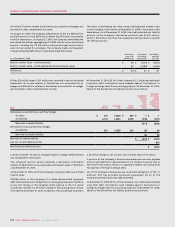

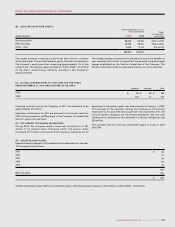

Credit risk related to Derivatives arises from the possibility that the

counterparties to the agreements may default on their respective

obligations under the agreements in instances where these agreements

have positive fair value for the Company. The Company assesses the

creditworthiness of the counterparties in order to minimize the risk of

counterparty default under the agreements. All of the portfolio is held

by financial institutions with a Standard & Poor’s rating (or the

equivalent) ranging from A to AA–. The Company does not require

collateral or other security to support the credit risk associated with

Derivatives due to the Company’s assessment of the creditworthiness of

the counterparties. The obligations under U.S.$5.1 billion aggregate

notional amount of the Derivatives are unsecured and generally rank

equally with the Company’s senior indebtedness. The credit risk of the

Company and the counterparties, as applicable, is taken into

consideration in determining the fair value of the Derivatives for

accounting purposes (note 15(d)).

15. FINANCIAL RISK MANAGEMENT AND FINANCIAL INSTRUMENTS: