Rogers 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT 89

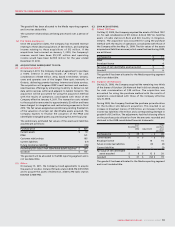

(R) USE OF ESTIMATES:

The preparation of financial statements requires management to make

estimates and assumptions that affect the reported amounts of assets

and liabilities and disclosure of contingent assets and liabilities at the

date of the financial statements and the reported amounts of revenue

and expenses during the years. Actual results could differ from those

estimates.

Key areas of estimation, where management has made difficult,

complex or subjective judgments, often as a result of matters that are

inherently uncertain, include the allowance for doubtful accounts and

certain accrued liabilities, the ability to use income tax loss

carryforwards and other future income tax assets and liabilities,

capitalization of internal labour and overhead, useful lives of

depreciable assets and intangible assets with finite useful lives, discount

rates and expected returns on plan assets affecting pension expense

and the deferred pension asset, estimation of Credit Spreads for

determination of the fair value of derivative instruments and the

assessment of the recoverability or impairment of long-lived assets,

goodwill and intangible assets, which require estimates of future cash

flows and discount rates. For business combinations, key areas of

estimation and judgment include the determination of the fair value of

the assets acquired and liabilities assumed.

Significant changes in the assumptions, including those with respect to

future business plans and cash flows, could materially change the

recorded carrying amounts.

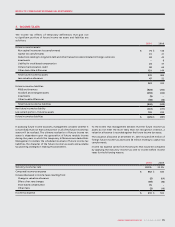

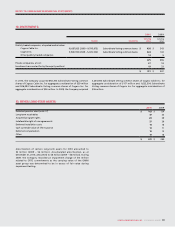

(S) ADOPTED CANADIAN ACCOUNTING STANDARDS:

In October 2008, The Canadian Institute of Chartered Accountants

(“CICA”) issued Handbook Section 1582, Business Combinations (“CICA

1582”), concurrently with Handbook Sections 1601, Consolidated

Financial Statements (“CICA 1601”), and 1602, Non-controlling Interests

(“CICA 1602”). CICA 1582, which replaces Handbook Section 1581,

Business Combinations, establishes standards for the measurement of a

business combination and the recognition and measurement of assets

acquired and liabilities assumed. CICA 1601, which replaces Handbook

Section 1600, establishes standards for the preparation of consolidated

financial statements. CICA 1602 establishes guidance for the treatment

of non-controlling interests. These new standards are effective for the

Company’s interim and annual consolidated financial statements

commencing on January 1, 2011 with earlier adoption permitted as of

the beginning of a fiscal year. The Company has chosen to adopt these

three sections effective January 1, 2010. CICA 1582 and CICA 1601 were

applied prospectively, while the presentation requirements of CICA

1602 were applied retrospectively. The adoption of these standards had

no material impact on previously reported amounts.

(T) RECENT CANADIAN ACCOUNTING PRONOUNCEMENTS:

International Financial Reporting Standards (“IFRS”):

In February 2008, the Canadian Accounting Standards Board confirmed

that IFRS will be mandatory in Canada for profit-oriented publicly

accountable entities for fiscal periods beginning on or after January 1,

2011. The Company’s first annual IFRS financial statements will be for

the year ending December 31, 2011 and will include the comparative

period of 2010. Starting in the first quarter of 2011, the Company will

provide unaudited consolidated financial information in accordance

with IFRS including comparative figures for 2010.

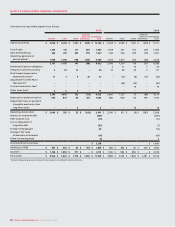

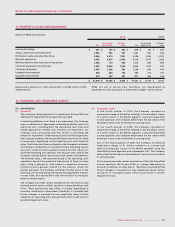

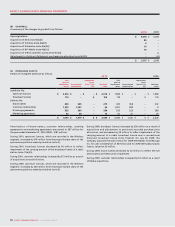

(A) OPERATING SEGMENTS:

The accounting policies of the segments are the same as those described

in the significant accounting policies (note 2). The Company discloses

segment operating results based on income before settlement of

pension obligations, integration and restructuring, stock-based

compensation expense (recovery), adjustment for CRTC Part II fees

decision, contract termination fees, other items (net), depreciation and

amortization, impairment losses on goodwill, intangible assets and

other long-term assets, interest on long-term debt, debt issuance costs,

loss on repayment of long-term debt, foreign exchange gain (loss),

change in fair value of derivative instruments, other income (expense)

and income taxes, consistent with internal management reporting. This

measure of segment operating results differs from operating income in

the consolidated statements of income. All of the Company’s reportable

segments are substantially in Canada.

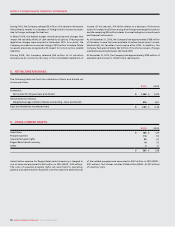

3. SEGMENTED INFORMATION: