Rogers 2010 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

34 ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT

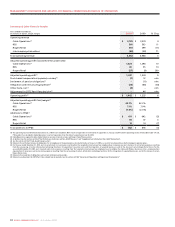

(1) The operating results of Blink Communications Inc. (“Blink”) are included in RBS’s results of operations from the date of acquisition on January 29, 2010 and the operating results of Kincardine Cable T.V. Ltd.

(“Kincardine”) are included in Cable Operations’ results of operations from the date of acquisition on July 30, 2010.

(2) Cable Operations segment includes Cable Television services, Internet services and Rogers Home Phone services.

(3) As defined. See the sections entitled “Key Performance Indicators and Non-GAAP Measures” and “Supplementary Information: Non-GAAP Calculations”.

(4) See the section entitled “Stock-based Compensation”.

(5) Relates to the settlement of pension obligations for all employees in the pension plans who had retired as of January 1, 2009 as a result of annuity purchases by the Company’s pension plans.

(6) For the year ended December 31, 2010, costs incurred relate to i) severances resulting from the targeted restructuring of our employee base to improve our cost structure; ii) restructuring expenses resulting

from the outsourcing of certain information technology functions; iii) acquisition transaction costs and the integration of acquired businesses; and iv) the closure of certain Rogers Retail stores. For the

year ended December 31, 2009, costs incurred relate to i) severances resulting from the targeted restructuring of our employee base to combine the Cable and Wireless businesses into a communications

organization; ii) severances and restructuring expenses resulting from the outsourcing of certain information technology functions; iii) the integration of acquired businesses; and iv) the closure of certain

Rogers Retail stores.

(7) Relates to the resolution of obligations and accruals relating to prior periods.

(8) Relates to an adjustment for CRTC Part II fees related to prior periods. See the section entitled “Government Regulation and Regulatory Developments”.

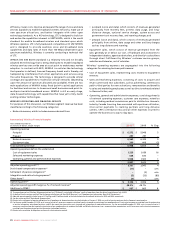

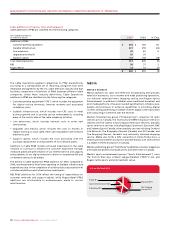

Summarized Cable Financial Results

Years ended December 31,

(In millions of dollars, except margin) 2010(1) 2009 %Chg

Operating revenue

Cable Operations(2) $ 3,185 $ 3,074 4

RBS 560 503 11

Rogers Retail 355 399 (11)

Intercompany eliminations (48) (28) 71

Total operating revenue 4,052 3,948 3

Adjusted operating profit (loss) before the undernoted

Cable Operations(2) 1,424 1,298 10

RBS 40 35 14

Rogers Retail (27) (9) 200

Adjusted operating profit(3) 1,437 1,324 9

Stock-based compensation (expense) recovery(4) (7) 12 n/m

Settlement of pension obligations(5) –(11) n/m

Integration and restructuring expenses(6) (23) (46) (50)

Other items, net (7) (5) –n/m

Adjustment for CRTC Part II fees decision(8) –46 n/m

Operating profit(3) $ 1,402 $ 1,325 6

Adjusted operating profit (loss) margin(3)

Cable Operations(2) 44.7% 42.2%

RBS 7.1% 7.0%

Rogers Retail (7.6%) (2.3%)

Additions to PP&E(3)

Cable Operations(2) $ 611 $ 642 (5)

RBS 38 37 3

Rogers Retail 13 14 (7)

Total additions to PP&E $ 662 $ 693 (4)