Rogers 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT 65

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

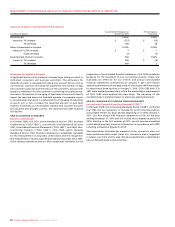

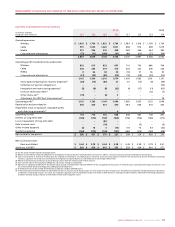

Impact of Changes in Estimated Useful Lives

Impairment of Goodwill, Indefinite-Lived Intangible Assets and

Long-Lived Assets

Indefinite-lived intangible assets, including goodwill and spectrum/

broadcast licences, as well as long-lived assets, including PP&E and

other intangible assets, are assessed for impairment on at least an

annual basis or more often if events or circumstances warrant. These

impairment tests involve the use of both undiscounted and discounted

net cash flow analyses to assess the recoverability of the carrying value

of these assets and the fair value of both indefinite-lived and long-lived

assets, if applicable. These analyses involve estimates of future cash

flows, estimated periods of use and applicable discount rates. During

2010, we recorded an impairment charge of $6 million related to a radio

station licence, due to the weakening of advertising revenues in a local

market. During 2009, we recorded an impairment charge of $18 million

related to certain of our broadcast assets, due to the challenging

economic conditions and weakening industry expectations in the

conventional television business and a decline in advertising revenues.

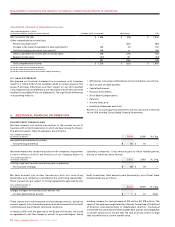

Income Tax Estimates

We use judgment in the estimation of income taxes and future income

tax assets and liabilities. In the preparation of our Consolidated

Financial Statements, we are required to estimate income taxes in each

of the jurisdictions in which we operate. This involves estimating actual

current tax expense, together with assessing temporary differences

that result from differing treatments in items for accounting purposes

versus tax purposes, and in estimating the recoverability of the benefits

arising from tax loss carryforwards. We are required to assess whether

it is more likely than not that future income tax assets will be realized

prior to the expiration of the related tax loss carryforwards. Judgment

is required to determine if a valuation allowance is needed against

either all or a portion of our future income tax assets. Various

considerations are reflected in this judgment, including future

profitability of related companies, tax planning strategies that are

being implemented or could be implemented to recognize the benefits

of these tax assets, as well as the expiration of the tax loss carryforwards.

Judgments and estimates made to assess the tax treatment of items

and the need for a valuation allowance impact the future income tax

balances as well as net income through the current and future income

tax provisions. As at December 31, 2010, and as detailed in Note 7 to the

2010 Audited Consolidated Financial Statements, we have non-capital

income tax loss carryforwards of approximately $188 million. Our net

future income tax liability, prior to valuation allowances, totals

approximately $470 million at December 31, 2010 (2009 – liability of

$125 million). The recorded valuation allowance of $47 million reduces

future income tax assets to $323 million, which the Company believes it

is more likely than not to realize.

(In millions of dollars)

Amortization

Period

Increase in Net Income

if Life Increased by 1 year

Decrease in Net Income

if Life Decreased by 1 year

Brand names 5–20 years $ 1 $ (1)

Customer relationships 2–5 years $ 5 $ (10)

Roaming agreements 12 years $ 3 $ (4)

Marketing agreement 5 years $ 2 $ (3)

Credit Spreads and the Impact on Fair Value of Derivatives

Rogers’ Derivatives are recorded using an estimated credit-adjusted

mark-to-market valuation, which is determined by increasing the

treasury-related discount rates used to calculate the risk-free estimated

mark-to-market valuation by an estimated Bond Spread for the relevant

term and counterparty for each Derivative. In the case of Derivatives in

an asset position (i.e., those Derivatives for which the counterparties

owe Rogers), the Bond Spread for the bank counterparty is added to

the risk-free discount rate to determine the estimated credit-adjusted

value. In the case of Derivatives in a liability position (i.e., those

Derivatives for which Rogers owes the counterparties), Rogers’ Bond

Spread is added to the risk-free discount rate. The estimated credit-

adjusted values of the Derivatives are subject to changes in credit

spreads of Rogers and its counterparties.

Pension Plans

When accounting for defined benefit pension plans, assumptions are

made in determining the valuation of benefit obligations and the

future performance of plan assets. Delayed recognition of differences

between actual results and expected or estimated results is a guiding

principle of pension accounting. This principle results in recognition of

changes in benefit obligations and plan performance over the working

lives of the employees receiving benefits under the plan. The primary

assumptions and estimates include the discount rate, the expected

return on plan assets and the rate of compensation increase. Changes

to these primary assumptions and estimates would impact pension

expense and the deferred pension asset. The current economic

conditions may also have an impact on the pension plan of the Company

as there is no assurance that the plan will be able to earn the assumed

rate of return. As well, market-driven changes may result in changes in

the discount rates and other variables which would result in the

Company being required to make contributions in the future that differ

significantly from the current contributions and assumptions

incorporated into the actuarial valuation process.

During 2009, the Company made a lump-sum contribution of $61

million to its pension plans, following which the pension plans

purchased $172 million of annuities from insurance companies for all

employees in the pension plans who had retired as of January 1, 2009.

The purchase of the annuities relieves the Company of primary

responsibility for, and eliminates significant risk associated with, the

accrued benefit obligation for the retired employees. The non-cash

settlement loss arising from this transaction was $30 million and was

recorded in the year ended December 31, 2009. The Company did not

make any additional lump sum contributions to its pension plans in the

year ended December 31, 2010.

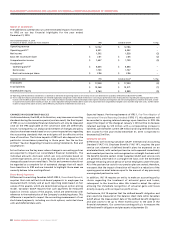

The following table illustrates the increase (decrease) in the accrued

benefit obligation and pension expense for changes in these primary

assumptions and estimates: