Rogers 2010 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32 ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT

Cable believes that the 860 MHz FTTF architecture provides sufficient

bandwidth to provide for television, data, telephony and other future

services, high picture quality, advanced two-way capability and

network reliability. This architecture also allows for the introduction of

bandwidth optimization technologies, such as switched digital video

(“SDV”) and MPEG4, and offers the ability to continue to expand

service offerings on the existing infrastructure. SDV has been

successfully deployed in almost all head-ends. In addition, Cable’s

clustered network of cable systems served by regional head-ends

facilitates its ability to rapidly introduce new services to large areas of

subscribers simultaneously. In new construction projects in major urban

areas, Cable is now deploying a cable network architecture commonly

referred to as fibre-to-the-curb (“FTTC”). This architecture provides

improved reliability and reduced maintenance due to fewer active

network devices being deployed.

Cable’s voice-over-cable telephony services are offered over an

advanced broadband IP multimedia network layer deployed across its

cable service areas. This network platform provides for a scalable

primary line quality digital voice-over-cable telephony service utilizing

Packet Cable and Data Over Cable Service Interface Specification

(“DOCSIS”) standards, including network redundancy as well as multi-

hour network and customer premises backup powering.

Cable operates on behalf of Wireless and RBS (including the recently

acquired Atria Networks LP), a North American transcontinental fibre-

optic network extending over 38,000 route kilometres providing a

significant North American geographic footprint connecting Canada’s

largest markets while also reaching key U.S. markets for the exchange

of data and voice traffic, also known as peering. In Canada, the network

extends from Vancouver in the west to St. John’s in the east. The assets

include local and regional fibre, transmission electronics and systems,

hubs, points of presence (“POPs”), and switching infrastructure. Cable’s

network extends into the U.S. from Vancouver south to Seattle in the

west, from the Manitoba-Minnesota border, through Minneapolis,

Milwaukee and Chicago in the mid-west and from Toronto through

Buffalo and Montreal through Albany to New York City in the east.

Cable has connected its North American network with Europe through

international gateway switches in New York City.

Where Cable does not have its own local facilities directly to a business

customer’s premises, the local service is provided under a third party

wholesale arrangement.

CABLE’S STRATEGY

Cable seeks to maximize

subscriber share, revenue,

operating profit and return on

invested capital by leveraging its

technologically advanced cable

networks and innovative

products and services to meet

the information, entertainment

and communications needs of

its residential and small business

customers. The key elements of

the strategy are as follows:

• Maintaining technologically

advanced cable networks

and systems clustered and

interconnected in and around

metropolitan areas;

• Offeringawideselectionofadvancedandinnovativeinformation,

entertainment and communications products and services over

its broadband networks, such as the ongoing expansion of its

HDTV, specialty and on-demand video services, increasingly faster

broadband Internet speeds, and emerging opportunities for home

monitoring and control;

• Ongoing focus on enhanced customer experience through the

quality and reliability of its innovative products, services and

customer support programs;

• Targeting itsproductandcontent developmentto the changing

demographic trends within its service territory, such as products

targeted to multicultural communities and small businesses;

• Continuingtoleadthedevelopmentandexpansionoftheonline

content and entertainment experience with the continued expansion

of its successful broadband video platform, Rogers On-Demand

Online;

• Continuing to deepen our presence and core connections in an

increasing number of customer homes with anchor products such as

broadband Internet, video and telephony; and

• Focusingondrivingdeeperpenetrationofitson-netdataandvoice

services into the small and medium-sized business segments within

and contiguous to its cable footprint.

RECENT CABLE INDUSTRY TRENDS

Investment in Improved Cable Television Networks and Expanded

Service Offerings

In recent years, North American cable television companies have made

substantial investments in the installation of fibre-optic cable, including

fibre to the home and premises initiatives, and electronics in their

respective networks and in the development of Internet, digital cable

and voice-over-cable telephony services. These investments have

enabled cable television companies to offer expanded packages of

digital cable television services, including VOD and SVOD, pay television

packages, PVR, HDTV programming, increasingly fast tiers of Internet

services, and telephony services. These investments have enabled cable

television companies to offer increased speed and quality of service in

their expanded digital television packages, PVR, HDTV programming,

higher speed Internet and telephony services.

Increased Competition from Alternative Broadcasting Distribution

Undertakings

As fully described in the section entitled “Competition in our

Businesses”, Canadian cable television systems generally face legal and

illegal competition from several alternative multi-channel broadcasting

distribution systems.

Growth of Internet Protocol-Based Services

The availability of telephony over the Internet has become a direct

competitor to Canadian cable television systems. Voice-over-Internet

Protocol (“VoIP”) local services are being provided by non-facilities-

based providers, such as Vonage, who market VoIP local services to the

subscribers of ILEC, cable and other companies’ high-speed Internet

services. In addition and as discussed below, certain television and

movie content is increasingly becoming available over the Internet.

Traditional TV viewing will be challenged by wide range of options

available to consumers such as over-the-top television (such as Apple

TV), online video offerings (such as Netflix) and Mobile TV.

In the enterprise market, there is a continuing shift to IP-based services,

in particular from asynchronous transfer mode (“ATM”) and frame relay

(two common data networking technologies) to IP delivered through

virtual private networking (“VPN”) services. This transition results in

lower costs for both users and carriers.

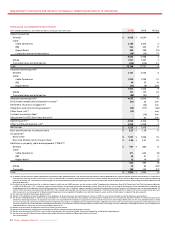

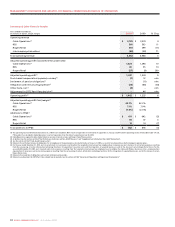

20102009

2008

2008

201

0

2009

$4,052$3,948$3,809

CABLE TOTAL REVENUE

(In millions of dollars)

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS