Rogers 2010 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT 101

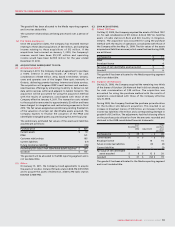

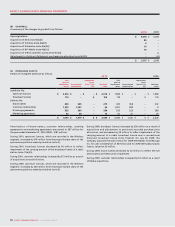

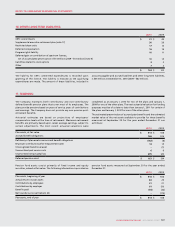

(D) REDEMPTION OF SENIOR NOTES:

On August 27, 2010, the Company redeemed the entire outstanding

principal amount of its U.S.$490 million ($516 million) 9.625% Senior

Notes due 2011 at the prescribed redemption price of 105.999% of the

principal amount effective on that date. The Company incurred a loss

on the repayment of the Senior Notes aggregating $39 million,

including aggregate redemption premiums of $31 million, a net loss on

the termination of the associated swaps of $16 million, offset by a

write-down of a previously recorded fair value increment of $8 million.

Concurrently with this redemption, on August 27, 2010, the Company

terminated the associated Derivatives aggregating U.S.$500 million

notional principal amount, including the U.S.$10 million notional

principal amount which were not accounted for as hedges. The

Company made a net payment of approximately $269 million to

terminate these Derivatives.

On August 31, 2010, the Company redeemed the entire outstanding

principal amount of its $460 million 7.625% Senior Notes due 2011 at

the prescribed redemption price of 107.696% of the principal amount

effective on that date. The Company incurred a loss on repayment of

the Senior Notes of $35 million.

On August 31, 2010, the Company redeemed the entire outstanding

principal amount of its $175 million 7.25% Senior Notes due 2011 at the

prescribed redemption price of 107.219% of the principal amount

effective on that date. The Company incurred a loss on repayment of

the Senior Notes of $13 million.

The total loss on repayment of the Senior Notes was $87 million for the

year ended December 31, 2010.

As a result of these redemptions, the Company paid an aggregate of

approximately $1,230 million, including approximately $1,151 million

aggregate principal amount and $79 million for the premiums payable

in connection with the redemptions.

On December 15, 2009, the Company redeemed the entire outstanding

principal amount of its U.S.$400 million ($424 million) 8.00% Senior

Subordinated Notes due 2012 at the prescribed redemption price of

102% of the principal amount effective on that date. The Company

incurred a net loss on repayment of the Senior Subordinated Notes

aggregating $7 million, including aggregate redemption premiums of

$8 million offset by a write-down of a previously recorded fair value

increment of $1 million.

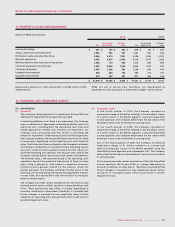

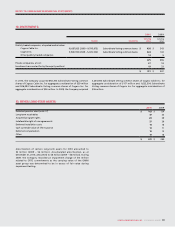

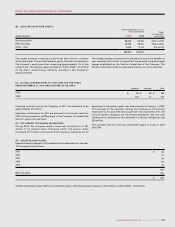

(E) UNSECURED OBLIGATIONS:

Prior to the Company’s reorganization completed on July 1, 2010, RCl’s

public debt originally issued by Rogers Cable Inc. had Rogers Cable

Communications Inc. (“RCCI”), a wholly-owned subsidiary, as a

co-obligor, and Rogers Wireless Partnership (“RWP”), a wholly-owned

subsidiary, as an unsecured guarantor, while RCl’s public debt originally

issued by Rogers Wireless Inc. had RWP as a co-obligor and RCCI as an

unsecured guarantor. Similarly, RCCI and RWP had provided unsecured

guarantees for the public debt issued directly by RCI, the bank credit

facility and the Derivatives. Accordingly, RCI’s bank credit facility, senior

public debt and Derivatives ranked pari passu on an unsecured basis.

Prior to its redemption in December 2009, RCI’s U.S.$400 million 8.00%

Senior Subordinated Notes were subordinated to its senior debt.

July 1, 2010 corporate reorganization:

On June 30, 2010, RWP changed its name to Rogers Communications

Partnership (“RCP”). On July 1, 2010, the Company completed a

reorganization which included the amalgamation of RCI and RCCI and

another of RCI’s wholly-owned subsidiaries forming one amalgamated

company under the name Rogers Communications Inc. Following this

amalgamation, certain of the operating assets and operating liabilities

of the amalgamated company together with all of its employees were

transferred to RCP, subject to certain exceptions. The amalgamated

company did not transfer its interests or obligations in or under: equity

interests in any subsidiaries; long-term debt; derivative instruments;

real estate assets; and intercompany notes.

As a result of this reorganization, effective July 1, 2010, RCP holds

substantially all of the Company’s shared services and Cable and

Wireless operations. Reporting will continue to reflect the Cable and

Wireless services as separate operating segments.

In addition, RCCI ceased to be a separate legal entity on July 1, 2010 as a

result of the amalgamation and effective July 1, 2010 RCCI is no longer a

guarantor or obligor, as applicable, for the Company’s bank credit

facility, public debt and Derivatives. Following the amalgamation, RCI

continues to be the obligor in respect of each of the Company’s bank

credit facility, public debt and Derivatives, while RCP remains either a

co-obligor or guarantor, as applicable, for the public debt and a

guarantor for the bank credit facility and Derivatives. RCl’s and RCP’s

respective obligations under the bank credit facility, the public debt

and the Derivatives continue to rank pari passu on an unsecured basis.

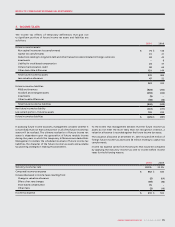

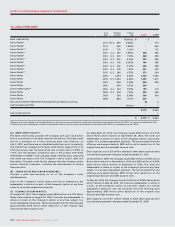

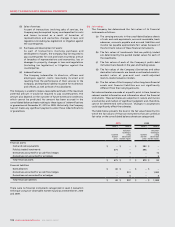

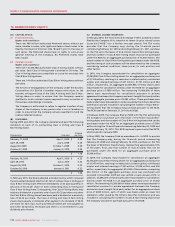

(F) FAIR VALUE INCREMENT (DECREMENT) ARISING FROM

PURCHASE ACCOUNTING:

The fair value increment (decrement) on long-term debt is a purchase

accounting adjustment required by GAAP as a result of the acquisition

of the minority interest of Wireless during 2004. Under GAAP, the

purchase method of accounting requires that the assets and liabilities of

an acquired enterprise be revalued to fair value when allocating the

purchase price of the acquisition. The fair value increment (decrement)

is amortized over the remaining term of the related debt and recorded

as part of interest expense. The fair value increment (decrement),

applied to the specific debt instruments to which it relates, results in

the following carrying values at December 31, 2010 and 2009 of the

debt in the Company’s consolidated accounts:

2010 2009

Senior Notes, due 2011 9.625% $ – $ 533

Senior Notes, due 2011 7.625% –460

Senior Notes, due 2012 7.250% 469 495

Senior Notes, due 2014 6.375% 738 774

Senior Notes, due 2015 7.500% 549 579

Total $ 1,756 $ 2,841