Rogers 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT 95

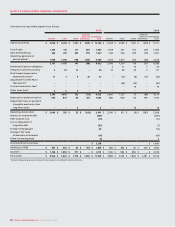

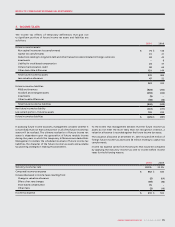

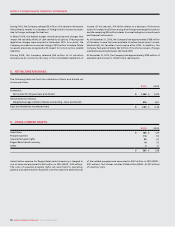

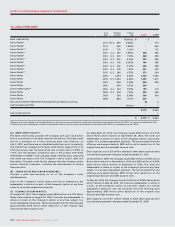

The income tax effects of temporary differences that give rise

to significant portions of future income tax assets and liabilities are

as follows:

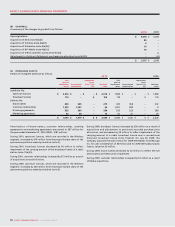

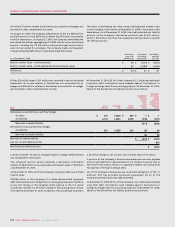

In assessing future income tax assets, management considers whether it

is more likely than not that some portion or all of the future income tax

assets will be realized. The ultimate realization of future income tax

assets is dependent upon the generation of future taxable income

during the years in which the temporary differences are deductible.

Management considers the scheduled reversals of future income tax

liabilities, the character of the future income tax assets and available

tax planning strategies in making this assessment.

To the extent that management believes that the future income tax

assets do not meet the more likely than not recognition criterion, a

valuation allowance is recorded against the future income tax assets.

The valuation allowance at December 31, 2010 includes $39 million of

foreign future income tax assets and $8 million relating to capital loss

carryforwards.

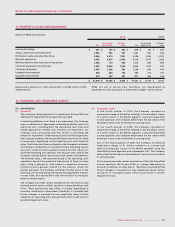

Income tax expense varies from the amounts that would be computed

by applying the statutory income tax rate to income before income

taxes for the following reasons:

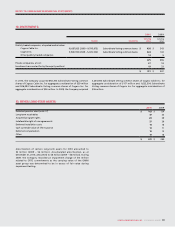

7. INCOME TAXES:

2010 2009

Future income tax assets:

Non-capital income tax loss carryforwards $ 74 $ 148

Capital loss carryforwards 31 31

Deductions relating to long-term debt and other transactions denominated in foreign currencies 32 42

Investments –8

Liability for stock-based compensation 24 47

Ontario harmonization credit 58 64

Other deductible differences 151 144

Total future income tax assets 370 484

Less valuation allowance 47 52

323 432

Future income tax liabilities:

PP&E and inventory (428) (246)

Goodwill and intangible assets (359) (325)

Investments (5) –

Other taxable differences (48) (38)

Total future income tax liabilities (840) (609)

Net future income tax liability (517) (177)

Less current portion – future tax assets 159 220

Future income tax liabilities $ (676) $ (397)

2010 2009

Statutory income tax rate 30.5% 32.3%

Computed income tax expense $ 652 $ 640

Increase (decrease) in income taxes resulting from:

Change in valuation allowance (5) (64)

Effect of tax rate changes (69) (58)

Stock-based compensation 35 –

Other items (3) (16)

Income tax expense $ 610 $ 502