Rogers 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

68 ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT

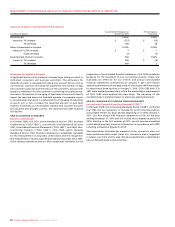

CHANGES IN ACCOUNTING POLICIES

As discussed above, the IASB, at its discretion, may issue new accounting

standards during the conversion period, and as a result, the final impact

of IFRS on our consolidated financial statements will only be measured

once all the IFRS applicable at the conversion date are definitively

known. Consequently, our analysis and estimates of changes and policy

decisions have been made based on our current expectations regarding

the accounting standards that we anticipate will be effective at the

time of transition. The future impacts of IFRS will also depend on the

particular circumstances prevailing in those years. See the section

entitled “Caution Regarding Forward-Looking Statements, Risk and

Assumptions”.

Set out below are the key areas where changes in accounting policies

are expected to impact our consolidated financial statements. The

individual amounts disclosed, which are only estimates based on

current expectations, are on a pre-tax basis and the tax impact of all

changes discussed on an overall basis. The list and comments should not

be regarded as a complete list of estimated changes that will result

from transition to IFRS and are intended to highlight those areas we

currently believe to be most significant.

Share-Based Payments

Differences from existing Canadian GAAP: IFRS 2, Share-Based Payments,

requires that cash-settled stock-based payments to employees be

measured (both initially and at each reporting date) based on fair

values of the awards, which are determined using an option pricing

model. Canadian GAAP requires that such payments be measured

based on intrinsic values of the awards, which are determined with

reference to the market price of the Company’s underlying shares. This

difference is expected to impact the accounting measurement of our

stock-based payments, including our stock options, restricted share

units and deferred share units.

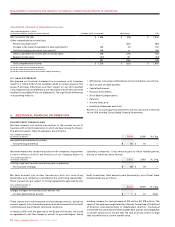

Expected impact: Per the requirements of IFRS 1, First-Time Adoption of

International Financial Reporting Standards (“IFRS 1”), this adjustment will

be recorded in opening retained earnings upon transition to IFRS. We

expect the impact of the change at January 1, 2010 will be to decrease

retained earnings by $15 million with a corresponding increase in

liabilities, split between current ($9 million) and long-term ($6 million).

Net income for the year ended December 31, 2010 is expected to

decrease by $3 million.

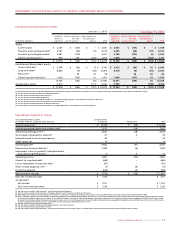

Employee Benefits

Differences with existing Canadian GAAP: International Accounting

Standard (“IAS”) 19, Employee Benefits (“IAS 19”), requires the past

service cost element of defined benefit plans be expensed on an

accelerated basis, with vested past service costs expensed immediately

and unvested past service costs recognized on a straight-line basis until

the benefits become vested. Under Canadian GAAP, past service costs

are generally amortized on a straight-line basis over the estimated

average remaining service period of active employees under the plan.

All of the past service costs for our pension plan are vested; therefore,

we expect that the impact of transition will result in a reduction of the

opening pension asset balance equal to the amount of any previously

unrecognized past service costs.

In addition, IAS 19 requires an entity to make an accounting policy

choice regarding the treatment of actuarial gains and losses,

subsequent to the transition date. We intend to adopt the option

allowing the immediate recognition of actuarial gains and losses

directly in equity, with no impact on profit or loss.

Furthermore, IAS 19 requires that the defined benefit obligation and

plan assets be measured at the balance sheet date while Canadian

GAAP allows the measurement date of the defined benefit obligation

and plan assets to be up to three months prior to the date of the

financial statements. Our current accounting policy is to measure the

defined benefit obligation and plan assets at September 30.

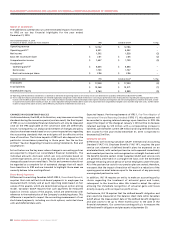

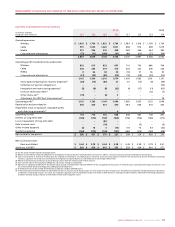

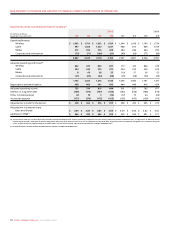

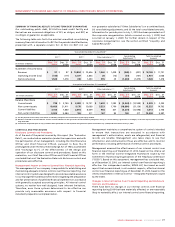

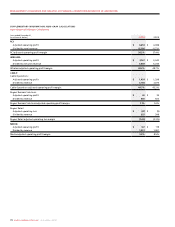

Impact of Conversion

The table below summarizes our current estimated impact of conversion

to IFRS on our key financial highlights for the year ended

December31,2010.

(1) Operating profit should not be considered as a substitute or alternative for operating income or net income, in each case determined in accordance with both Canadian GAAP and IFRS.

(2) The ‘as adjusted’ amounts presented above are reviewed regularly by management and our Board of Directors in assessing our performance and in making decisions regarding the ongoing operations of the

business and the ability to generate cash flows. The ‘as adjusted’ amounts exclude (i) stock-based compensation expense (recovery); (ii) integration and restructuring expenses; (iii) other items (net); and (iv)

in respect of net income and net income per share, loss on the repayment of long-term debt, debt issuance costs, impairment losses on goodwill, intangible assets and other long-term assets, and the related

income tax impact of the above amounts, and for IFRS only, amortization of deferred transaction costs.

Year ended December 31, 2010

(In millions of dollars, except per share amounts) IFRS Canadian GAAP %Chg

Operating revenue $ 12,142 $ 12,186 –

Operating profit(1) 4,531 4,552 –

Net income 1,502 1,528 (2)

Basic net income per share $ 2.61 $ 2.65 (2)

Comprehensive income $ 1,647 $ 1,729 (5)

As adjusted(2)

Operating profit(1) $ 4,635 $ 4,653 –

Net income 1,703 1,707 –

Basic net income per share $ 2.96 $ 2.96 –

December 31, 2010 IFRS Canadian GAAP %Chg

Total assets $ 17,028 $ 17,330 (2)

Total liabilities $ 13,268 $ 13,371 (1)

Shareholders’ equity $ 3,760 $ 3,959 (5)