Rogers 2010 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

94 ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT

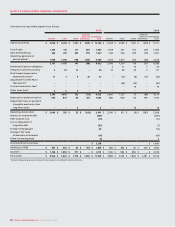

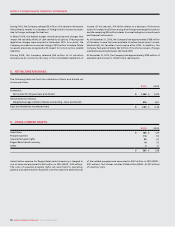

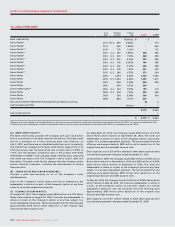

The Company has contributed certain assets to joint ventures involved

in the provision of wireless broadband Internet service and in certain

mobile commerce initiatives. As at December 31, 2010 and 2009 and for

the years then ended, proportionately consolidating these joint

ventures resulted in the following increases (decreases) in the accounts

of the Company:

2010 2009

Long-term assets $ 143 $ 103

Current liabilities 50 16

Revenue 1–

Expenses 31 32

Net loss for the year (30) (32)

In 2010, the Company completed the purchase of spectrum and

broadcast licences from Craig Wireless (“Craig”) and YourLink Inc.

(“YourLink”) (through Inukshuk Wireless Partnership (“Inukshuk”), the

Company’s 50% owned joint venture with Bell Canada). Under the

agreement, Inukshuk paid $80 million for Craig’s 61 MHz of BRS

spectrum licences in the provinces of British Columbia and Manitoba

and paid $14 million for YourLink’s 61 MHz spectrum in the province of

Saskatchewan. The Company recorded an increase in spectrum licences

of $47 million related to its proportionate share of the purchases.

In 2009, Inukshuk completed the purchase of spectrum and broadcast

licences from Look Communications Inc. (“Look”). Under the agreement,

Inukshuk paid $80 million for Look’s 92 MHz of spectrum in the

provinces of Ontario and Quebec. The Company recorded an increase in

spectrum licences of $40 million related to its proportionate share of

the purchase.

In 2007, the Company contributed its 2.3 GHz and 3.5 GHz spectrum

licences with a carrying value of $11 million to Inukshuk for non-cash

consideration of $58 million. A deferred gain of $24 million, being the

portion of the excess of fair value over carrying value related to the

other non-related venturer’s interest in the spectrum licences

contributed by the Company, was recorded on contribution of these

spectrum licences. This deferred gain is recorded in other long-term

liabilities and is being amortized to income on a straight-line basis over

seven years, of which $4 million was recognized in 2010 (2009 –

$4million). In addition to a cash contribution of $8 million, the other

venturer also contributed its 2.3 GHz and 3.5 GHz spectrum licences

valued at $50 million to the joint venture. The Company recorded an

increase in spectrum licences and cash of $25 million and $4million,

respectively, related to its proportionate share of the contribution by

the other venturer.

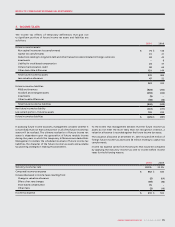

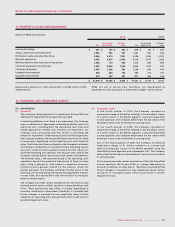

During 2010, the Company incurred $21 million (2009 – $88 million) of

restructuring expenses related to severances resulting from the

targeted restructuring of its employee base and to improve the

Company’s cost structure.

During 2010, the Company incurred $9 million (2009 – $23 million) of

restructuring expenses resulting from the outsourcing of certain

information technology functions.

During 2010, the Company incurred $5 million (2009 – $4 million) related

to the closure of 50 (2009 – 20) underperforming retail store locations,

primarily located in the province of Ontario.

During 2010, the Company incurred $5 million (2009 – $2 million) of

acquisition transaction costs for business combinations and integration

expenses related to previously acquired businesses and related

restructuring.

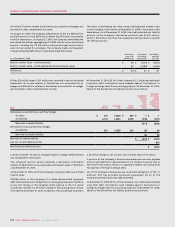

The additions to the liabilities related to the integration and

restructuring activities and payments made against such liabilities

during 2010 are as follows:

5. INVESTMENT IN JOINT VENTURES:

6. INTEGRATION AND RESTRUCTURING EXPENSES:

As at

December 31,

2009 Additions Payments

As at

December 31,

2010

Severances resulting from the targeted restructuring of the Company’s employee base $ 83 $ 21 $ (57) $ 47

Outsourcing of certain information technology functions 9 9 (18) –

Retail store closures 2 5 (3) 4

Acquisition costs and integration of previously acquired businesses 2 5 (4) 3

$ 96 $ 40 $ (82) $ 54

The remaining liability, which is included in accounts payable and accrued liabilities as at December 31, 2010, will be paid over the course of 2011

and 2012.