Rogers 2010 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

52 ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT

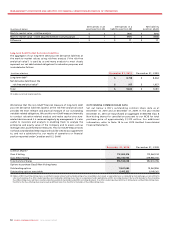

(In millions of dollars) Less Than 1 Year 1–3 Years 4–5 Years After 5 Years Total

Long-term debt(1) $ – $ 1,164 $ 1,920 $ 5,639 $ 8,723

Derivative instruments(2) – 406 418 60 884

Operating leases 130 158 73 43 404

Player contracts 53 34 19 9 115

Purchase obligations(3) 572 532 338 240 1,682

Pension obligation(4) 70 – – – 70

Other long-term liabilities – 65 20 39 124

Total $ 825 $ 2,359 $ 2,788 $ 6,030 $ 12,002

Computershare Trust Company of Canada is the Plan Agent and acts on

behalf of participants to invest eligible dividends. Registered

shareholders of Rogers wishing to participate in the DRIP can find the

full text of the DRIP Plan Document and enrolment forms at

computershare.com/rogers. Non-registered beneficial shareholders are

advised to contact their broker, investment dealer or other financial

intermediary for details on how to participate in the DRIP.

While Rogers, at its discretion, may fund the quarterly DRIP share

requirements with either Class B Non-Voting shares acquired on the

Canadian open market or issued by Rogers, our current intention is that

such shares will, for the foreseeable future, be acquired on the

Canadian open market by the DRIP Agent.

Material Obligations Under Firm Contractual Arrangements

(1) Amounts reflect principal obligations due at maturity.

(2) Amounts reflect net disbursements due at maturity.

(3) Purchase obligations consist of agreements to purchase goods and services that are enforceable and legally binding and that specify all significant terms, including fixed or minimum quantities to be

purchased, price provisions and timing of the transaction. In addition, we incur expenditures for other items that are volume-dependent.

(4) Represents expected contributions to our pension plans in 2011. Contributions for the year ended December 31, 2012 and beyond cannot be reasonably estimated as they will depend on future economic

conditions and may be impacted by future government legislation.

Quarterly dividends are only payable as and when declared by Rogers’

Board of Directors and there is no entitlement to any dividend prior

thereto. Before enrolling, shareholders are advised to read the

complete text of the DRIP and to consult their financial advisors

regarding their unique investment profile and tax situation. Only

Canadian and U.S. residents can participate in the DRIP.

COMMITMENTS AND OTHER CONTRACTUAL OBLIGATIONS

Contractual Obligations

Our material obligations under firm contractual arrangements are

summarized below at December 31, 2010. See also Notes 14, 15 and 23

to the 2010 Audited Consolidated Financial Statements.

OFF-BALANCE SHEET ARRANGEMENTS

Guarantees

As a regular part of our business, we enter into agreements that

provide for indemnification and guarantees to counterparties in

transactions involving business sale and business combination

agreements, sales of services and purchases and development of assets.

Due to the nature of these indemnifications, we are unable to make a

reasonable estimate of the maximum potential amount we could be

required to pay counterparties. Historically, we have not made any

significant payment under these indemnifications or guarantees. Refer

to Note 15(e)(ii) to the 2010 Audited Consolidated Financial Statements.

Derivative Instruments

As previously discussed, we use derivative instruments to manage our

exposure to interest rate and foreign currency risks. We do not use

derivative instruments for speculative purposes.

Operating Leases

We have entered into operating leases for the rental of premises,

distribution facilities, equipment and microwave towers and other

contracts. The effect of terminating any one lease agreement would

not have an adverse effect on us as a whole. Refer to the section

entitled “Contractual Obligations” above and Note 23 to the 2010

Audited Consolidated Financial Statements.

4. OPERATING ENVIRONMENT

Additional discussion of regulatory matters and recent developments

specific to the Wireless, Cable and Media segments follows.

GOVERNMENT REGULATION AND REGULATORY DEVELOPMENTS

Substantially all of our business activities, except for Cable’s Rogers

Retail segment and the non-broadcasting operations of Media, are

subject to regulation by one or more of: the Canadian Federal

Department of Industry, on behalf of the Minister of Industry (Canada)

(collectively, “Industry Canada”), the CRTC under the

Telecommunications Act (Canada) (the “Telecommunications Act”) and

the CRTC under the Broadcasting Act (Canada) (the “Broadcasting Act”),

and, accordingly, our results of operations are affected by changes in

regulations and by the decisions of these regulators.

Canadian Radio-television and Telecommunications Commission

Canadian broadcasting operations, including our cable television

systems, radio and television stations, and specialty services are licenced

(or operated pursuant to an exemption order) and regulated by the

CRTC pursuant to the Broadcasting Act. Under the Broadcasting Act,

the CRTC is responsible for regulating and supervising all aspects of the

Canadian broadcasting system with a view to implementing certain

broadcasting policy objectives enunciated in that Act.