Rogers 2010 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT 111

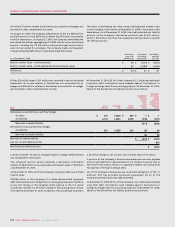

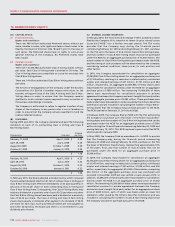

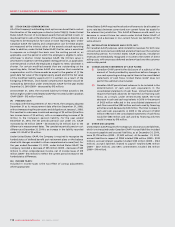

(D) ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS):

2010 2009

Unrealized gain on available-for-sale investments $ 323 $ 219

Unrealized loss on cash flow hedging instruments (122) (256)

Related income taxes 43 80

$ 244 $ 43

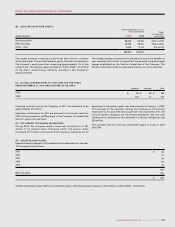

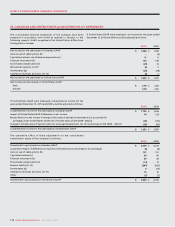

At December 31, 2010, the Company had a liability of $162 million (2009

– $178 million), of which $142 million (2009 – $164 million) is a current

liability related to stock-based compensation recorded at its intrinsic

value, including stock options, RSUs and DSUs. During the year ended

December 31, 2010, $58 million (2009 – $63 million) was paid to holders

upon exercise of RSUs and stock options using the cash settlement

feature.

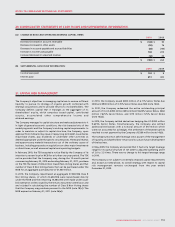

(A) STOCK OPTIONS:

(i) Stock option plans:

Options to purchase Class B Non-Voting shares of the Company on

a one-for-one basis may be granted to employees, directors and

officers of the Company and its affiliates by the Board or by the

Company’s Management Compensation Committee. There are 30

million options authorized under the 2000 Plan, 25 million options

authorized under the 1996 Plan, and 9.5 million options authorized

under the 1994 Plan. The term of each option is 7 to 10 years and

the vesting period is generally four years but may be adjusted by

the Management Compensation Committee on the date of grant.

The exercise price for options is equal to the fair market value of

the Class B Non-Voting shares determined as the five-day average

before the grant date as quoted on the TSX.

For in-the-money stock options measured at the Company’s

December 31 share price of Class B Non-Voting shares,

unrecognized stock-based compensation expense related to stock

option plans was $3 million (2009 – $5 million), and will be recorded

in the consolidated statements of income over the next four years.

(ii) Performance options:

During the year ended December 31, 2010, the Company granted

759,200 (2009 – 1,156,200) performance-based options to certain

key executives. These options are governed by the terms of the

2000 Plan. These options vest on a straight-line basis over four

years provided that certain targeted stock prices are met on or

after the anniversary date. At December 31, 2010, 4,894,980

performance options were outstanding.

All outstanding options, including the performance options, are

classified as liabilities and are carried at their intrinsic value as

adjusted for vesting.

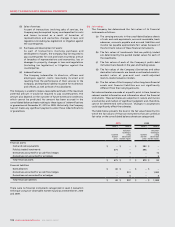

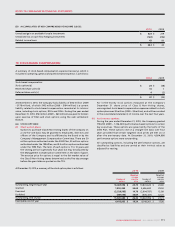

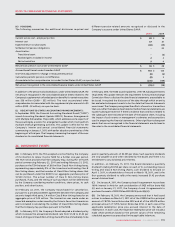

19. STOCK-BASED COMPENSATION:

A summary of stock-based compensation expense (recovery), which is

included in operating, general and administrative expense, is as follows:

2010 2009

Stock-based compensation:

Stock options (a) $ 24 $ (38)

Restricted share units (b) 19 7

Deferred share units (c) 4(2)

$ 47 $ (33)

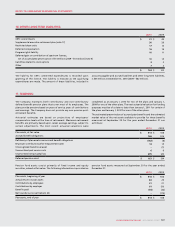

At December 31, 2010, a summary of the stock option plans is as follows:

2010 2009

Number of

options

Weighted

average

exercise

price

Number of

options

Weighted

average

exercise

price

Outstanding, beginning of year 13,467,096 $ 23.73 13,841,620 $ 20.80

Granted 1,350,225 34.69 2,636,600 29.50

Exercised (2,528,585) 14.78 (2,604,787) 12.88

Forfeited (4 47,056) 34.89 (406,337) 32.20

Outstanding, end of year 11,841,680 $ 26.42 13,467,096 $ 23.73

Exercisable, end of year 6,415,933 $ 19.24 8,149,361 $ 17.56