Rogers 2010 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT 21

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

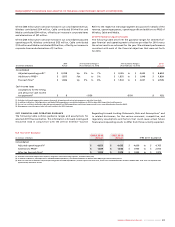

Operating Highlights and Significant Developments in 2010

• Generatedrevenuegrowthof5%atWirelessnetwork,4%atCable

Operations and 7% at Media, with consolidated annual revenue

growthof4%.Adjustedoperatingprotgrew6%to$4,653million

and adjusted operating profit margins expanded by 80 basis points

to38.2%.

• InFebruary2010,werenewedournormalcourseissuerbid(“NCIB”)

to repurchase up to the lesser of $1.5 billion or 43.6 million Class B

Non-Voting shares during the twelve-month period ending February

21, 2011, under which we purchased for cancellation 37.1 million

ClassB Non-Voting shares during 2010 for $1.3 billion.

• InFebruary2010,weincreasedtheannualizeddividendfrom$1.16

to $1.28 per Class A Voting and Class B Non-Voting share, paying out

$734 million in dividends to shareholders during the year.

• Weclosed$1.7billionaggregateprincipalamountofinvestment

grade debt offerings during the year, consisting of $800 million of

6.11%SeniorNotesdue2040and$900millionof4.70%SeniorNotes

due 2020. Among other things, proceeds of the offerings were used

to repay bank debt and redeem our public debt issues maturing in

2011. We redeemed all three of our public debt issues maturing in

2011,includingUS$490millionof9.625%SeniorNotes,$460million

of7.625%SeniorNotesand$175millionof7.25%SeniorNotes.In

total,wereducedourweightedaveragecostofborrowingto6.68%

atDecember31,2010from7.27%atDecember31,2009.

• We increased our ownership position in Cogeco Cable Inc. and

Cogeco Inc. for investment purposes, with the acquisition of

892,250 subordinate voting shares of Cogeco Cable Inc. and 946,090

subordinate voting shares of Cogeco Inc.

• Weincreasedfreecashow,denedasadjustedoperatingprot

less PP&E expenditures and interest on long-term debt, by 14%

from 2009 levels to $2.1 billion. Free cash flow per share increased

by23%reectingthegrowthinunderlyingfreecashowandthe

accretion from our share buybacks, which have decreased the base of

outstanding shares.

• AtDecember31,2010,therewerenoadvancesoutstandingunder

our $2.4 billion committed bank credit facility that matures in July

2013. This strong liquidity position is further enhanced by the fact

that our earliest scheduled debt maturity is in May 2012, together

providing us with substantial liquidity and flexibility.

• Subsequenttotheendof2010,onFebruary15,2011,weannounced

thatourBoardofDirectorshadapproved a11%increase inthe

annualized dividend to $1.42 per share effective immediately, and

that it has approved the renewal of our NCIB share buyback program

authorizing the repurchase of up to $1.5 billion of Rogers shares on

the open market during the next twelve months.

• Alsosubsequenttotheendoftheyear,onFebruary18,2011,we

announced that we have issued notices to redeem on March 21,2011

allofourUS$350millionprincipalamountof7.875%SeniorNotes

due2012andallofourUS$470millionprincipalamountof7.25%

Senior Notes due 2012, in each case at the applicable redemption

price plus accrued interest to the date of redemption, as prescribed

in the applicable indenture.

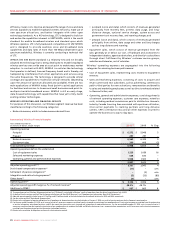

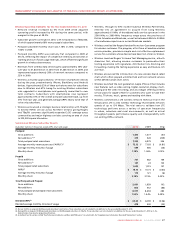

Year Ended December 31, 2010 Compared to Year Ended

December31,2009

For the year ended December 31, 2010, Wireless, Cable and Media

represented 57%, 34% and 12% of our consolidated revenue,

respectively(2009–57%,34%and12%),offsetbycorporateitemsand

eliminationsof3%.Onthebasisofconsolidatedadjustedoperating

prot,Wireless,CableandMediaalsorepresented68%,31%and3%,

respectively(2009–69%,30%and3%),offsetbycorporateitemsand

eliminationsof2%(2009–2%).

For detailed discussions of Wireless, Cable and Media, refer to the

respective segment discussions below.

CONSOLIDATED ADJUSTED OPERATING PROFIT BY SEGMENT

(%)

Cable 30% Wireless 67%

Media 3%

CONSOLIDATED REVENUE BY SEGMENT

(%)

Media 12%

Wireless 56%

Cable 32%