Rogers 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT 71

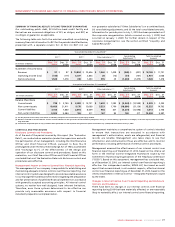

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

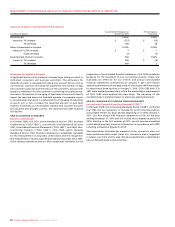

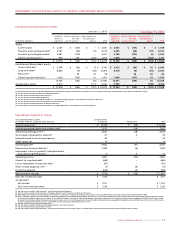

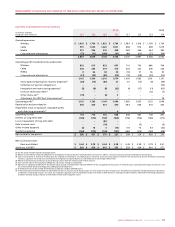

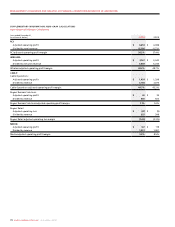

Condensed consolidated balance sheets:

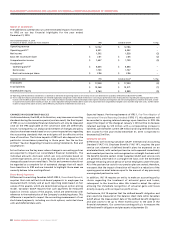

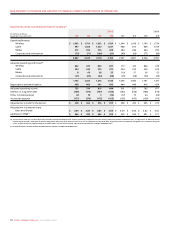

Consolidated statement of income:

(1) See the sections entitled “Joint Ventures” and “Customer Loyalty Programs”.

(2) See the sections entitled “Joint Ventures”, “Employee Benefits” and “Provisions for Onerous Contracts”.

(3) Operating profit should not be considered as a substitute or alternative for operating income or net income, in each case determined in accordance with both Canadian GAAP and IFRS.

(4) The ‘as adjusted’ amounts presented above are reviewed regularly by management and our Board of Directors in assessing our performance and in making decisions regarding the ongoing operations of the

business and the ability to generate cash flows. The ‘as adjusted’ amounts exclude (i) stock-based compensation expense (recovery); (ii) integration and restructuring expenses; (iii) other items (net); and (iv)

in respect of net income and net income per share, debt issuance costs, loss on the repayment of long-term debt, impairment losses on goodwill, intangible assets and other long-term assets, and the related

income tax impact of the above amounts, and for IFRS only, amortization of deferred transaction costs.

(5) See the section entitled “Share-Based Payments”.

(6) See the sections entitled “Fixed Asset: Componentization” and “Joint Ventures”.

(7) See the section entitled “Impairment of Assets”.

(8) See the sections entitled “Joint Ventures” and “Financial Instruments: Transactions Costs”. The adjustments also include reclassification related to income from associates.

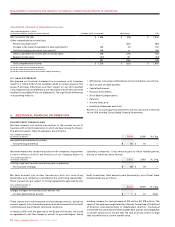

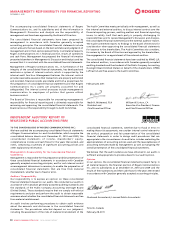

(1) Reclassification includes change from proportionate consolidation to equity method for joint ventures as well as other presentation changes which do not impact shareholders’ equity.

(2) See the section entitled “Fixed Assets: Componentization”.

(3) See the section entitled “Impairment of Assets”.

(4) See the section entitled “Employee Benefits”.

(5) See the sections entitled “Share-Based Payments”, “Customer Loyalty Programs” and “Provisions for Onerous Contracts”.

(6) See the section entitled “Financial Instruments: Transaction Costs”.

(7) See the section entitled “Provisions for Onerous Contracts”.

(8) See the sections entitled “Share-Based Payments”, “Employee Benefits”, “Joint Ventures” and “Other impacts”.

January 1, 2010 December 31, 2010

(In millions of dollars)

Canadian

GAAP, as

reported

Reclassification

for IFRS

presentation(1)

Adjustments to

shareholders’

equity IFRS

Canadian

GAAP, as

reported

Reclassification

for IFRS

presentation(1)

Adjustments to

shareholders’

equity IFRS

Assets

Current assets $ 2,255 $ (230) $ – $ 2,025 $ 2,005 $ (147) $ – $ 1,858

Property, plant and equipment(2) 8,197 (50) (11) 8 ,136 8,493 (46) (10) 8,437

Goodwill and intangible assets(3) 5,661 (110) – 5,551 5,784 (157) (5) 5,622

Other long-term assets(4) 905 228 (120) 1,013 1,048 201 (138) 1,111

$ 17,018 $ (162) $ (131) $ 16,725 $ 17,330 $ (149) $ (153) $ 17,028

Liabilities and Shareholders’ equity

Current liabilities(5) $ 2,748 $ (59) $ 15 $ 2,704 $ 3,013 $ (69) $ 22 $ 2,966

Long-term debt(6) 8,463 (9) (58) 8,396 8,718 (9) (55) 8,654

Provisions(7) – 39 19 58 – 36 26 62

Other long-term liabilities(8) 1,534 (133) 10 1,411 1,640 (107) 53 1,586

12,745 (162) (14) 12,569 13,371 (149) 46 13,268

Shareholders’ equity 4,273 – (117) 4,156 3,959 – (199) 3,760

$ 17,018 $ (162) $ (131) $ 16,725 $ 17,330 $ (149) $ (153) $ 17,028

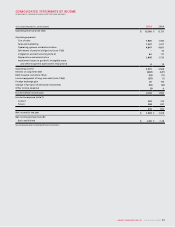

Year ended December 31,2010

(In millions of dollars, except per share amounts)

Canadian GAAP,

as reported Adjustments IFRS

Operating revenue(1) $ 12,186 $ (44) $ 12,142

Operating expenses before the undernoted(2) 7,533 (26) 7,507

Adjusted operating profit(3)(4) 4,653 (18) 4,635

Stock-based compensation expense(5) 47 350

Integration and restructuring expenses 40 – 40

Other items, net 14 – 14

Operating profit(3) 4,552 (21) 4,531

Depreciation and amortization(6) 1,645 (6) 1,639

Impairment losses on goodwill, intangible assets

and other long-term assets(7) 6 5 11

Operating income 2,901 (20) 2,881

Interest on long-term debt (669) –(669)

Loss on repayment of long-term debt (87) –(87)

Other income (expense), net(8) (7) (4) (11)

Income tax expense (610) (2) (612)

Net income for the year $ 1,528 $ (26) $ 1,502

Basic net income per share $ 2.65 $ 2.61

As adjusted:(4)

Net income $ 1,707 $ 1,703

Basic net income per share $ 2.96 $ 2.96