Rogers 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT 99

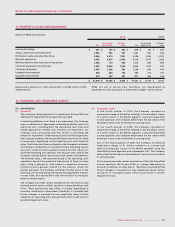

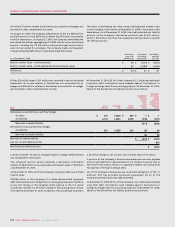

2010 2009

Number Description

Carrying

value

Carrying

value

Publicly traded companies, at quoted market value:

Cogeco Cable Inc. 10,687,925 (2009 – 9,795,675) Subordinate Voting common shares $ 438 $ 343

Cogeco Inc. 5,969,390 (2009 – 5,023,300) Subordinate Voting common shares 224 144

Other publicly traded companies 13 9

675 496

Private companies, at cost 27 18

Investments accounted for by the equity method 19 33

$ 721 $ 547

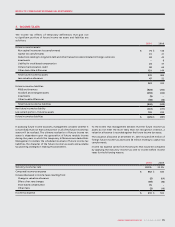

12. INVESTMENTS:

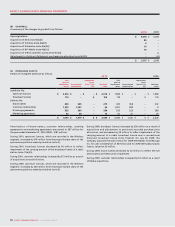

In 2010, the Company acquired 892,250 Subordinate Voting common

shares of Cogeco Cable Inc. for aggregate consideration of $39 million

and 946,090 Subordinate Voting common shares of Cogeco Inc. for

aggregate consideration of $36 million. In 2009, the Company acquired

3,200,000 Subordinate Voting common shares of Cogeco Cable Inc. for

aggregate consideration of $117 million and 1,623,500 Subordinate

Voting common shares of Cogeco Inc. for aggregate consideration of

$46 million.

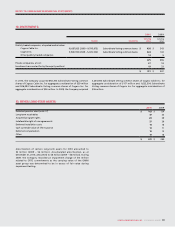

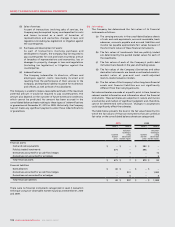

13. OTHER LONG-TERM ASSETS:

2010 2009

Deferred pension asset (note 17) $ 163 $ 134

Long-term receivables 47 23

Acquired program rights 28 39

Indefeasible right of use agreements 27 29

Deferred installation costs 14 16

Cash surrender value of life insurance 13 11

Deferred compensation 10 12

Other 19 16

$ 321 $ 280

Amortization of certain long-term assets for 2010 amounted to

$2 million (2009 – $6 million). Accumulated amortization, as at

December 31, 2010, amounted to $8 million (2009 – $6 million). During

2009, the Company recorded an impairment charge of $13 million

related to CRTC commitments as the carrying value of the OMNI

asset group was determined to be in excess of fair value during

impairment testing.