Rogers 2010 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

48 ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT

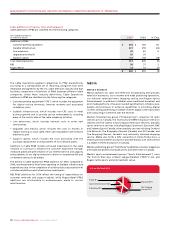

RCI’s senior unsecured debt to

be BBB, each with a Stable

outlook and assigned its BBB

rating to each of the 2040 Notes

and the 2020 Notes.

In August and September 2010,

Fitch Ratings affirmed the

issuer default rating for RCI to

be BBB and the rating for RCI’s

senior unsecured debt to be

BBB, each with a Stable outlook

and assigned its BBB rating to

each of the 2040 Notes and the

2020 Notes.

Credit ratings are intended to

provide investors with an

independent measure of credit

quality of an issue of securities.

Ratings for debt instruments

range along a scale from AAA,

in the case of Standard & Poor’s and Fitch, or Aaa in the case of Moody’s,

which represent the highest quality of securities rated, to D, in the case

of Standard & Poor’s, C, in the case of Moody’s and Substantial Risk in

the case of Fitch, which represent the lowest quality of securities rated.

The credit ratings accorded by the rating agencies are not

recommendations to purchase, hold or sell the rated securities inasmuch

as such ratings do not comment as to market price or suitability for a

particular investor. There is no assurance that any rating will remain in

effect for any given period of time, or that any rating will not be revised

or withdrawn entirely by a rating agency in the future if in its judgment

circumstances so warrant. The ratings on RCI’s senior debt of BBB from

Standard & Poor’s and Fitch and of Baa2 from Moody’s represent

investment grade ratings.

Deficiency of Pension Plan Assets Over Accrued Obligations

As disclosed in Note 17 to our 2010 Audited Consolidated Financial

Statements, our pension plans had a deficiency of plan assets over

accrued obligations of $152 million and $8 million at our September30

measurement date for the years ended December 31, 2010 and

December 31, 2009, respectively, related to funded plans, and a

deficiency of $37 million and $31 million at our September 30

measurement date for the years ended December 31, 2010 and

December 31, 2009, respectively, related to unfunded plans. Our

pension plans had a deficiency on a solvency basis at December 31,

2009, and are expected to have a deficiency on a solvency basis at

December 31, 2010. Consequently, in addition to our regular

contributions, we are making certain minimum monthly special

payments to eliminate the solvency deficiency. In 2010, the special

payments, including contributions associated with benefits paid from

the plans, totalled approximately $33 million. Our total estimated

annual funding requirements, which include both our regular

contributions and these special payments, are expected to increase

from $61 million in 2010 to approximately $70 million in 2011, subject to

annual adjustments thereafter, due to various market factors and the

assumption that our staffing levels will remain relatively stable year-

over-year. We are contributing to the plans on this basis. As further

discussed in the section entitled “Critical Accounting Estimates”,

changes in factors such as the discount rate, the rate of compensation

increase and the expected return on plan assets can impact the accrued

benefit obligation, pension expense and the deficiency of plan assets

over accrued obligations in the future.

In 2009, we made a lump-sum contribution of $61 million to our pension

plans, following which the pension plans purchased $172 million of

annuities from insurance companies for employees in the pension plans

who had retired as of January 1, 2009. The purchase of the annuities

party, 1.4 million shares for an aggregate purchase price of $45 million.

The transaction was made under an issuer bid exemption order issued

by the Ontario Securities Commission and is included in calculating the

number of Class B Non-Voting shares that we may purchase pursuant to

the NCIB.

Investment in Cogeco Cable Inc. and Cogeco Inc.

In November 2010, we acquired additional 892,250 subordinate voting

shares of Cogeco Cable Inc. and 946,090 subordinate voting shares of

Cogeco Inc. for an aggregate purchase price of $75 million. These

purchases were made for investment purposes.

Covenant Compliance

We are currently in compliance with all of the covenants under our debt

instruments, and we expect to remain in compliance with all of these

covenants during 2011. At December 31, 2010, there were no financial

leverage covenants in effect other than those pursuant to our bank

credit facility (see Note 14(a) to the 2010 Audited Consolidated Financial

Statements). Based on our most restrictive leverage covenants, we

would have had the capacity to issue up to approximately $18.1 billion

of additional long-term debt at December 31, 2010.

2011 Cash Requirements

On a consolidated basis, we anticipate that we will generate a net cash

surplus in 2011 from cash generated from operations. We expect that

we will have sufficient capital resources to satisfy our cash funding

requirements in 2011, including the funding of dividends on our

common shares, taking into account cash from operations and the

amount available under our $2.4 billion bank credit facility. At

December 31, 2010, there were no restrictions on the flow of funds

between subsidiary companies or between RCI and any of its

subsidiaries.

In the event that we require additional funding, we believe that any

such funding requirements may be satisfied by issuing additional debt

financing, which may include the restructuring of our existing bank

credit facility or issuing public or private debt or issuing equity, all

depending on market conditions. In addition, we may refinance a

portion of existing debt subject to market conditions and other factors.

There is no assurance that this will or can be done.

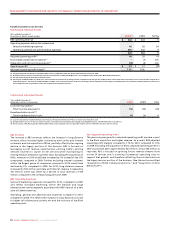

Required Principal Repayments

At December 31, 2010, the required repayments on all long-term debt

in the next five years totalled $3,084 million, comprised of $816 million

principal repayments due in 2012, $348 million due in 2013, $1,094

million due in 2014 and $826 million due in 2015. The required principal

repaymentsduein2012consistof$468million(US$470million)7.25%

SeniorNotesand$348million(US$350million)7.875%SeniorNotes.

The required principal repayment due in 2013 is the $348 million

(US$350million)6.25%SeniorNotes,aswellasthematurityofthebank

credit facility, which at December 31, 2010 is undrawn. The required

principal repayments due in 2014 consist of $348 million (US$350

million)5.50%SeniorNotesand$746million(US$750million)6.375%

Senior Notes. The required principal repayments due in 2015 consist of

$279 million(US$280million)6.75% Senior Notes and$547million

(US$550million)7.50%SeniorNotes.

Coincident with the maturity of our U.S. dollar-denominated long-term

debt, certain of our Derivatives also mature, the impact of which is not

included in the principal repayments noted above (See the section

entitled “Material Obligations Under Firm Contractual Agreements”).

Credit Ratings

In August and September 2010, Moody’s Investors Service affirmed the

rating for RCI’s senior unsecured debt to be Baa2, with a Stable outlook

and assigned its Baa2 rating to each of the 2040 Notes and the

2020 Notes.

In August and September 2010, Standard & Poor’s Ratings Services

affirmed the corporate credit rating for RCI to be BBB and the rating for

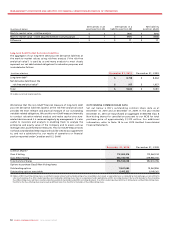

20102009

2008

2009

200

8

201

0

7.0x6.8x7.1x

RATIO OF ADJUSTED OPERATING

PROFIT TO INTEREST