Rogers 2010 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

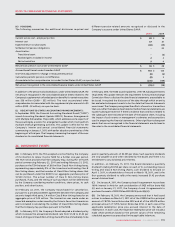

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT 115

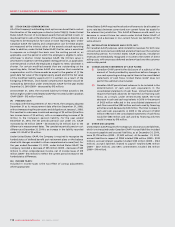

(E) Pursuant to CRTC regulation, the Company is required to pay

certain telecom contribution fees. These fees are based on a formula,

including certain types of revenue, including the majority of wireless

revenue. The Company estimates that these fees for 2011 will amount to

approximately $31 million.

(F) Pursuant to Industry Canada regulation, the Company is required

to pay certain fees for the use of its spectrum licences. These fees are

primarily based on the bandwidth and population covered by the

spectrum licence. The Company estimates that these fees for 2011 will

amount to $85 million.

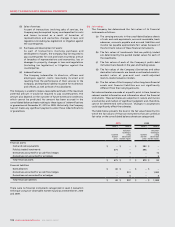

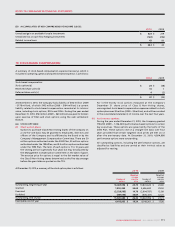

(G) In addition to the items listed above, the future minimum lease

payments under operating leases for the rental of premises, distribution

facilities, equipment and microwave towers, commitments

for player contracts, purchase obligations and other contracts, including

outsourcing arrangements, at December 31, 2010 are as follows:

Year ending December 31:

2011 $ 755

2012 409

2013 315

2014 246

2015 184

2016 and thereafter 292

$ 2,201

Rent expense for 2010 amounted to $180 million (2009 – $181 million).

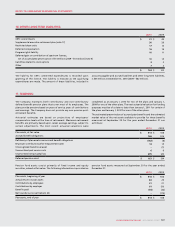

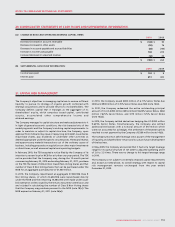

(A) In August 2008, a proceeding was commenced in Ontario pursuant

to that province’s Class Proceedings Act, 1992 against Cable and other

providers of communications services in Canada. The proceedings

involve allegations of, among other things, false, misleading and

deceptive advertising relating to charges for long-distance telephone

usage. The plaintiffs are seeking $20 million in general damages and

punitive damages of $5 million. The plaintiffs intend to seek an order

certifying the proceedings as a class action. Any potential liability is not

yet determinable.

(B) In June 2008, a proceeding was commenced in Saskatchewan

under that province’s Class Actions Act against providers of wireless

communications services in Canada. The proceeding involves allegations

of, among other things, breach of contract, misrepresentation and false

advertising in relation to the 911 fee charged by the Company and the

other wireless communication providers in Canada. The plaintiffs are

seeking unquantified damages and restitution. The plaintiffs intend to

seek an order certifying the proceeding as a national class action in

Saskatchewan. Any potential liability is not yet determinable.

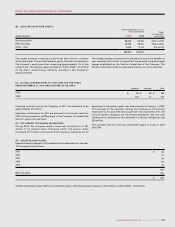

(C) In August 2004, a proceeding under the Class Actions Act

(Saskatchewan) was commenced against providers of wireless

communications in Canada relating to the system access fee charged by

wireless carriers to some of their customers. In September 2007, the

Saskatchewan Court granted the plaintiffs’ application to have the

proceeding certified as a national, “opt-in” class action. The “opt-in”

nature of the class was later confirmed by the Saskatchewan Court of

Appeal. As a national, “opt-in” class action, affected customers outside

Saskatchewan have to take specific steps to participate in the

proceeding. In February 2008, the Company’s motion to stay the

proceeding based on the arbitration clause in the wireless service

agreements was granted and the Saskatchewan Court directed that its

order in respect of the certification of the action would exclude from the

class of plaintiffs those customers who are bound by an arbitration clause.

In August 2009, counsel for the plaintiffs commenced a second

proceeding under the Class Actions Act (Saskatchewan) asserting the

same claims as the original proceeding. This second proceeding was

ordered conditionally stayed in December 2009 on the basis that it was

an abuse of the process.

The Company’s appeal of the 2007 certification decision was heard in

December 2010 and the Company awaits the decision. The Company has

not recorded a liability for this contingency since the likelihood and

amount of any potential loss cannot be reasonably estimated. If the

ultimate resolution of this action differs from the Company’s assessment

and assumptions, a material adjustment to the financial position and

results of operations could result.

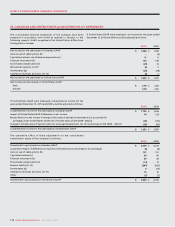

(D) The Company believes that it has adequately provided for income

taxes based on all of the information that is currently available. The

calculation of income taxes in many cases, however, requires significant

judgment in interpreting tax rules and regulations. The Company’s tax

filings are subject to audits, which could materially change the amount

of current and future income tax assets and liabilities, and could, in

certain circumstances, result in the assessment of interest and penalties.

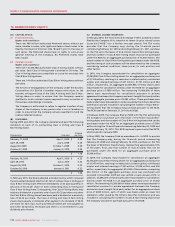

(E) In October 2009, the Government of Canada announced that a

settlement had been reached between the Government of Canada and

members of the broadcasting industry with respect to Part II fees.

Under the terms of the settlement, the Government agreed to forgive

the amounts otherwise owing to it up to August 31, 2009 and the fees

going forward will be approximately one-third less than historical rates.

As a result, during the fourth quarter of 2009, Cable and Media

recorded recoveries in operating, general and administrative expenses

of approximately $60 million and $19 million, respectively, for CRTC Part

II fees covering periods from September 1, 2006 to August 31, 2009.

(F) There exist certain other claims and potential claims against the

Company, none of which is expected to have a material adverse effect

on the consolidated financial position of the Company.

24. CONTINGENT LIABILITIES: