Rogers 2010 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

28 ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT

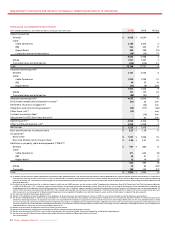

Wireless Subscribers and Network Revenue

The year-over-year decrease in total net subscriber additions for the

year primarily reflects an increase in the level of postpaid churn

associated with heightened competitive intensity, partially offset by

increased gross additions of prepaid subscribers.

Included in postpaid additions are a record number of new smartphone

subscriber sales. The increase in prepaid subscriber additions was the

result of Wireless’ launch of its urban zone-based unlimited voice and

text ‘chatr’ product and also its continued offering from earlier in the

summer of prepaid wireless service plans for the Apple iPad. In addition,

Wireless introduced prepaid Rocket stick wireless data plans that offer

the same speed and reliability as existing postpaid plans but are

designed for customers seeking the convenience of prepaid online

credit card activation without term contracts.

During 2010, we acquired British Columbia based wireless service

reseller Cityfone, a wholesale customer of Wireless. The Cityfone

customer base of approximately 44,000 subscribers was added as an

adjustment to Wireless’ postpaid subscriber base during the year. In

addition, we signed a strategic business relationship with TBayTel to

extend HSPA+ service across Northern Ontario, and migrated 17,000

postpaid subscribers and 10,000 prepaid subscribers to TBayTel.

The increase in network revenue in 2010 compared to 2009 was driven

predominantly by the continued growth of Wireless’ postpaid

subscriber base and the continued adoption of wireless data services.

Year-over-year blended ARPU decreased by 0.9%, which reflects

declines in roaming, out-of-plan usage and network access fees, offset

by higher wireless data and other ancillary revenues. These decreases

reflect a combination of factors, including the creation over the past

year of voice and data roaming value plans for frequent travelers, and

general competitive intensity.

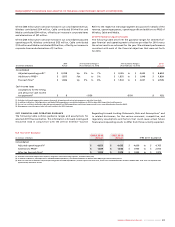

During2010,wirelessdatarevenueincreasedbyapproximately34%

from 2009, to $1,834 million. This growth in wireless data revenue

reflects the continued penetration and growing usage of smartphone

and wireless laptop devices which are driving increased usage of e-mail,

wireless Internet access, text messaging and other wireless data

services.In2010,datarevenuerepresentedapproximately28%oftotal

networkrevenue,comparedto22%in2009.

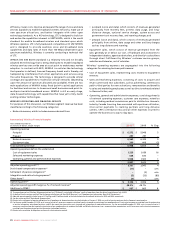

During 2010, Wireless activated

and upgraded approximately

1.9 million smartphones,

compared to approximately 1.5

million smartphones during

2009. These smartphones were

predominately iPhone,

BlackBerry and Android devices,

of which approximately 33%

were for subscribers new to

Wireless. This resulted in

subscribers with smartphones

representing41%oftheoverall

postpaid subscriber base as at

December 31, 2010, compared to

31% as at December 31, 2009.

These subscribers generally

commit to new multi-year-term

contracts, and typically generate

ARPU nearly twice that of voice

only subscribers. This is the

largest number of smartphone

activations and new smartphone customer additions that Wireless has

ever reported.

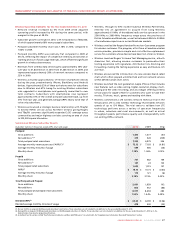

Wireless Equipment Sales

The year-over-year decrease in revenue from equipment sales, including

activation fees and net of equipment subsidies for 2010, reflects the

higher smartphone subsidy levels, which offset the increase in the

number of smartphone activations.

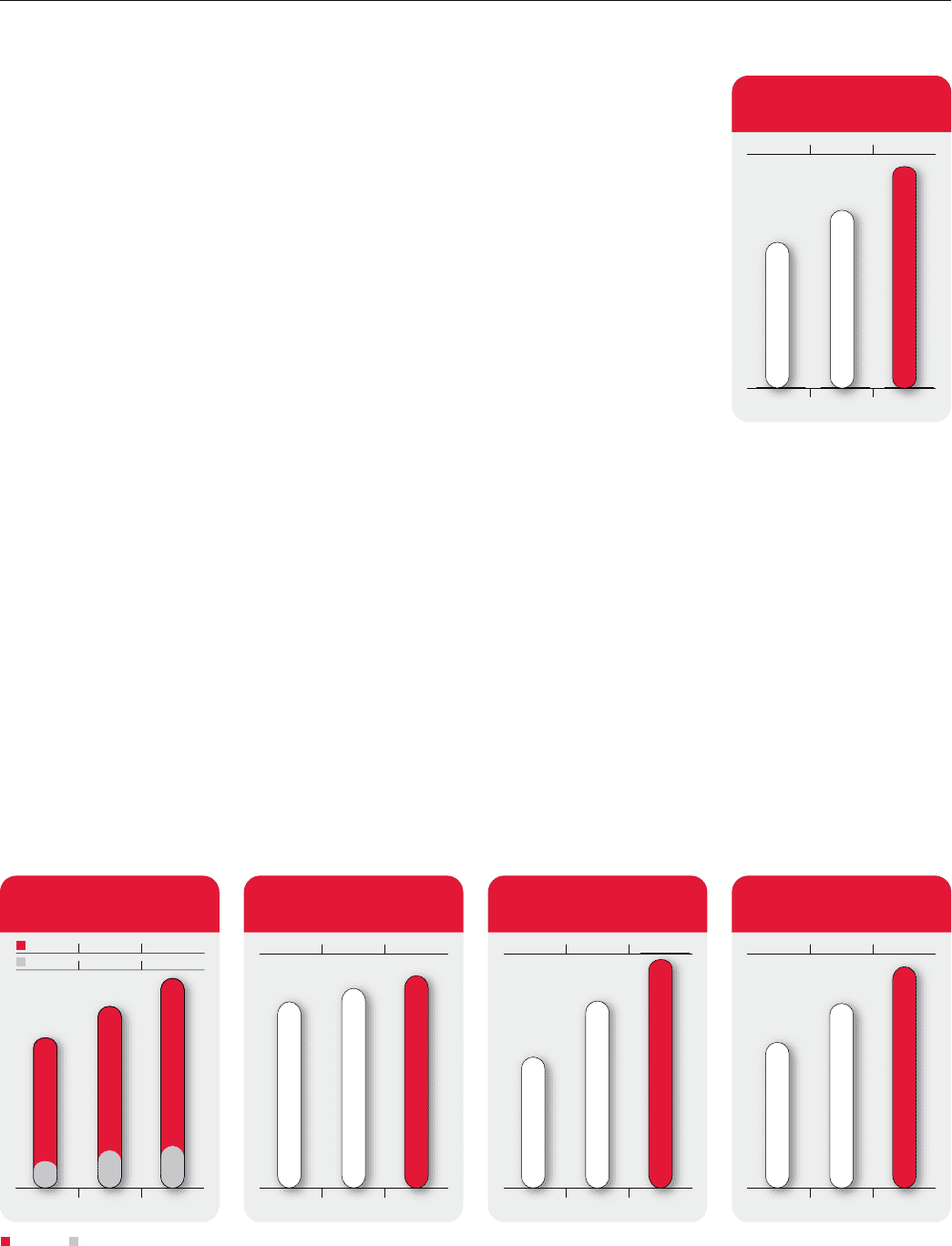

20102009

2008

2008

201

0

2009

41.0%31.0%19.0%

SMARTPHONES AS A PERCENT

OF POSTPAID SUBSCRIBERS

20102009

2008

2009

200

8

201

0

7,3256,451

1,652

6,979

1,5151,491

Postpaid Prepaid

WIRELESS POSTPAID AND

PREPAID SUBSCRIBERS

(In thousands)

20102009

2008

2008

201

0

2009

$1,834$1,366$946

WIRELESS DATA

REVENUE

(In millions of dollars)

20102009

2008

2009

200

8

201

0

$6,569$6,245$5,843

WIRELESS NETWORK

REVENUE

(In millions of dollars)

20102009

2008

2008

201

0

2009

27.9%21.9%16.4%

DATA REVENUE PERCENT

OF BLENDED ARPU