Rogers 2010 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

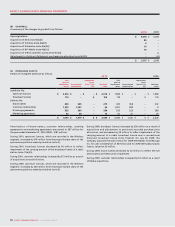

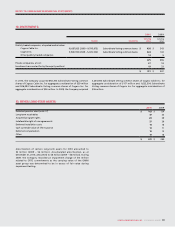

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT 97

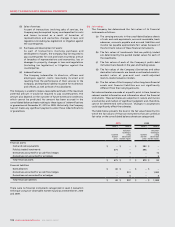

Depreciation expense for 2010 amounted to $1,560 million (2009 –

$1,543 million).

PP&E not yet in service and, therefore, not depreciated at

December31,2010 amounted to $1,610 million (2009 – $1,013 million).

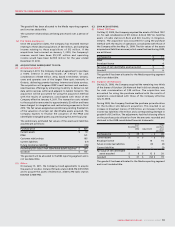

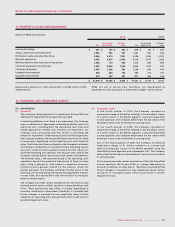

(A) IMPAIRMENT:

(i) Goodwill:

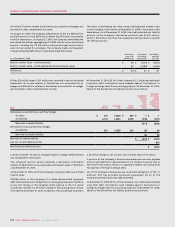

The Company tested goodwill for impairment during 2010 and

2009 and no impairment of goodwill was recorded.

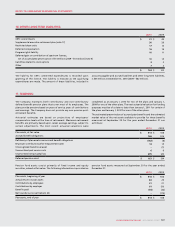

In assessing whether or not there is an impairment, the Company

uses a combination of approaches to determine the fair value of a

reporting unit, including both the discounted cash flows and

market approaches. If there is an indication of impairment, the

Company uses a discounted cash flow model in estimating the

amount of impairment. Under the discounted cash flows approach,

the Company estimates the discounted future cash flows for three

to seven years, depending on the reporting unit, and a terminal

value. The future cash flows are based on the Company’s estimates

and include consideration for expected future operating results,

economic conditions and a general outlook for the industry in

which the reporting unit operates. The discount rates used by the

Company consider debt to equity ratios and certain risk premiums.

The terminal value is the value attributed to the reporting unit’s

operations beyond the projected time period of three to seven

years using a perpetuity rate based on expected economic

conditions and a general outlook for the industry. Under the

market approach, the Company estimates the fair value of the

reporting unit by multiplying normalized earnings before interest,

income taxes and depreciation and amortization by multiples

based on market inputs.

The Company has made certain assumptions for the discount and

terminal growth rates to reflect variations in expected future cash

flows. These assumptions may differ or change depending on

economic conditions or other events. Therefore, it is possible that

future changes in assumptions may negatively impact future

valuations of reporting units and goodwill which could result in

goodwill impairment losses.

(ii) Intangible assets:

In the fourth quarter of 2010, the Company recorded an

impairment charge of $6 million relating to the broadcast licence

of a radio station in the Media segment. Using the Greenfield

income approach, the Company determined the fair value of the

broadcast licence to be lower than its carrying value.

In the fourth quarter of 2009, the Company recorded an

impairment charge of $4 million relating to the broadcast licence

of a radio station in the Media segment. Using the Greenfield

income approach, the Company determined the fair value of the

broadcast licence to be lower than its carrying value.

Also in the fourth quarter of 2009, the Company recorded an

impairment charge of $1 million related to a conventional

television broadcast licence in the Media segment using the

Greenfield income approach and replacement cost. The Company

determined the fair value of the broadcast licence to be lower than

its carrying value.

The Company has made certain assumptions within the Greenfield

income approach which may differ or change depending on

economic conditions or other events. Therefore, it is possible that

future changes in assumptions may negatively impact future

valuations of intangible assets which could result in further

impairment losses.

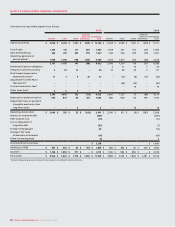

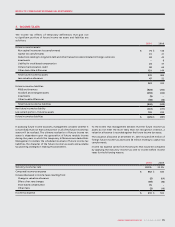

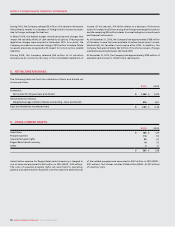

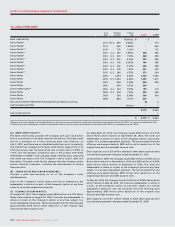

10. PROPERTY, PLANT AND EQUIPMENT:

11. GOODWILL AND INTANGIBLE ASSETS:

Details of PP&E are as follows:

2010 2009

Cost

Accumulated

depreciation

Net book

value Cost

Accumulated

depreciation

Net book

value

Land and buildings $ 821 $ 196 $ 625 $ 828 $ 181 $ 647

Towers, head-ends and transmitters 1,583 996 587 1,361 833 528

Distribution cable and subscriber drops 5,206 3,315 1,891 5,058 3,055 2,003

Network equipment 6,082 3,276 2,806 5,530 2,847 2,683

Wireless network radio base station equipment 1,408 774 634 1,219 654 565

Computer equipment and software 3,292 2,232 1,060 2,853 1,974 879

Customer equipment 1,469 1,086 383 1,358 949 409

Leasehold improvements 384 224 160 369 212 157

Equipment and vehicles 974 627 347 891 565 326

$ 21,219 $ 12,726 $ 8,493 $ 19,467 $ 11, 270 $ 8,197