Rogers 2010 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT 23

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Of the $455 million year-over-year increase in our consolidated revenue,

Wireless contributed $314 million, Cable contributed $104 million and

Media contributed $94 million, offset by an increase in corporate items

and eliminations of $57 million.

Of the $265 million year-over-year increase in our consolidated adjusted

operating profit, Wireless contributed $125 million, Cable contributed

$113 million and Media contributed $28 million, offset by an increase in

corporate items and eliminations of $1 million.

Refer to the respective individual segment discussions for details of the

revenue, operating expenses, operating profit and additions to PP&E of

Wireless, Cable and Media.

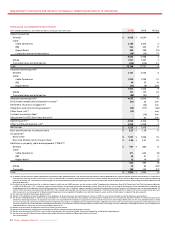

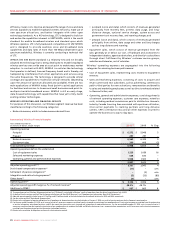

2010 Performance Against Targets

The following table sets forth the guidance ranges for selected full-

year financial and operating metrics that we provided for 2010 versus

the actual results we achieved for the year. We achieved performance

consistent with each of the financial objectives that were set forth

for 2010.

(In millions of dollars)

2009

Actual

2010GuidanceRange%

(As at February 17, 2010)

2010 Guidance Range $

(As at February 17, 2010)

2010

Actual

Consolidated

Adjusted operating profit(1) $ 4,388 Up 2% to 7% $ 4, 476 to $ 4, 695 $ 4,653

Additions to PP&E(2) $ 1,855 Flat to 5% $ 1,855 to $ 1,9 4 8 $ 1,839

Free cash flow(3) $ 1,886 Up 3% to 8% $ 1,943 to $ 2 ,037 $ 2,145

Cash income taxes

Assumptions for the timing

and amount of cash income

tax payments(4)

$ 8

~$150

~$150

$ 152

(1) Excludes stock-based compensation expense (recovery), integration and restructuring expenses, and other items (net).

(2) In addition to Wireless, Cable Operations and Media PP&E expenditures, consolidated additions to PP&E includes RBS, Rogers Retail and Corporate.

(3) Pre-tax free cash flow is defined as adjusted operating profit less PP&E expenditures and interest expense and is not a term defined under Canadian GAAP.

(4) Management currently expects to be fully cash taxable in the 2012 timeframe.

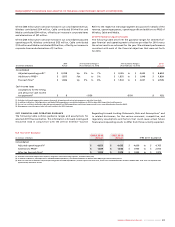

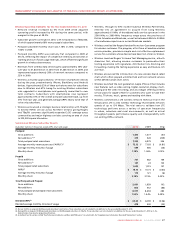

2011 FINANCIAL AND OPERATING GUIDANCE

The following table outlines guidance ranges and assumptions for

selected 2011 financial metrics. This information is forward-looking and

should be read in conjunction with the section entitled “Caution

Regarding Forward-Looking Statements, Risks and Assumptions” and

in related disclosures, for the various economic, competitive, and

regulatory assumptions and factors that could cause actual future

financial and operating results to differ from those currently expected.

(In millions of dollars)

GAAP 2010

Actual IFRS 2010

Actual IFRS 2011 Guidance

Consolidated

Adjusted operating profit(1) $ 4,653 $ 4,635 $ 4,600 to $ 4,765

Additions to PP&E(2) $ 1,839 $ 1,842 $ 1,950 to $ 2,050

After-tax free cash flow(3) $ 1,993 $ 1,972 $ 1,850 to $ 1,975

Full Year 2011 Guidance

(1) Excludes stock-based compensation expense, integration and restructuring expenses, and other items (net).

(2) In addition to Wireless, Cable Operations and Media PP&E expenditures, consolidated additions to PP&E includes RBS, Rogers Retail and Corporate.

(3) After-tax cash flow is defined as adjusted operating profit less PP&E expenditures, interest expense and cash taxes, and is not a term defined under Canadian GAAP or IFRS. Cash taxes are expected to be

approximately $90 million in 2011.