Rogers 2010 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2010 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2010 ANNUAL REPORT 43

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

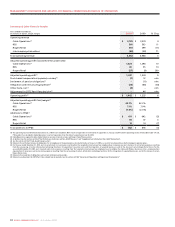

RECONCILIATION OF NET INCOME TO OPERATING

PROFIT AND ADJUSTED OPERATING PROFIT FOR

THE PERIOD

The items listed below represent the consolidated income and expense

amounts that are required to reconcile net income as defined under

Canadian GAAP to the non-GAAP measures operating profit and

adjusted operating profit for the year. See the section entitled

“Supplementary Information: Non-GAAP Calculations” for a full

reconciliation to adjusted operating profit, adjusted net income and

adjusted net income per share. For details of these amounts on a

segment-by-segment basis and for an understanding of intersegment

eliminations on consolidation, the following section should be read in

conjunction with Note 3 to the 2010 Audited Consolidated Financial

Statements entitled “Segmented Information”.

Years ended December 31,

(In millions of dollars) 2010 2009 %Chg

Net income $ 1,528 $ 1,478 3

Income tax expense 610 502 22

Other expense (income) 1(6) n/m

Change in the fair value of derivative instruments 16 65 (75)

Loss on repayment of long-term debt 87 7 n/m

Foreign exchange gain (20) (136) (85)

Debt issuance costs 10 11 (9)

Interest on long-term debt 669 647 3

Operating income 2,901 2,568 13

Impairment losses on goodwill, intangible assets and

other long-term assets 6 18 (67)

Depreciation and amortization 1,645 1,730 (5)

Operating profit 4,552 4,316 5

Stock-based compensation expense (recovery) 47 (33) n/m

Settlement of pension obligations – 30 n/m

Integration and restructuring expenses 40 117 (66)

Other items, net 14 – n/m

Contract termination fees –19 n/m

Adjustment for CRTC Part II fees decision –(61) n/m

Adjusted operating profit $ 4,653 $ 4,388 6

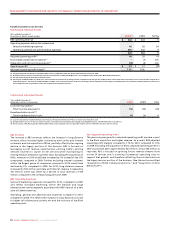

Net Income

The $50 million increase in net

income compared to the prior

year is primarily due to the growth

in operating income of $333

million, offset mainly by a

decrease in foreign exchange

gains of $116 million, an increase

in loss on repayment of long-term

debt of $80 million, and a $108

million increase in income tax

expense.

Income Tax Expense

Our effective income tax rate for

the years ended December 31,

2010 and 2009 was 28.5% and

25.4%, respectively. The 2010

effective income tax rate was less

than the 2010 statutory income

taxrateof30.5%primarilyduetoanincometaxrecoveryof$69million

resulting from the effect of tax rate changes, which was partially offset

by an income tax charge of $35 million to reduce future tax assets

previously recognized relating to stock options (see the section entitled

“Stock-based Compensation”). For the year ended December 31, 2010,

our income taxes paid were $152 million.

The 2009 effective income tax rate was less than the 2009 statutory

incometaxrateof32.3%primarilyduetoanincometaxrecoveryof

$58 million resulting from reductions in substantively enacted tax rates

and the $64 million release of our valuation allowance. The release of

our valuation allowance includes $14 million relating to a decrease of

future tax assets in foreign jurisdictions arising from foreign exchange

rate fluctuations and $50 million relating to unrealized gains on

investments and financial instruments. For the year ended December

31, 2009, our income taxes paid were $8 million.

Income tax expense varies from the amounts that would be computed

by applying the statutory income tax rate to income before income

taxes for the following reasons:

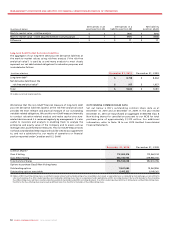

20102009

2008

2009

200

8

201

0

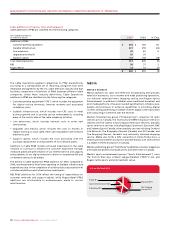

$1,556$1,260 $1,707

CONSOLIDATED ADJUSTED

NET INCOME

(In millions of dollars)