Rogers 2010 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

20 ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT

We seek to exploit opportunities for Wireless, Cable and Media to

create bundled product and service offerings at attractive prices, in

addition to implementing cross-marketing and cross-promotion of

products and services to increase sales and enhance subscriber loyalty.

We also work to identify and implement areas of opportunity for our

businesses that will enhance operating efficiencies by sharing

infrastructure, corporate services and sales distribution channels. We

continue to develop brand awareness and promote the “Rogers” brand

as a symbol of quality and innovation.

In September 2009, we announced the further integration of our Cable

and Wireless businesses with the creation of a Communications Services

organization. This more streamlined organizational structure is

intended to facilitate faster time to market, deliver an enhanced and

more consistent customer experience, and improve the overall

effectiveness and efficiency of the Wireless and Cable businesses. This

more integrated operating approach also recognizes the continued

convergence of certain aspects of wireless and wireline networks and

services. In July2010, our shared services and substantially all of Cable

and Wireless operations were consolidated into Rogers Communications

Partnership. Segmented reporting continues to reflect the foregoing

Cable and Wireless services as separate product segments (See the

section entitled “July1,2010 Corporate Reorganization”).

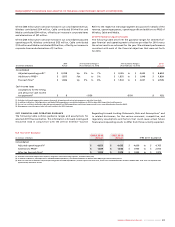

CONSOLIDATED FINANCIAL AND OPERATING RESULTS

See the sections in this MD&A entitled “Critical Accounting Policies”,

“Critical Accounting Estimates” and “New Accounting Standards” and

also the Notes to the 2010 Audited Consolidated Financial Statements

for a discussion of critical and new accounting policies and estimates

as they relate to the discussion of our operating and financial

results below.

We measure the success of our strategies using a number of key

performance indicators as outlined in the section entitled “Key

Performance Indicators and Non-GAAP Measures”. These key

performance indicators are not measurements in accordance with

Canadian or U.S. GAAP and should not be considered as alternatives to

net income or any other measure of performance under Canadian or

U.S. GAAP. The non-GAAP measures presented in this MD&A include,

among other measures, operating profit, adjusted operating profit,

adjusted operating profit margin, adjusted net income, adjusted basic

and diluted net income per share and free cash flow. We believe that

the non-GAAP financial measures provided, which exclude: (i) stock-

based compensation expense (recovery); (ii) integration and

restructuring expenses; (iii) contract termination fees; (iv) an

adjustment for Canadian Radio-television and Telecommunications

Commission (“CRTC”) Part II fees related to prior periods; (v) settlement

of pension obligations; (vi) other items (net); and (vii) in respect of net

income and net income per share, debt issuance costs, loss on

repayment of long-term debt, impairment losses on goodwill,

intangible assets and other long-term assets and the related income tax

impacts of the above items, provide for a more effective analysis of our

operating performance. See the sections entitled “Key Performance

Indicators and Non-GAAP Measures” and “Supplementary Information:

Non-GAAP Calculations” for further details.

The increased levels of competitive intensity have negatively impacted

the results of our Wireless and Cable businesses during 2010. This

includes higher subscriber churn and lower average revenue per user

(“ARPU”) at Wireless and a slowing in the number of new subscriber

additions and increased promotional and retention activity at Cable.

During 2010, Media has benefited from a rebound in the advertising

market. In response to the competitive intensity and economic

conditions, we restructured our organization and employee base to

improve our organizational efficiency and cost structure which resulted

in cost efficiencies during 2010.

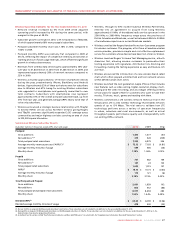

We believe that we are well-positioned from both a leverage and a

liquidity perspective with a debt to adjusted operating profit ratio of

2.1. In addition, there were no advances outstanding under our entire

$2.4 billion fully committed multi-year bank credit facility at

December31,2010 and we have no scheduled debt maturities until

May2012.

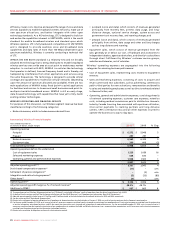

20102009

2008

2009

200

8

201

0

$1,839$1,855$2,021

ADDITIONS TO

CONSOLIDATED PP&E

(In millions of dollars)

20102009

2008

2009

200

8

201

0

$17,018$17,082 $17,330

CONSOLIDATED TOTAL ASSETS

(In millions of dollars)